Clock - Uranium Supply Crunch and Critical ... - Andrew Johns

Clock - Uranium Supply Crunch and Critical ... - Andrew Johns

Clock - Uranium Supply Crunch and Critical ... - Andrew Johns

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

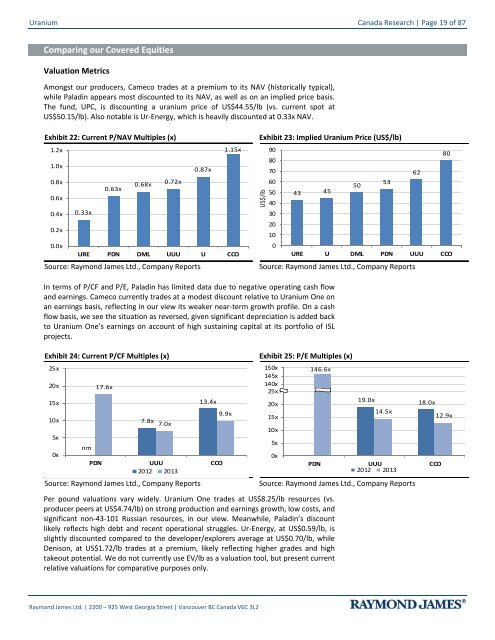

<strong>Uranium</strong> Canada Research | Page 19 of 87Comparing our Covered EquitiesValuation MetricsAmongst our producers, Cameco trades at a premium to its NAV (historically typical),while Paladin appears most discounted to its NAV, as well as on an implied price basis.The fund, UPC, is discounting a uranium price of US$44.55/lb (vs. current spot atUS$50.15/lb). Also notable is Ur-Energy, which is heavily discounted at 0.33x NAV.Exhibit 22: Current P/NAV Multiples (x)1.2x1.0x0.8x0.6x0.4x0.2x0.0x0.33x0.63x0.68x0.72x0.87x1.15xExhibit 23: Implied <strong>Uranium</strong> Price (US$/lb)P/NAVImplied uranium price40Current Current to addURE PDN DML UUU U CCOSource: Raymond James Ltd., Company ReportsUS$/lb9080706050302010043 45In terms of P/CF <strong>and</strong> P/E, Paladin has limited data due to negative operating cash flow<strong>and</strong> earnings. Cameco currently trades at a modest discount relative to <strong>Uranium</strong> One onan earnings basis, reflecting in our view its weaker near-term growth profile. On a cashflow basis, we see the situation as reversed, given significant depreciation is added backto <strong>Uranium</strong> One’s earnings on account of high sustaining capital at its portfolio of ISLprojects.Exhibit 24: Current P/CF Multiples (x)25x20x15x10x5x0xP/CF2013Enm17.6x7.8x7.0x13.4xPDN UUU CCO2012 2013Source: Raymond James Ltd., Company Reports9.9x50URE U DML PDN UUU CCOSource: Raymond James Ltd., Company ReportsExhibit 25: P/E Multiples (x)150x145x140x135x 25x130x20x146.6xP/E2013EPer pound valuations vary widely. <strong>Uranium</strong> One trades at US$8.25/lb resources (vs.producer peers at US$4.74/lb) on strong production <strong>and</strong> earnings growth, low costs, <strong>and</strong>significant non-43-101 Russian resources, in our view. Meanwhile, Paladin’s discountlikely reflects high debt <strong>and</strong> recent operational struggles. Ur-Energy, at US$0.59/lb, isslightly discounted compared to the developer/explorers average at US$0.70/lb, whileDenison, at US$1.72/lb trades at a premium, likely reflecting higher grades <strong>and</strong> hightakeout potential. We do not currently use EV/lb as a valuation tool, but present currentrelative valuations for comparative purposes only.15x10x5x0x53628019.0x 18.0x14.5x12.9xPDN UUU CCO2012 2013Source: Raymond James Ltd., Company ReportsRaymond James Ltd. | 2200 – 925 West Georgia Street | Vancouver BC Canada V6C 3L2