J - Monroeville

J - Monroeville

J - Monroeville

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

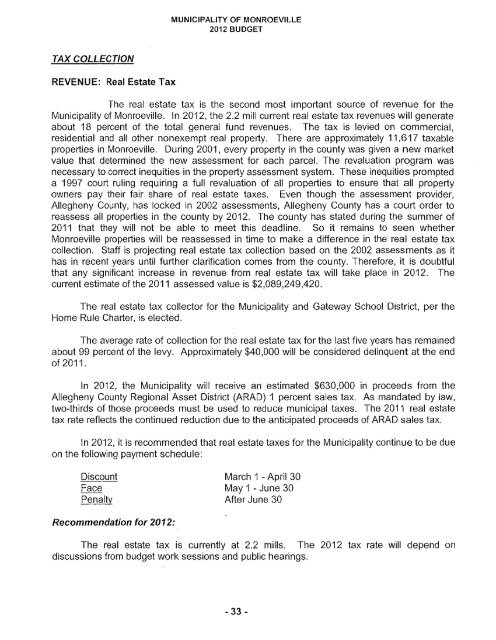

MUNICIPALITY OF MONROEVILLE2012 BUDGETTAX COLLECTIONREVENUE: Real Estate TaxThe real estate tax is the second most important source of revenue for theMunicipality of <strong>Monroeville</strong>. In 2012. the 2.2 mill current real estate tax revenues will generateabout 18 percent of the total general fund revenues. The tax is levied on commercial,residential and all other nonexempt real property. There are approximately 11,617 taxableproperties in <strong>Monroeville</strong>. During 2001, every property in the county was given a new marketvalue that determined the new assessment for each parcel. The revaluation program wasnecessary to correct inequities in the property assessment system. These inequities prompteda 1997 court ruling requiring a full revaluation of all properties to ensure that all propertyowners pay their fair share of real estate taxes. Even though the assessment provider,Allegheny County, has locked in 2002 assessments, Allegheny County has a court order toreassess all properties in the county by 2012. The county has stated during the summer of2011 that they will not be able to meet this deadline. So it remains to seen whether<strong>Monroeville</strong> properties will be reassessed in time to make a difference in the real estate taxcollection. Staff is projecting real estate tax collection based on the 2002 assessments as ithas in recent years until further clarification comes from the county. Therefore, it is doubtfulthat any significant increase in revenue from real estate tax will take place in 2012. Thecurrent estimate of the 2011 assessed value is $2,089,249,420.The real estate tax collector for the Municipality and Gateway School District, per theHome Rule Charter, is elected.The average rate of collection for the real estate tax for the last five years has remainedabout 99 percent of the levy. Approximately $40,000 will be considered delinquent at the endof 2011.In 2012, the Municipality will receive an estimated $630,000 in proceeds from theAllegheny County Regional Asset District (ARAD) 1 percent sales tax. As mandated by law,two-thirds of those proceeds must be used to reduce municipal taxes. The 2011 real estatetax rate reflects the continued reduction due to the anticipated proceeds of ARAD sales tax.In 2012, it is recommended that real estate taxes for the Municipality continue to be dueon the following payment schedule:DiscountFacePenaltyMarch 1 - April 30May 1 - June 30After June 30Recommendation for 2012:The real estate tax is currently at 2.2 mills. The 2012 tax rate will depend ondiscussions from budget work sessions and public hearings.- 33 -