Clock - Uranium Supply Crunch and Critical ... - Andrew Johns

Clock - Uranium Supply Crunch and Critical ... - Andrew Johns

Clock - Uranium Supply Crunch and Critical ... - Andrew Johns

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

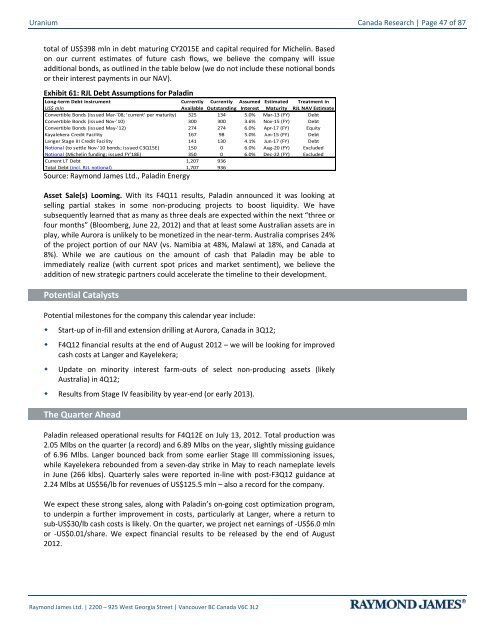

<strong>Uranium</strong> Canada Research | Page 47 of 87total of US$398 mln in debt maturing CY2015E <strong>and</strong> capital required for Michelin. Basedon our current estimates of future cash flows, we believe the company will issueadditional bonds, as outlined in the table below (we do not include these notional bondsor their interest payments in our NAV).Exhibit 61: RJL Debt Assumptions for PaladinLong-term Debt Instrument Currently Currently Assumed Estimated Treatment inUS$ mln Available Outst<strong>and</strong>ing Interest Maturity RJL NAV EstimateConvertible Bonds (issued Mar-'08; 'current' per maturity) 325 134 5.0% Mar-13 (FY) DebtConvertible Bonds (issued Nov-'10) 300 300 3.6% Nov-15 (FY) DebtConvertible Bonds (issued May-'12) 274 274 6.0% Apr-17 (FY) EquityKayalekera Credit Facility 167 98 5.0% Jun-15 (FY) DebtLanger Stage III Credit Facility 141 130 4.1% Jun-17 (FY) DebtNotional (to settle Nov-'10 bonds; issued C3Q15E) 150 0 6.0% Aug-20 (FY) ExcludedNotional (Michelin funding; issued FY'18E) 350 0 6.0% Dec-22 (FY) ExcludedCurrent LT Debt 1,207 936Total Debt (incl. RJL notional) 1,707 936Source: Raymond James Ltd., Paladin EnergyAsset Sale(s) Looming. With its F4Q11 results, Paladin announced it was looking atselling partial stakes in some non-producing projects to boost liquidity. We havesubsequently learned that as many as three deals are expected within the next “three orfour months” (Bloomberg, June 22, 2012) <strong>and</strong> that at least some Australian assets are inplay, while Aurora is unlikely to be monetized in the near-term. Australia comprises 24%of the project portion of our NAV (vs. Namibia at 48%, Malawi at 18%, <strong>and</strong> Canada at8%). While we are cautious on the amount of cash that Paladin may be able toimmediately realize (with current spot prices <strong>and</strong> market sentiment), we believe theaddition of new strategic partners could accelerate the timeline to their development.Potential CatalystsPotential milestones for the company this calendar year include:• Start-up of in-fill <strong>and</strong> extension drilling at Aurora, Canada in 3Q12;• F4Q12 financial results at the end of August 2012 – we will be looking for improvedcash costs at Langer <strong>and</strong> Kayelekera;• Update on minority interest farm-outs of select non-producing assets (likelyAustralia) in 4Q12;• Results from Stage IV feasibility by year-end (or early 2013).The Quarter AheadPaladin released operational results for F4Q12E on July 13, 2012. Total production was2.05 Mlbs on the quarter (a record) <strong>and</strong> 6.89 Mlbs on the year, slightly missing guidanceof 6.96 Mlbs. Langer bounced back from some earlier Stage III commissioning issues,while Kayelekera rebounded from a seven-day strike in May to reach nameplate levelsin June (266 klbs). Quarterly sales were reported in-line with post-F3Q12 guidance at2.24 Mlbs at US$56/lb for revenues of US$125.5 mln – also a record for the company.We expect these strong sales, along with Paladin’s on-going cost optimization program,to underpin a further improvement in costs, particularly at Langer, where a return tosub-US$30/lb cash costs is likely. On the quarter, we project net earnings of -US$6.0 mlnor -US$0.01/share. We expect financial results to be released by the end of August2012.Raymond James Ltd. | 2200 – 925 West Georgia Street | Vancouver BC Canada V6C 3L2