Clock - Uranium Supply Crunch and Critical ... - Andrew Johns

Clock - Uranium Supply Crunch and Critical ... - Andrew Johns

Clock - Uranium Supply Crunch and Critical ... - Andrew Johns

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

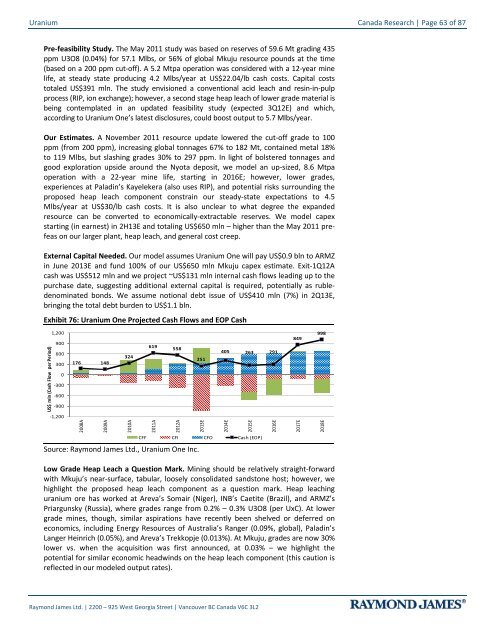

<strong>Uranium</strong> Canada Research | Page 63 of 87Pre-feasibility Study. The May 2011 study was based on reserves of 59.6 Mt grading 435ppm U3O8 (0.04%) for 57.1 Mlbs, or 56% of global Mkuju resource pounds at the time(based on a 200 ppm cut-off). A 5.2 Mtpa operation was considered with a 12-year minelife, at steady state producing 4.2 Mlbs/year at US$22.04/lb cash costs. Capital coststotaled US$391 mln. The study envisioned a conventional acid leach <strong>and</strong> resin-in-pulpprocess (RIP, ion exchange); however, a second stage heap leach of lower grade material isbeing contemplated in an updated feasibility study (expected 3Q12E) <strong>and</strong> which,according to <strong>Uranium</strong> One’s latest disclosures, could boost output to 5.7 Mlbs/year.Our Estimates. A November 2011 resource update lowered the cut-off grade to 100ppm (from 200 ppm), increasing global tonnages 67% to 182 Mt, contained metal 18%to 119 Mlbs, but slashing grades 30% to 297 ppm. In light of bolstered tonnages <strong>and</strong>good exploration upside around the Nyota deposit, we model an up-sized, 8.6 Mtpaoperation with a 22-year mine life, starting in 2016E; however, lower grades,experiences at Paladin’s Kayelekera (also uses RIP), <strong>and</strong> potential risks surrounding theproposed heap leach component constrain our steady-state expectations to 4.5Mlbs/year at US$30/lb cash costs. It is also unclear to what degree the exp<strong>and</strong>edresource can be converted to economically-extractable reserves. We model capexstarting (in earnest) in 2H13E <strong>and</strong> totaling US$650 mln – higher than the May 2011 prefeason our larger plant, heap leach, <strong>and</strong> general cost creep.External Capital Needed. Our model assumes <strong>Uranium</strong> One will pay US$0.9 bln to ARMZin June 2013E <strong>and</strong> fund 100% of our US$650 mln Mkuju capex estimate. Exit-1Q12Acash was US$512 mln <strong>and</strong> we project ~US$131 mln internal cash flows leading up to thepurchase date, suggesting additional external capital is required, potentially as rubledenominatedbonds. We assume notional debt issue of US$410 mln (7%) in 2Q13E,bringing the total debt burden to US$1.1 bln.Exhibit 76: <strong>Uranium</strong> One Projected Cash Flows <strong>and</strong> EOP CashUS$ mln (Cash Flow per Period)1,200900619558600405324251300 176 148263 2910-300-600-900-1,2002008A2009A2010A2011A2012A2013E2014E2015E2016ESource: Raymond James Ltd., <strong>Uranium</strong> One Inc.CFF CFI CFO Cash (EOP)8492017E9982018ELow Grade Heap Leach a Question Mark. Mining should be relatively straight-forwardwith Mkuju’s near-surface, tabular, loosely consolidated s<strong>and</strong>stone host; however, wehighlight the proposed heap leach component as a question mark. Heap leachinguranium ore has worked at Areva’s Somair (Niger), INB’s Caetite (Brazil), <strong>and</strong> ARMZ’sPriargunsky (Russia), where grades range from 0.2% – 0.3% U3O8 (per UxC). At lowergrade mines, though, similar aspirations have recently been shelved or deferred oneconomics, including Energy Resources of Australia’s Ranger (0.09%, global), Paladin’sLanger Heinrich (0.05%), <strong>and</strong> Areva’s Trekkopje (0.013%). At Mkuju, grades are now 30%lower vs. when the acquisition was first announced, at 0.03% – we highlight thepotential for similar economic headwinds on the heap leach component (this caution isreflected in our modeled output rates).Raymond James Ltd. | 2200 – 925 West Georgia Street | Vancouver BC Canada V6C 3L2