Clock - Uranium Supply Crunch and Critical ... - Andrew Johns

Clock - Uranium Supply Crunch and Critical ... - Andrew Johns

Clock - Uranium Supply Crunch and Critical ... - Andrew Johns

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

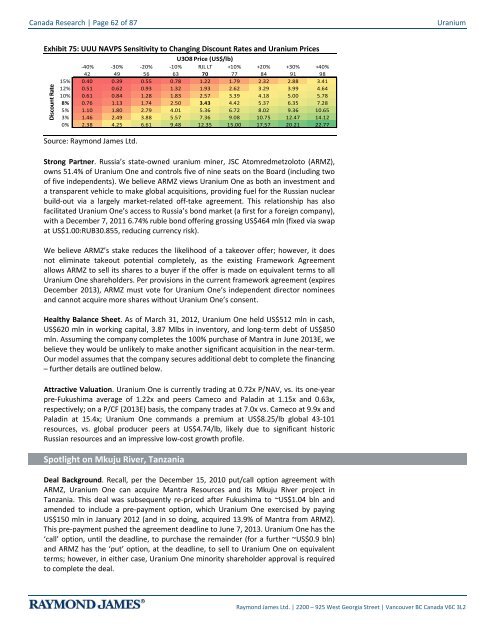

Canada Research | Page 62 of 87<strong>Uranium</strong>Exhibit 75: UUU NAVPS Sensitivity to Changing Discount Rates <strong>and</strong> <strong>Uranium</strong> PricesU3O8 Price (US$/lb)-40% -30% -20% -10% RJL LT +10% +20% +30% +40%#### 42 49 56 63 70 77 84 91 9815% 0.40 0.39 0.55 0.78 1.22 1.79 2.32 2.88 3.4112% 0.51 0.62 0.93 1.32 1.93 2.62 3.29 3.99 4.6410% 0.61 0.84 1.28 1.83 2.57 3.39 4.18 5.00 5.788% 0.76 1.13 1.74 2.50 3.43 4.42 5.37 6.35 7.28Discount Rate5% 1.10 1.80 2.79 4.01 5.36 6.72 8.02 9.36 10.653% 1.46 2.49 3.88 5.57 7.36 9.08 10.75 12.47 14.120% 2.38 4.25 6.61 9.48 12.35 15.00 17.57 20.21 22.77Source: Raymond James Ltd.Strong Partner. Russia’s state-owned uranium miner, JSC Atomredmetzoloto (ARMZ),owns 51.4% of <strong>Uranium</strong> One <strong>and</strong> controls five of nine seats on the Board (including twoof five independents). We believe ARMZ views <strong>Uranium</strong> One as both an investment <strong>and</strong>a transparent vehicle to make global acquisitions, providing fuel for the Russian nuclearbuild-out via a largely market-related off-take agreement. This relationship has alsofacilitated <strong>Uranium</strong> One’s access to Russia’s bond market (a first for a foreign company),with a December 7, 2011 6.74% ruble bond offering grossing US$464 mln (fixed via swapat US$1.00:RUB30.855, reducing currency risk).We believe ARMZ’s stake reduces the likelihood of a takeover offer; however, it doesnot eliminate takeout potential completely, as the existing Framework Agreementallows ARMZ to sell its shares to a buyer if the offer is made on equivalent terms to all<strong>Uranium</strong> One shareholders. Per provisions in the current framework agreement (expiresDecember 2013), ARMZ must vote for <strong>Uranium</strong> One’s independent director nominees<strong>and</strong> cannot acquire more shares without <strong>Uranium</strong> One’s consent.Healthy Balance Sheet. As of March 31, 2012, <strong>Uranium</strong> One held US$512 mln in cash,US$620 mln in working capital, 3.87 Mlbs in inventory, <strong>and</strong> long-term debt of US$850mln. Assuming the company completes the 100% purchase of Mantra in June 2013E, webelieve they would be unlikely to make another significant acquisition in the near-term.Our model assumes that the company secures additional debt to complete the financing– further details are outlined below.Attractive Valuation. <strong>Uranium</strong> One is currently trading at 0.72x P/NAV, vs. its one-yearpre-Fukushima average of 1.22x <strong>and</strong> peers Cameco <strong>and</strong> Paladin at 1.15x <strong>and</strong> 0.63x,respectively; on a P/CF (2013E) basis, the company trades at 7.0x vs. Cameco at 9.9x <strong>and</strong>Paladin at 15.4x; <strong>Uranium</strong> One comm<strong>and</strong>s a premium at US$8.25/lb global 43-101resources, vs. global producer peers at US$4.74/lb, likely due to significant historicRussian resources <strong>and</strong> an impressive low-cost growth profile.Spotlight on Mkuju River, TanzaniaDeal Background. Recall, per the December 15, 2010 put/call option agreement withARMZ, <strong>Uranium</strong> One can acquire Mantra Resources <strong>and</strong> its Mkuju River project inTanzania. This deal was subsequently re-priced after Fukushima to ~US$1.04 bln <strong>and</strong>amended to include a pre-payment option, which <strong>Uranium</strong> One exercised by payingUS$150 mln in January 2012 (<strong>and</strong> in so doing, acquired 13.9% of Mantra from ARMZ).This pre-payment pushed the agreement deadline to June 7, 2013. <strong>Uranium</strong> One has the‘call’ option, until the deadline, to purchase the remainder (for a further ~US$0.9 bln)<strong>and</strong> ARMZ has the ‘put’ option, at the deadline, to sell to <strong>Uranium</strong> One on equivalentterms; however, in either case, <strong>Uranium</strong> One minority shareholder approval is requiredto complete the deal.Raymond James Ltd. | 2200 – 925 West Georgia Street | Vancouver BC Canada V6C 3L2