Clock - Uranium Supply Crunch and Critical ... - Andrew Johns

Clock - Uranium Supply Crunch and Critical ... - Andrew Johns

Clock - Uranium Supply Crunch and Critical ... - Andrew Johns

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

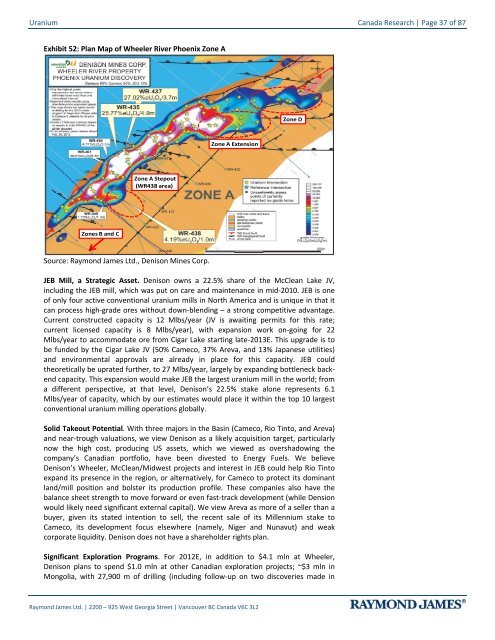

<strong>Uranium</strong> Canada Research | Page 37 of 87Exhibit 52: Plan Map of Wheeler River Phoenix Zone AZone DZone A ExtensionZone A Stepout(WR438 area)Zones B <strong>and</strong> CSource: Raymond James Ltd., Denison Mines Corp.JEB Mill, a Strategic Asset. Denison owns a 22.5% share of the McClean Lake JV,including the JEB mill, which was put on care <strong>and</strong> maintenance in mid-2010. JEB is oneof only four active conventional uranium mills in North America <strong>and</strong> is unique in that itcan process high-grade ores without down-blending – a strong competitive advantage.Current constructed capacity is 12 Mlbs/year (JV is awaiting permits for this rate;current licensed capacity is 8 Mlbs/year), with expansion work on-going for 22Mlbs/year to accommodate ore from Cigar Lake starting late-2013E. This upgrade is tobe funded by the Cigar Lake JV (50% Cameco, 37% Areva, <strong>and</strong> 13% Japanese utilities)<strong>and</strong> environmental approvals are already in place for this capacity. JEB couldtheoretically be uprated further, to 27 Mlbs/year, largely by exp<strong>and</strong>ing bottleneck backendcapacity. This expansion would make JEB the largest uranium mill in the world; froma different perspective, at that level, Denison’s 22.5% stake alone represents 6.1Mlbs/year of capacity, which by our estimates would place it within the top 10 largestconventional uranium milling operations globally.Solid Takeout Potential. With three majors in the Basin (Cameco, Rio Tinto, <strong>and</strong> Areva)<strong>and</strong> near-trough valuations, we view Denison as a likely acquisition target, particularlynow the high cost, producing US assets, which we viewed as overshadowing thecompany’s Canadian portfolio, have been divested to Energy Fuels. We believeDenison’s Wheeler, McClean/Midwest projects <strong>and</strong> interest in JEB could help Rio Tintoexp<strong>and</strong> its presence in the region, or alternatively, for Cameco to protect its dominantl<strong>and</strong>/mill position <strong>and</strong> bolster its production profile. These companies also have thebalance sheet strength to move forward or even fast-track development (while Densionwould likely need significant external capital). We view Areva as more of a seller than abuyer, given its stated intention to sell, the recent sale of its Millennium stake toCameco, its development focus elsewhere (namely, Niger <strong>and</strong> Nunavut) <strong>and</strong> weakcorporate liquidity. Denison does not have a shareholder rights plan.Significant Exploration Programs. For 2012E, in addition to $4.1 mln at Wheeler,Denison plans to spend $1.0 mln at other Canadian exploration projects; ~$3 mln inMongolia, with 27,900 m of drilling (including follow-up on two discoveries made inRaymond James Ltd. | 2200 – 925 West Georgia Street | Vancouver BC Canada V6C 3L2