Clock - Uranium Supply Crunch and Critical ... - Andrew Johns

Clock - Uranium Supply Crunch and Critical ... - Andrew Johns

Clock - Uranium Supply Crunch and Critical ... - Andrew Johns

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

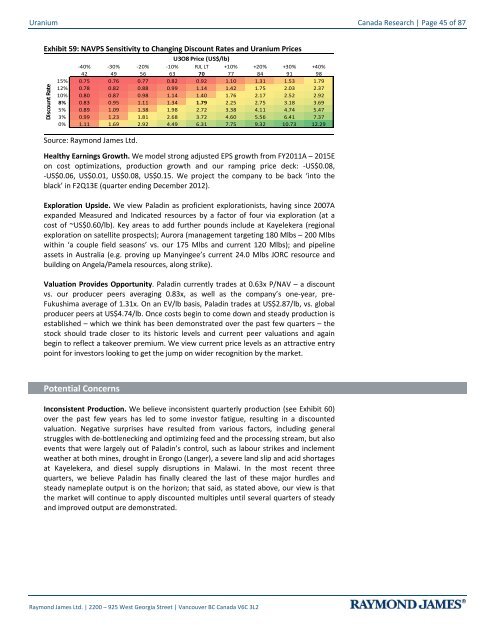

<strong>Uranium</strong> Canada Research | Page 45 of 87Exhibit 59: NAVPS Sensitivity to Changing Discount Rates <strong>and</strong> <strong>Uranium</strong> PricesU3O8 Price (US$/lb)-40% -30% -20% -10% RJL LT +10% +20% +30% +40%#### 42 49 56 63 70 77 84 91 9815% 0.75 0.76 0.77 0.82 0.92 1.10 1.31 1.53 1.7912% 0.78 0.82 0.88 0.99 1.14 1.42 1.75 2.03 2.3710% 0.80 0.87 0.98 1.14 1.40 1.76 2.17 2.52 2.928% 0.83 0.95 1.11 1.34 1.79 2.25 2.75 3.18 3.69Discount Rate5% 0.89 1.09 1.38 1.98 2.72 3.38 4.11 4.74 5.473% 0.99 1.23 1.81 2.68 3.72 4.60 5.56 6.41 7.370% 1.11 1.69 2.92 4.49 6.31 7.75 9.32 10.73 12.29Source: Raymond James Ltd.Healthy Earnings Growth. We model strong adjusted EPS growth from FY2011A – 2015Eon cost optimizations, production growth <strong>and</strong> our ramping price deck: -US$0.08,-US$0.06, US$0.01, US$0.08, US$0.15. We project the company to be back ‘into theblack’ in F2Q13E (quarter ending December 2012).Exploration Upside. We view Paladin as proficient explorationists, having since 2007Aexp<strong>and</strong>ed Measured <strong>and</strong> Indicated resources by a factor of four via exploration (at acost of ~US$0.60/lb). Key areas to add further pounds include at Kayelekera (regionalexploration on satellite prospects); Aurora (management targeting 180 Mlbs – 200 Mlbswithin ‘a couple field seasons’ vs. our 175 Mlbs <strong>and</strong> current 120 Mlbs); <strong>and</strong> pipelineassets in Australia (e.g. proving up Manyingee’s current 24.0 Mlbs JORC resource <strong>and</strong>building on Angela/Pamela resources, along strike).Valuation Provides Opportunity. Paladin currently trades at 0.63x P/NAV – a discountvs. our producer peers averaging 0.83x, as well as the company’s one-year, pre-Fukushima average of 1.31x. On an EV/lb basis, Paladin trades at US$2.87/lb, vs. globalproducer peers at US$4.74/lb. Once costs begin to come down <strong>and</strong> steady production isestablished – which we think has been demonstrated over the past few quarters – thestock should trade closer to its historic levels <strong>and</strong> current peer valuations <strong>and</strong> againbegin to reflect a takeover premium. We view current price levels as an attractive entrypoint for investors looking to get the jump on wider recognition by the market.Potential ConcernsInconsistent Production. We believe inconsistent quarterly production (see Exhibit 60)over the past few years has led to some investor fatigue, resulting in a discountedvaluation. Negative surprises have resulted from various factors, including generalstruggles with de-bottlenecking <strong>and</strong> optimizing feed <strong>and</strong> the processing stream, but alsoevents that were largely out of Paladin’s control, such as labour strikes <strong>and</strong> inclementweather at both mines, drought in Erongo (Langer), a severe l<strong>and</strong> slip <strong>and</strong> acid shortagesat Kayelekera, <strong>and</strong> diesel supply disruptions in Malawi. In the most recent threequarters, we believe Paladin has finally cleared the last of these major hurdles <strong>and</strong>steady nameplate output is on the horizon; that said, as stated above, our view is thatthe market will continue to apply discounted multiples until several quarters of steady<strong>and</strong> improved output are demonstrated.Raymond James Ltd. | 2200 – 925 West Georgia Street | Vancouver BC Canada V6C 3L2