Clock - Uranium Supply Crunch and Critical ... - Andrew Johns

Clock - Uranium Supply Crunch and Critical ... - Andrew Johns

Clock - Uranium Supply Crunch and Critical ... - Andrew Johns

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

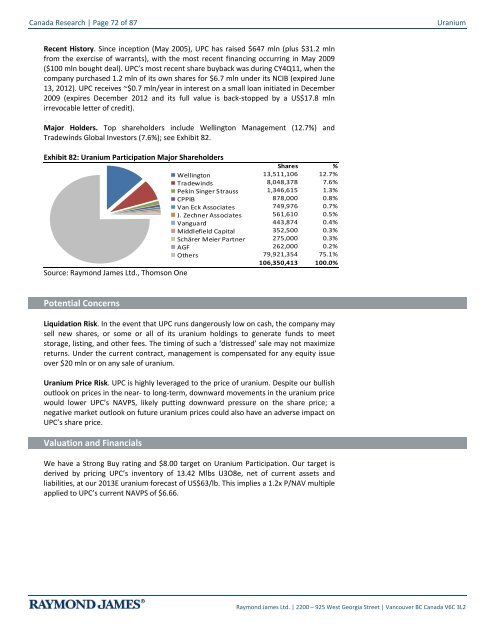

Canada Research | Page 72 of 87<strong>Uranium</strong>Recent History. Since inception (May 2005), UPC has raised $647 mln (plus $31.2 mlnfrom the exercise of warrants), with the most recent financing occurring in May 2009($100 mln bought deal). UPC’s most recent share buyback was during CY4Q11, when thecompany purchased 1.2 mln of its own shares for $6.7 mln under its NCIB (expired June13, 2012). UPC receives ~$0.7 mln/year in interest on a small loan initiated in December2009 (expires December 2012 <strong>and</strong> its full value is back-stopped by a US$17.8 mlnirrevocable letter of credit).Major Holders. Top shareholders include Wellington Management (12.7%) <strong>and</strong>Tradewinds Global Investors (7.6%); see Exhibit 82.Exhibit 82: <strong>Uranium</strong> Participation Major ShareholdersSource: Raymond James Ltd., Thomson OneWellingtonTradewindsPekin Singer StraussCPPIBVan Eck AssociatesJ. Zechner AssociatesVanguardMiddlefield CapitalSchärer Meier PartnerAGFOthersShares %13,511,106 12.7%8,048,378 7.6%1,346,615 1.3%878,000 0.8%749,976 0.7%561,610 0.5%443,874 0.4%352,500 0.3%275,000 0.3%262,000 0.2%79,921,354 75.1%106,350,413 100.0%Potential ConcernsLiquidation Risk. In the event that UPC runs dangerously low on cash, the company maysell new shares, or some or all of its uranium holdings to generate funds to meetstorage, listing, <strong>and</strong> other fees. The timing of such a ‘distressed’ sale may not maximizereturns. Under the current contract, management is compensated for any equity issueover $20 mln or on any sale of uranium.<strong>Uranium</strong> Price Risk. UPC is highly leveraged to the price of uranium. Despite our bullishoutlook on prices in the near- to long-term, downward movements in the uranium pricewould lower UPC’s NAVPS, likely putting downward pressure on the share price; anegative market outlook on future uranium prices could also have an adverse impact onUPC’s share price.Valuation <strong>and</strong> FinancialsWe have a Strong Buy rating <strong>and</strong> $8.00 target on <strong>Uranium</strong> Participation. Our target isderived by pricing UPC’s inventory of 13.42 Mlbs U3O8e, net of current assets <strong>and</strong>liabilities, at our 2013E uranium forecast of US$63/lb. This implies a 1.2x P/NAV multipleapplied to UPC’s current NAVPS of $6.66.Raymond James Ltd. | 2200 – 925 West Georgia Street | Vancouver BC Canada V6C 3L2