Clock - Uranium Supply Crunch and Critical ... - Andrew Johns

Clock - Uranium Supply Crunch and Critical ... - Andrew Johns

Clock - Uranium Supply Crunch and Critical ... - Andrew Johns

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

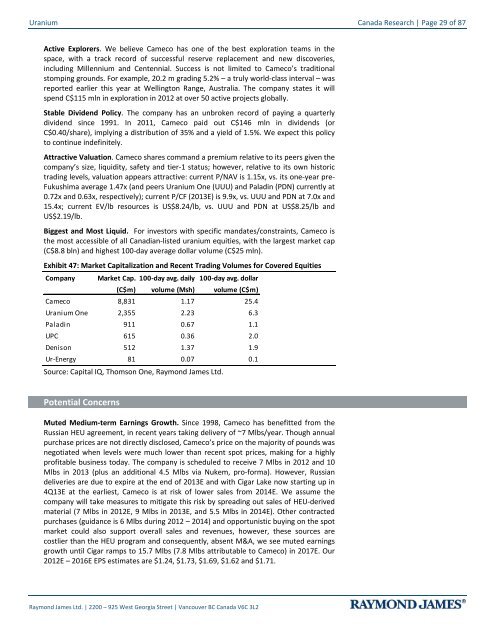

<strong>Uranium</strong> Canada Research | Page 29 of 87Active Explorers. We believe Cameco has one of the best exploration teams in thespace, with a track record of successful reserve replacement <strong>and</strong> new discoveries,including Millennium <strong>and</strong> Centennial. Success is not limited to Cameco’s traditionalstomping grounds. For example, 20.2 m grading 5.2% – a truly world-class interval – wasreported earlier this year at Wellington Range, Australia. The company states it willspend C$115 mln in exploration in 2012 at over 50 active projects globally.Stable Dividend Policy. The company has an unbroken record of paying a quarterlydividend since 1991. In 2011, Cameco paid out C$146 mln in dividends (orC$0.40/share), implying a distribution of 35% <strong>and</strong> a yield of 1.5%. We expect this policyto continue indefinitely.Attractive Valuation. Cameco shares comm<strong>and</strong> a premium relative to its peers given thecompany’s size, liquidity, safety <strong>and</strong> tier-1 status; however, relative to its own historictrading levels, valuation appears attractive: current P/NAV is 1.15x, vs. its one-year pre-Fukushima average 1.47x (<strong>and</strong> peers <strong>Uranium</strong> One (UUU) <strong>and</strong> Paladin (PDN) currently at0.72x <strong>and</strong> 0.63x, respectively); current P/CF (2013E) is 9.9x, vs. UUU <strong>and</strong> PDN at 7.0x <strong>and</strong>15.4x; current EV/lb resources is US$8.24/lb, vs. UUU <strong>and</strong> PDN at US$8.25/lb <strong>and</strong>US$2.19/lb.Biggest <strong>and</strong> Most Liquid. For investors with specific m<strong>and</strong>ates/constraints, Cameco isthe most accessible of all Canadian-listed uranium equities, with the largest market cap(C$8.8 bln) <strong>and</strong> highest 100-day average dollar volume (C$25 mln).Exhibit 47: Market Capitalization <strong>and</strong> Recent Trading Volumes for Covered EquitiesCompany Market Cap. 100-day avg. daily 100-day avg. dollar(C$m) volume (Msh) volume (C$m)Cameco 8,831 1.17 25.4<strong>Uranium</strong> One 2,355 2.23 6.3Paladin 911 0.67 1.1UPC 615 0.36 2.0Denison 512 1.37 1.9Ur-Energy 81 0.07 0.1Source: Capital IQ, Thomson One, Raymond James Ltd.Potential ConcernsMuted Medium-term Earnings Growth. Since 1998, Cameco has benefitted from theRussian HEU agreement, in recent years taking delivery of ~7 Mlbs/year. Though annualpurchase prices are not directly disclosed, Cameco’s price on the majority of pounds wasnegotiated when levels were much lower than recent spot prices, making for a highlyprofitable business today. The company is scheduled to receive 7 Mlbs in 2012 <strong>and</strong> 10Mlbs in 2013 (plus an additional 4.5 Mlbs via Nukem, pro-forma). However, Russi<strong>and</strong>eliveries are due to expire at the end of 2013E <strong>and</strong> with Cigar Lake now starting up in4Q13E at the earliest, Cameco is at risk of lower sales from 2014E. We assume thecompany will take measures to mitigate this risk by spreading out sales of HEU-derivedmaterial (7 Mlbs in 2012E, 9 Mlbs in 2013E, <strong>and</strong> 5.5 Mlbs in 2014E). Other contractedpurchases (guidance is 6 Mlbs during 2012 – 2014) <strong>and</strong> opportunistic buying on the spotmarket could also support overall sales <strong>and</strong> revenues, however, these sources arecostlier than the HEU program <strong>and</strong> consequently, absent M&A, we see muted earningsgrowth until Cigar ramps to 15.7 Mlbs (7.8 Mlbs attributable to Cameco) in 2017E. Our2012E – 2016E EPS estimates are $1.24, $1.73, $1.69, $1.62 <strong>and</strong> $1.71.Raymond James Ltd. | 2200 – 925 West Georgia Street | Vancouver BC Canada V6C 3L2