Clock - Uranium Supply Crunch and Critical ... - Andrew Johns

Clock - Uranium Supply Crunch and Critical ... - Andrew Johns

Clock - Uranium Supply Crunch and Critical ... - Andrew Johns

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

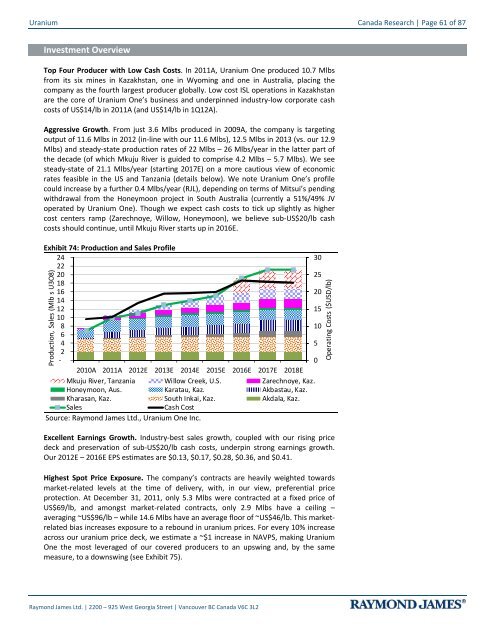

<strong>Uranium</strong> Canada Research | Page 61 of 87Investment OverviewTop Four Producer with Low Cash Costs. In 2011A, <strong>Uranium</strong> One produced 10.7 Mlbsfrom its six mines in Kazakhstan, one in Wyoming <strong>and</strong> one in Australia, placing thecompany as the fourth largest producer globally. Low cost ISL operations in Kazakhstanare the core of <strong>Uranium</strong> One’s business <strong>and</strong> underpinned industry-low corporate cashcosts of US$14/lb in 2011A (<strong>and</strong> US$14/lb in 1Q12A).Aggressive Growth. From just 3.6 Mlbs produced in 2009A, the company is targetingoutput of 11.6 Mlbs in 2012 (in-line with our 11.6 Mlbs), 12.5 Mlbs in 2013 (vs. our 12.9Mlbs) <strong>and</strong> steady-state production rates of 22 Mlbs – 26 Mlbs/year in the latter part ofthe decade (of which Mkuju River is guided to comprise 4.2 Mlbs – 5.7 Mlbs). We seesteady-state of 21.1 Mlbs/year (starting 2017E) on a more cautious view of economicrates feasible in the US <strong>and</strong> Tanzania (details below). We note <strong>Uranium</strong> One’s profilecould increase by a further 0.4 Mlbs/year (RJL), depending on terms of Mitsui’s pendingwithdrawal from the Honeymoon project in South Australia (currently a 51%/49% JVoperated by <strong>Uranium</strong> One). Though we expect cash costs to tick up slightly as highercost centers ramp (Zarechnoye, Willow, Honeymoon), we believe sub-US$20/lb cashcosts should continue, until Mkuju River starts up in 2016E.Exhibit 74: Production <strong>and</strong> Sales Profile2430222025181620141215108106452-02010A 2011A 2012E 2013E 2014E 2015E 2016E 2017E 2018EMkuju River, Tanzania Willow Creek, U.S. Zarechnoye, Kaz.Honeymoon, Aus. Karatau, Kaz. Akbastau, Kaz.Kharasan, Kaz. South Inkai, Kaz. Akdala, Kaz.SalesCash CostSource: Raymond James Ltd., <strong>Uranium</strong> One Inc.Production, Sales (Mlb s U3O8)Excellent Earnings Growth. Industry-best sales growth, coupled with our rising pricedeck <strong>and</strong> preservation of sub-US$20/lb cash costs, underpin strong earnings growth.Our 2012E – 2016E EPS estimates are $0.13, $0.17, $0.28, $0.36, <strong>and</strong> $0.41.Highest Spot Price Exposure. The company’s contracts are heavily weighted towardsmarket-related levels at the time of delivery, with, in our view, preferential priceprotection. At December 31, 2011, only 5.3 Mlbs were contracted at a fixed price ofUS$69/lb, <strong>and</strong> amongst market-related contracts, only 2.9 Mlbs have a ceiling –averaging ~US$96/lb – while 14.6 Mlbs have an average floor of ~US$46/lb. This marketrelatedbias increases exposure to a rebound in uranium prices. For every 10% increaseacross our uranium price deck, we estimate a ~$1 increase in NAVPS, making <strong>Uranium</strong>One the most leveraged of our covered producers to an upswing <strong>and</strong>, by the samemeasure, to a downswing (see Exhibit 75).Operating Costs ($USD/lb)Raymond James Ltd. | 2200 – 925 West Georgia Street | Vancouver BC Canada V6C 3L2