Clock - Uranium Supply Crunch and Critical ... - Andrew Johns

Clock - Uranium Supply Crunch and Critical ... - Andrew Johns

Clock - Uranium Supply Crunch and Critical ... - Andrew Johns

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

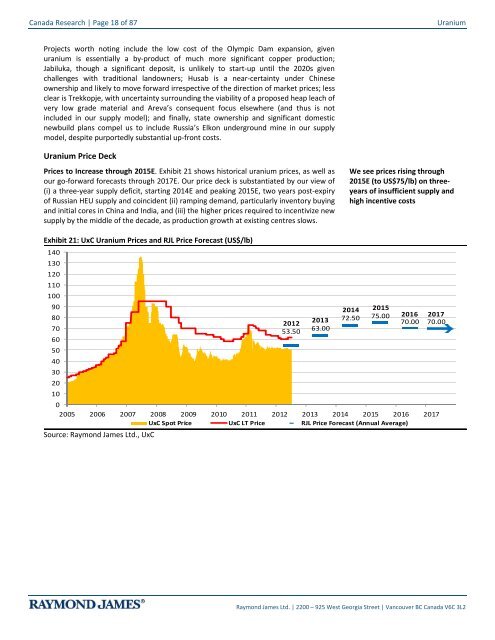

Canada Research | Page 18 of 87<strong>Uranium</strong>Projects worth noting include the low cost of the Olympic Dam expansion, givenuranium is essentially a by-product of much more significant copper production;Jabiluka, though a significant deposit, is unlikely to start-up until the 2020s givenchallenges with traditional l<strong>and</strong>owners; Husab is a near-certainty under Chineseownership <strong>and</strong> likely to move forward irrespective of the direction of market prices; lessclear is Trekkopje, with uncertainty surrounding the viability of a proposed heap leach ofvery low grade material <strong>and</strong> Areva’s consequent focus elsewhere (<strong>and</strong> thus is notincluded in our supply model); <strong>and</strong> finally, state ownership <strong>and</strong> significant domesticnewbuild plans compel us to include Russia’s Elkon underground mine in our supplymodel, despite purportedly substantial up-front costs.<strong>Uranium</strong> Price DeckPrices to Increase through 2015E. Exhibit 21 shows historical uranium prices, as well asour go-forward forecasts through 2017E. Our price deck is substantiated by our view of(i) a three-year supply deficit, starting 2014E <strong>and</strong> peaking 2015E, two years post-expiryof Russian HEU supply <strong>and</strong> coincident (ii) ramping dem<strong>and</strong>, particularly inventory buying<strong>and</strong> initial cores in China <strong>and</strong> India, <strong>and</strong> (iii) the higher prices required to incentivize newsupply by the middle of the decade, as production growth at existing centres slows.We see prices rising through2015E (to US$75/lb) on threeyearsof insufficient supply <strong>and</strong>high incentive costsExhibit 21: UxC <strong>Uranium</strong> Prices <strong>and</strong> RJL Price Forecast (US$/lb)1401301201101009080706050403020102014 201572.50 75.00 2016 20172012201370.00 70.0053.5063.0002005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017UxC Spot Price UxC LT Price RJL Price Forecast (Annual Average)Source: Raymond James Ltd., UxCRaymond James Ltd. | 2200 – 925 West Georgia Street | Vancouver BC Canada V6C 3L2