Clock - Uranium Supply Crunch and Critical ... - Andrew Johns

Clock - Uranium Supply Crunch and Critical ... - Andrew Johns

Clock - Uranium Supply Crunch and Critical ... - Andrew Johns

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

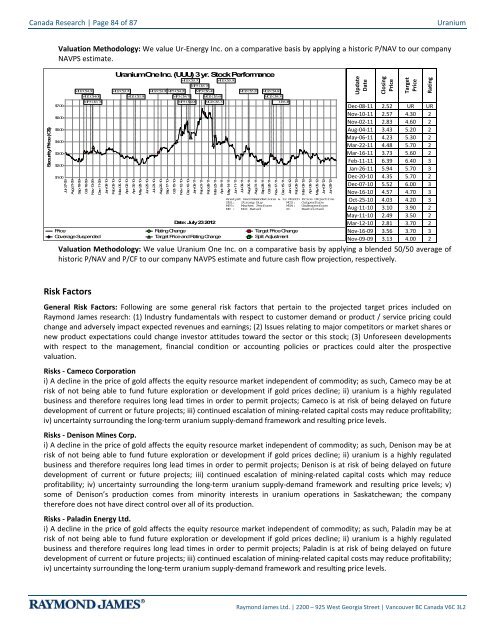

Canada Research | Page 84 of 87<strong>Uranium</strong>Security Price (C$)Valuation Methodology: We value Ur-Energy Inc. on a comparative basis by applying a historic P/NAV to our companyNAVPS estimate.$7.00$6.00$5.00$4.00$3.00$2.00$1.00Jul-27-09Aug-21-09MO2 C$4.30Sep-18-09MO2 C$4.00MP3 C$3.70Oct-16-09Nov-13-09Dec-11-09Jan-08-10Feb-05-10<strong>Uranium</strong>One Inc. (UUU) 3 yr. Stock PerformanceMO2 C$3.70Mar-05-10Apr-02-10MO2 C$3.50Apr-30-10May-28-10Jun-25-10MO2 C$3.90MP3 C$4.20Jul-23-10Aug-20-10Sep-17-10Oct-15-10Price Rating Change Target Price ChangeCoverage Suspended Target Price <strong>and</strong> Rating Change Split AdjustmentNov-12-10MO2 C$5.70MP3 C$4.70MP3 C$6.00Dec-10-10MP3 C$5.70Jan-05-11MP3 C$6.40Feb-01-11MO2 C$5.60MO2 C$5.70Feb-26-11Mar-23-11Date: July 23 2012MO2 C$5.30Apr-19-11May-14-11Jun-11-11MO2 C$5.20Jul-09-11Aug-05-11Aug-31-11MO2 C$4.60Sep-28-11MO2 C$4.30Oct-26-11Nov-17-11UR URAnalyst Recommendations & 12 Month Price ObjectiveSB1: Strong Buy MO2: OutperformMP3: Market Perform MU4: UnderperformNR : Not Rated R: RestrictedDec-15-11Jan-12-12Feb-09-12Mar-09-12Apr-06-12May-05-12Jun-02-12Jun-29-12UpdateDateClosingPriceTargetPriceRatingDec-08-11 2.52 UR URNov-10-11 2.57 4.30 2Nov-02-11 2.83 4.60 2Aug-04-11 3.43 5.20 2May-06-11 4.23 5.30 2Mar-22-11 4.48 5.70 2Mar-16-11 3.73 5.60 2Feb-11-11 6.39 6.40 3Jan-26-11 5.94 5.70 3Dec-20-10 4.35 5.70 2Dec-07-10 5.52 6.00 3Nov-16-10 4.57 4.70 3Oct-25-10 4.03 4.20 3Aug-11-10 3.10 3.90 2May-11-10 2.49 3.50 2Mar-12-10 2.81 3.70 2Nov-16-09 3.56 3.70 3Nov-09-09 3.13 4.00 2Valuation Methodology: We value <strong>Uranium</strong> One Inc. on a comparative basis by applying a blended 50/50 average ofhistoric P/NAV <strong>and</strong> P/CF to our company NAVPS estimate <strong>and</strong> future cash flow projection, respectively.Risk FactorsGeneral Risk Factors: Following are some general risk factors that pertain to the projected target prices included onRaymond James research: (1) Industry fundamentals with respect to customer dem<strong>and</strong> or product / service pricing couldchange <strong>and</strong> adversely impact expected revenues <strong>and</strong> earnings; (2) Issues relating to major competitors or market shares ornew product expectations could change investor attitudes toward the sector or this stock; (3) Unforeseen developmentswith respect to the management, financial condition or accounting policies or practices could alter the prospectivevaluation.Risks - Cameco Corporationi) A decline in the price of gold affects the equity resource market independent of commodity; as such, Cameco may be atrisk of not being able to fund future exploration or development if gold prices decline; ii) uranium is a highly regulatedbusiness <strong>and</strong> therefore requires long lead times in order to permit projects; Cameco is at risk of being delayed on futuredevelopment of current or future projects; iii) continued escalation of mining-related capital costs may reduce profitability;iv) uncertainty surrounding the long-term uranium supply-dem<strong>and</strong> framework <strong>and</strong> resulting price levels.Risks - Denison Mines Corp.i) A decline in the price of gold affects the equity resource market independent of commodity; as such, Denison may be atrisk of not being able to fund future exploration or development if gold prices decline; ii) uranium is a highly regulatedbusiness <strong>and</strong> therefore requires long lead times in order to permit projects; Denison is at risk of being delayed on futuredevelopment of current or future projects; iii) continued escalation of mining-related capital costs which may reduceprofitability; iv) uncertainty surrounding the long-term uranium supply-dem<strong>and</strong> framework <strong>and</strong> resulting price levels; v)some of Denison’s production comes from minority interests in uranium operations in Saskatchewan; the companytherefore does not have direct control over all of its production.Risks - Paladin Energy Ltd.i) A decline in the price of gold affects the equity resource market independent of commodity; as such, Paladin may be atrisk of not being able to fund future exploration or development if gold prices decline; ii) uranium is a highly regulatedbusiness <strong>and</strong> therefore requires long lead times in order to permit projects; Paladin is at risk of being delayed on futuredevelopment of current or future projects; iii) continued escalation of mining-related capital costs may reduce profitability;iv) uncertainty surrounding the long-term uranium supply-dem<strong>and</strong> framework <strong>and</strong> resulting price levels.Raymond James Ltd. | 2200 – 925 West Georgia Street | Vancouver BC Canada V6C 3L2