World Investment Report 2009: Transnational Corporations - Unctad

World Investment Report 2009: Transnational Corporations - Unctad

World Investment Report 2009: Transnational Corporations - Unctad

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

80 <strong>World</strong> <strong>Investment</strong> <strong>Report</strong> <strong>2009</strong>: <strong>Transnational</strong> <strong>Corporations</strong>, Agricultural Production and Development<br />

more than $1 billion) declined sharply. This caused<br />

the value of cross-border M&A inflows to drop to<br />

$35 billion in 2008 (a 65% decrease from the level of<br />

2007). The leading sources of Canada’s FDI inflows<br />

were the United States and European countries.<br />

FDI flows into the ������ countries fell by<br />

40% in 2008, to a total of $503 billion. The financial<br />

crisis and the economic downturn were responsible<br />

for the decline in inward FDI in the majority of<br />

these countries. In 2008, seven of the ten largest<br />

cross-border M&As worldwide took place in the<br />

EU (annex table A.I.3), of which four were intra-EU<br />

transactions. Cross-border bank mergers played an<br />

important role, as the process of consolidation in the<br />

European financial services industry continued. 106 In<br />

the first quarter of <strong>2009</strong>, FDI activity in most of EU<br />

countries was down compared to the first quarter of<br />

2008 (table II.27).<br />

Inward FDI flows to the 15 countries of the<br />

����������������������� (EMU) (or the euro zone)<br />

declined in 2008 by 48%, to $287 billion. A large<br />

share of inflows to EMU-member countries consisted<br />

of intra-EMU FDI. 107 Ten of the 15 EMU countries<br />

recorded a significant decline in FDI inflows in 2008.<br />

In France, FDI inflows fell by 26%, from a record<br />

level of $158 billion in 2007 to $118 billion, which<br />

was nevertheless still a high level. Indeed, France<br />

ranked second among FDI recipients worldwide in<br />

2008 (figure II.26), with inflows spread across a wide<br />

range of sectors. The overall decline in FDI inflows<br />

was mainly due to cutbacks in lending by TNCs to<br />

their foreign affiliates located in France. These intracompany<br />

loans fell by 35% to $68 billion. Equity<br />

capital inflows fell by 32% while reinvested earnings<br />

of foreign affiliates in France rose by 23%. Belgium<br />

saw its FDI inflows plunge by 46% to $60 billion in<br />

2008. Flows to Belgium are very volatile due to the<br />

presence of special purpose entities and corporate<br />

headquarters (WIR03, box. II.11). FDI inflows into<br />

Germany also fell sharply, by 56%, to only $25<br />

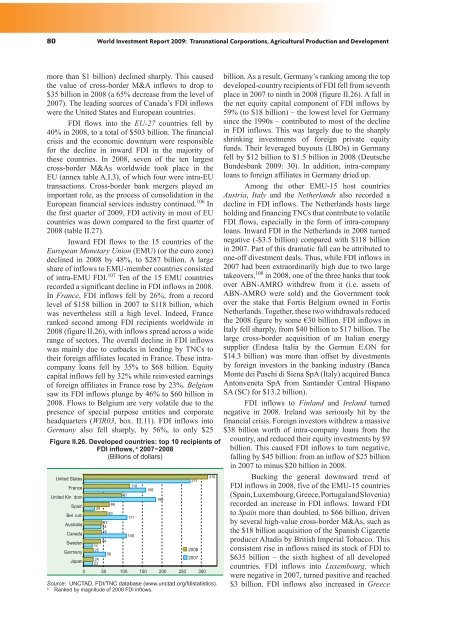

Figure II.26. Developed countries: top 10 recipients of<br />

FDI inflows, a ����������<br />

(Billions of dollars)<br />

������ ������<br />

���<br />

���<br />

������<br />

���<br />

���<br />

������ �������<br />

��<br />

���<br />

����� ��<br />

��<br />

�������<br />

��<br />

���<br />

���������<br />

��<br />

��<br />

������<br />

��<br />

���<br />

������ ��<br />

��<br />

�������<br />

�����<br />

��<br />

��<br />

��<br />

��<br />

����<br />

����<br />

� �� ��� ��� ��� ��� ���<br />

Source: UNCTAD, FDI/TNC database (www.unctad.org/fdistatistics).<br />

a Ranked by magnitude of 2008 FDI inflows.<br />

billion. As a result, Germany’s ranking among the top<br />

developed-country recipients of FDI fell from seventh<br />

place in 2007 to ninth in 2008 (figure II.26). A fall in<br />

the net equity capital component of FDI inflows by<br />

59% (to $18 billion) – the lowest level for Germany<br />

since the 1990s – contributed to most of the decline<br />

in FDI inflows. This was largely due to the sharply<br />

shrinking investments of foreign private equity<br />

funds. Their leveraged buyouts (LBOs) in Germany<br />

fell by $12 billion to $1.5 billion in 2008 (Deutsche<br />

Bundesbank <strong>2009</strong>: 30). In addition, intra-company<br />

loans to foreign affiliates in Germany dried up.<br />

Among the other EMU-15 host countries<br />

Austria, Italy and the ����������� also recorded a<br />

decline in FDI inflows. The Netherlands hosts large<br />

holding and financing TNCs that contribute to volatile<br />

FDI flows, especially in the form of intra-company<br />

loans. Inward FDI in the Netherlands in 2008 turned<br />

negative (-$3.5 billion) compared with $118 billion<br />

in 2007. Part of this dramatic fall can be attributed to<br />

one-off divestment deals. Thus, while FDI inflows in<br />

2007 had been extraordinarily high due to two large<br />

takeovers, 108 in 2008, one of the three banks that took<br />

over ABN-AMRO withdrew from it (i.e. assets of<br />

ABN-AMRO were sold) and the Government took<br />

over the stake that Fortis Belgium owned in Fortis<br />

Netherlands. Together, these two withdrawals reduced<br />

the 2008 figure by some €30 billion. FDI inflows in<br />

Italy fell sharply, from $40 billion to $17 billion. The<br />

large cross-border acquisition of an Italian energy<br />

supplier (Endesa Italia by the German E.ON for<br />

$14.3 billion) was more than offset by divestments<br />

by foreign investors in the banking industry (Banca<br />

Monte dei Paschi di Siena SpA (Italy) acquired Banca<br />

Antonveneta SpA from Santander Central Hispano<br />

SA (SC) for $13.2 billion).<br />

FDI inflows to Finland and Ireland turned<br />

negative in 2008. Ireland was seriously hit by the<br />

financial crisis. Foreign investors withdrew a massive<br />

$38 billion worth of intra-company loans from the<br />

country, and reduced their equity investments by $9<br />

billion. This caused FDI inflows to turn negative,<br />

falling by $45 billion: from an inflow of $25 billion<br />

in 2007 to minus $20 billion in 2008.<br />

Bucking the general downward trend of<br />

FDI inflows in 2008, five of the EMU-15 countries<br />

(Spain, Luxembourg, Greece, Portugal and Slovenia)<br />

recorded an increase in FDI inflows. Inward FDI<br />

to Spain more than doubled, to $66 billion, driven<br />

by several high-value cross-border M&As, such as<br />

the $18 billion acquisition of the Spanish Cigarette<br />

producer Altadis by British Imperial Tobacco. This<br />

consistent rise in inflows raised its stock of FDI to<br />

$635 billion – the sixth highest of all developed<br />

countries. FDI inflows into ����������� which<br />

were negative in 2007, turned positive and reached<br />

$3 billion. FDI inflows also increased in Greece