Clock - Uranium Supply Crunch and Critical ... - Andrew Johns

Clock - Uranium Supply Crunch and Critical ... - Andrew Johns

Clock - Uranium Supply Crunch and Critical ... - Andrew Johns

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

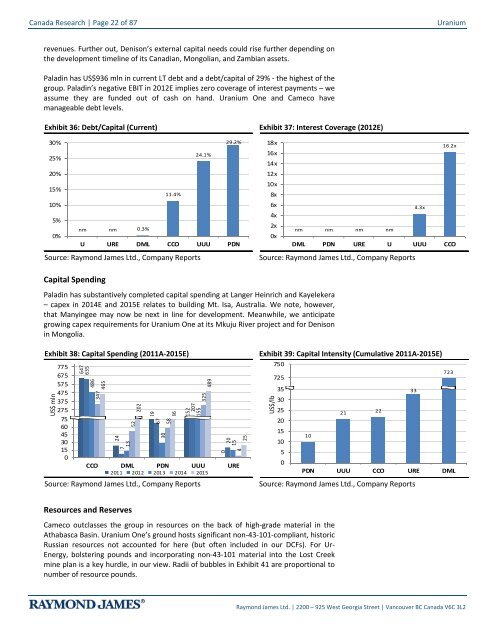

Canada Research | Page 22 of 87<strong>Uranium</strong>revenues. Further out, Denison’s external capital needs could rise further depending onthe development timeline of its Canadian, Mongolian, <strong>and</strong> Zambian assets.Paladin has US$936 mln in current LT debt <strong>and</strong> a debt/capital of 29% - the highest of thegroup. Paladin’s negative EBIT in 2012E implies zero coverage of interest payments – weassume they are funded out of cash on h<strong>and</strong>. <strong>Uranium</strong> One <strong>and</strong> Cameco havemanageable debt levels.Exhibit 36: Debt/Capital (Current)30%25%20%Debt/capitalCurrent29.2%24.1%15%11.4%10%5%nm nm 0.3%0%U URE DML CCO UUU PDNSource: Raymond James Ltd., Company ReportsExhibit 37: Interest Coverage (2012E)18x16x14x Interest Coverage12x Current10x8x6x4x16.2x4.3x2xnm nm nm nm0xDML PDN URE U UUU CCOSource: Raymond James Ltd., Company ReportsCapital SpendingPaladin has substantively completed capital spending at Langer Heinrich <strong>and</strong> Kayelekera– capex in 2014E <strong>and</strong> 2015E relates to building Mt. Isa, Australia. We note, however,that Manyingee may now be next in line for development. Meanwhile, we anticipategrowing capex requirements for <strong>Uranium</strong> One at its Mkuju River project <strong>and</strong> for Denisonin Mongolia.Exhibit 38: Capital Spending (2011A-2015E)US$ mln77567557547537527517575 604530150647635486Capital Spending('11-'15)347465to add24713522021296730588615220715532548902015CCO DML PDN UUU URE2011 2012 2013 2014 2015Source: Raymond James Ltd., Company Reports425Exhibit 39: Capital Intensity (Cumulative 2011A-2015E)750US$/lbUS$/lb723725700 353067525650 20Capital IntensityCumulative '11-'15?21 2215to10add1050PDN UUU CCO URE DMLSource: Raymond James Ltd., Company Reports33Resources <strong>and</strong> ReservesCameco outclasses the group in resources on the back of high-grade material in theAthabasca Basin. <strong>Uranium</strong> One’s ground hosts significant non-43-101-compliant, historicRussian resources not accounted for here (but often included in our DCFs). For Ur-Energy, bolstering pounds <strong>and</strong> incorporating non-43-101 material into the Lost Creekmine plan is a key hurdle, in our view. Radii of bubbles in Exhibit 41 are proportional tonumber of resource pounds.Raymond James Ltd. | 2200 – 925 West Georgia Street | Vancouver BC Canada V6C 3L2