Clock - Uranium Supply Crunch and Critical ... - Andrew Johns

Clock - Uranium Supply Crunch and Critical ... - Andrew Johns

Clock - Uranium Supply Crunch and Critical ... - Andrew Johns

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

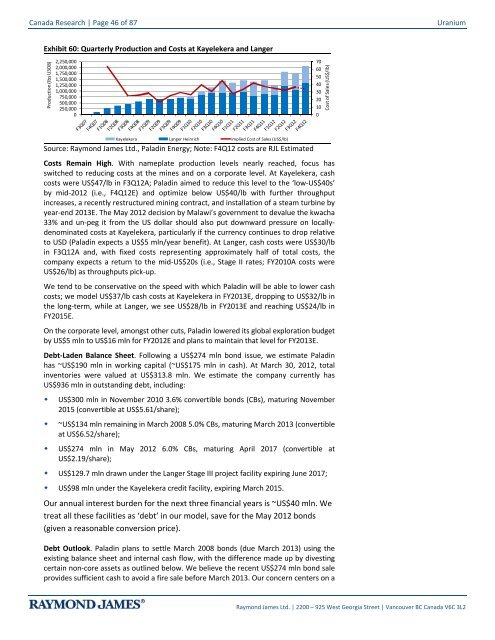

Canada Research | Page 46 of 87<strong>Uranium</strong>Exhibit 60: Quarterly Production <strong>and</strong> Costs at Kayelekera <strong>and</strong> LangerProduction (lbs U3O8)2,250,0002,000,0001,750,0001,500,0001,250,0001,000,000750,000500,000250,0000706050403020100Cost of Sales (US$/lb)Kayelekera Langer Heinrich Implied Cost of Sales (US$/lb)Source: Raymond James Ltd., Paladin Energy; Note: F4Q12 costs are RJL EstimatedCosts Remain High. With nameplate production levels nearly reached, focus hasswitched to reducing costs at the mines <strong>and</strong> on a corporate level. At Kayelekera, cashcosts were US$47/lb in F3Q12A; Paladin aimed to reduce this level to the ‘low-US$40s’by mid-2012 (i.e., F4Q12E) <strong>and</strong> optimize below US$40/lb with further throughputincreases, a recently restructured mining contract, <strong>and</strong> installation of a steam turbine byyear-end 2013E. The May 2012 decision by Malawi’s government to devalue the kwacha33% <strong>and</strong> un-peg it from the US dollar should also put downward pressure on locallydenominatedcosts at Kayelekera, particularly if the currency continues to drop relativeto USD (Paladin expects a US$5 mln/year benefit). At Langer, cash costs were US$30/lbin F3Q12A <strong>and</strong>, with fixed costs representing approximately half of total costs, thecompany expects a return to the mid-US$20s (i.e., Stage II rates; FY2010A costs wereUS$26/lb) as throughputs pick-up.We tend to be conservative on the speed with which Paladin will be able to lower cashcosts; we model US$37/lb cash costs at Kayelekera in FY2013E, dropping to US$32/lb inthe long-term, while at Langer, we see US$28/lb in FY2013E <strong>and</strong> reaching US$24/lb inFY2015E.On the corporate level, amongst other cuts, Paladin lowered its global exploration budgetby US$5 mln to US$16 mln for FY2012E <strong>and</strong> plans to maintain that level for FY2013E.Debt-Laden Balance Sheet. Following a US$274 mln bond issue, we estimate Paladinhas ~US$190 mln in working capital (~US$175 mln in cash). At March 30, 2012, totalinventories were valued at US$313.8 mln. We estimate the company currently hasUS$936 mln in outst<strong>and</strong>ing debt, including:• US$300 mln in November 2010 3.6% convertible bonds (CBs), maturing November2015 (convertible at US$5.61/share);• ~US$134 mln remaining in March 2008 5.0% CBs, maturing March 2013 (convertibleat US$6.52/share);• US$274 mln in May 2012 6.0% CBs, maturing April 2017 (convertible atUS$2.19/share);• US$129.7 mln drawn under the Langer Stage III project facility expiring June 2017;• US$98 mln under the Kayelekera credit facility, expiring March 2015.Our annual interest burden for the next three financial years is ~US$40 mln. Wetreat all these facilities as ‘debt’ in our model, save for the May 2012 bonds(given a reasonable conversion price).Debt Outlook. Paladin plans to settle March 2008 bonds (due March 2013) using theexisting balance sheet <strong>and</strong> internal cash flow, with the difference made up by divestingcertain non-core assets as outlined below. We believe the recent US$274 mln bond saleprovides sufficient cash to avoid a fire sale before March 2013. Our concern centers on aRaymond James Ltd. | 2200 – 925 West Georgia Street | Vancouver BC Canada V6C 3L2