Clock - Uranium Supply Crunch and Critical ... - Andrew Johns

Clock - Uranium Supply Crunch and Critical ... - Andrew Johns

Clock - Uranium Supply Crunch and Critical ... - Andrew Johns

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

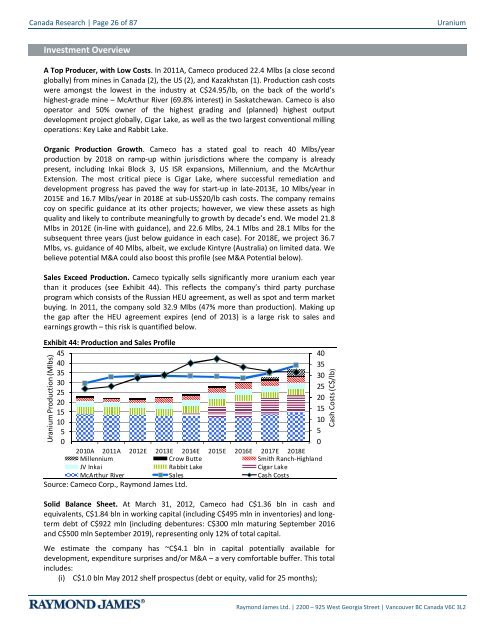

Canada Research | Page 26 of 87<strong>Uranium</strong>Investment OverviewA Top Producer, with Low Costs. In 2011A, Cameco produced 22.4 Mlbs (a close secondglobally) from mines in Canada (2), the US (2), <strong>and</strong> Kazakhstan (1). Production cash costswere amongst the lowest in the industry at C$24.95/lb, on the back of the world’shighest-grade mine – McArthur River (69.8% interest) in Saskatchewan. Cameco is alsooperator <strong>and</strong> 50% owner of the highest grading <strong>and</strong> (planned) highest outputdevelopment project globally, Cigar Lake, as well as the two largest conventional millingoperations: Key Lake <strong>and</strong> Rabbit Lake.Organic Production Growth. Cameco has a stated goal to reach 40 Mlbs/yearproduction by 2018 on ramp-up within jurisdictions where the company is alreadypresent, including Inkai Block 3, US ISR expansions, Millennium, <strong>and</strong> the McArthurExtension. The most critical piece is Cigar Lake, where successful remediation <strong>and</strong>development progress has paved the way for start-up in late-2013E, 10 Mlbs/year in2015E <strong>and</strong> 16.7 Mlbs/year in 2018E at sub-US$20/lb cash costs. The company remainscoy on specific guidance at its other projects; however, we view these assets as highquality <strong>and</strong> likely to contribute meaningfully to growth by decade’s end. We model 21.8Mlbs in 2012E (in-line with guidance), <strong>and</strong> 22.6 Mlbs, 24.1 Mlbs <strong>and</strong> 28.1 Mlbs for thesubsequent three years (just below guidance in each case). For 2018E, we project 36.7Mlbs, vs. guidance of 40 Mlbs, albeit, we exclude Kintyre (Australia) on limited data. Webelieve potential M&A could also boost this profile (see M&A Potential below).Sales Exceed Production. Cameco typically sells significantly more uranium each yearthan it produces (see Exhibit 44). This reflects the company’s third party purchaseprogram which consists of the Russian HEU agreement, as well as spot <strong>and</strong> term marketbuying. In 2011, the company sold 32.9 Mlbs (47% more than production). Making upthe gap after the HEU agreement expires (end of 2013) is a large risk to sales <strong>and</strong>earnings growth – this risk is quantified below.Exhibit 44: Production <strong>and</strong> Sales Profile45404035353030252520201515101055002010A 2011A 2012E 2013E 2014E 2015E 2016E 2017E 2018EMillennium Crow Butte Smith Ranch-Highl<strong>and</strong>JV Inkai Rabbit Lake Cigar LakeMcArthur River Sales Cash CostsSource: Cameco Corp., Raymond James Ltd.<strong>Uranium</strong> Production (Mlbs)Solid Balance Sheet. At March 31, 2012, Cameco had C$1.36 bln in cash <strong>and</strong>equivalents, C$1.84 bln in working capital (including C$495 mln in inventories) <strong>and</strong> longtermdebt of C$922 mln (including debentures: C$300 mln maturing September 2016<strong>and</strong> C$500 mln September 2019), representing only 12% of total capital.We estimate the company has ~C$4.1 bln in capital potentially available fordevelopment, expenditure surprises <strong>and</strong>/or M&A – a very comfortable buffer. This totalincludes:(i) C$1.0 bln May 2012 shelf prospectus (debt or equity, valid for 25 months);Cash Costs (C$/lb)Raymond James Ltd. | 2200 – 925 West Georgia Street | Vancouver BC Canada V6C 3L2