World Investment Report 2009: Transnational Corporations - Unctad

World Investment Report 2009: Transnational Corporations - Unctad

World Investment Report 2009: Transnational Corporations - Unctad

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

86 <strong>World</strong> <strong>Investment</strong> <strong>Report</strong> <strong>2009</strong>: <strong>Transnational</strong> <strong>Corporations</strong>, Agricultural Production and Development<br />

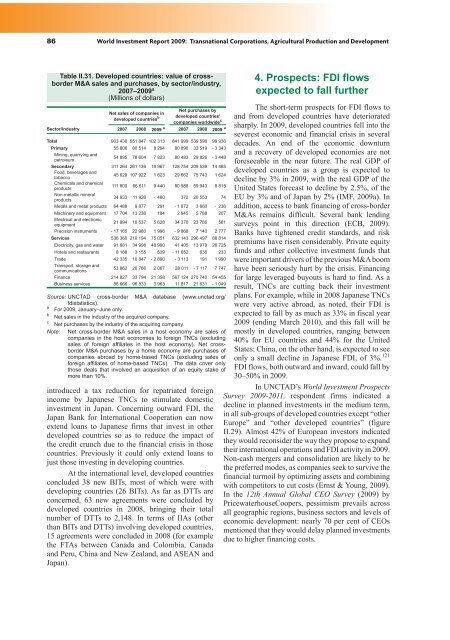

Table II.31. Developed countries: value of crossborder<br />

M&A sales and purchases, by sector/industry,<br />

2007–<strong>2009</strong> a<br />

(Millions of dollars)<br />

Net sales of companies in<br />

developed countries b<br />

Net purchases by<br />

developed countries’<br />

companies worldwide c<br />

Sector/industry 2007 2008 <strong>2009</strong> a 2007 2008 <strong>2009</strong> a<br />

Total 903 430 551 847 102 313 841 999 539 598 99 936<br />

Primary 55 806 80 514 8 294 80 890 33 519 - 3 343<br />

Mining, quarrying and<br />

petroleum<br />

54 895 78 604 7 823 80 483 29 826 - 3 448<br />

Secondary 311 264 261 139 18 967 128 754 209 539 14 465<br />

Food, beverages and<br />

tobacco<br />

45 629 107 922 1 623 29 662 75 743 1 624<br />

Chemicals and chemical<br />

products<br />

111 800 66 611 9 440 80 988 59 943 8 815<br />

Non-metallic mineral<br />

products<br />

34 933 11 926 - 460 372 20 553 74<br />

Metals and metal products 64 488 9 877 291 - 1 872 3 660 - 236<br />

Machinery and equipment 17 704 13 236 184 2 945 5 788 207<br />

Electrical and electronic<br />

equipment<br />

21 894 10 537 5 628 34 370 23 786 561<br />

Precision instruments - 17 165 22 980 1 996 - 9 868 7 140 2 777<br />

Services 536 360 210 194 75 051 632 143 296 497 88 814<br />

Electricity, gas and water 91 681 34 998 48 990 41 405 13 978 26 725<br />

Hotels and restaurants 8 188 3 155 539 - 11 652 636 233<br />

Trade 42 335 10 847 - 2 890 - 3 113 191 1 990<br />

Transport, storage and<br />

communications<br />

53 862 20 766 2 067 28 011 - 7 117 7 747<br />

Finance 214 827 33 794 21 358 567 124 270 740 54 455<br />

Business services 88 666 96 833 3 963 11 817 21 631 - 1 049<br />

Source: UNCTAD cross-border M&A database (www.unctad.org/<br />

fdistatistics).<br />

a For <strong>2009</strong>, January–June only.<br />

b Net sales in the industry of the acquired company.<br />

c Net purchases by the industry of the acquiring company.<br />

Note: Net cross-border M&A sales in a host economy are sales of<br />

companies in the host economies to foreign TNCs (excluding<br />

sales of foreign affiliates in the host economy). Net crossborder<br />

M&A purchases by a home economy are purchases of<br />

companies abroad by home-based TNCs (excluding sales of<br />

foreign affiliates of home-based TNCs). The data cover only<br />

those deals that involved an acquisition of an equity stake of<br />

more than 10%.<br />

introduced a tax reduction for repatriated foreign<br />

income by Japanese TNCs to stimulate domestic<br />

investment in Japan. Concerning outward FDI, the<br />

Japan Bank for International Cooperation can now<br />

extend loans to Japanese firms that invest in other<br />

developed countries so as to reduce the impact of<br />

the credit crunch due to the financial crisis in those<br />

countries. Previously it could only extend loans to<br />

just those investing in developing countries.<br />

At the international level, developed countries<br />

concluded 38 new BITs, most of which were with<br />

developing countries (26 BITs). As far as DTTs are<br />

concerned, 63 new agreements were concluded by<br />

developed countries in 2008, bringing their total<br />

number of DTTs to 2,148. In terms of IIAs (other<br />

than BITs and DTTs) involving developed countries,<br />

15 agreements were concluded in 2008 (for example<br />

the FTAs between Canada and Colombia, Canada<br />

and Peru, China and New Zealand, and ASEAN and<br />

Japan).<br />

4. Prospects: FDI flows<br />

expected to fall further<br />

The short-term prospects for FDI flows to<br />

and from developed countries have deteriorated<br />

sharply. In <strong>2009</strong>, developed countries fell into the<br />

severest economic and financial crisis in several<br />

decades. An end of the economic downturn<br />

and a recovery of developed economies are not<br />

foreseeable in the near future. The real GDP of<br />

developed countries as a group is expected to<br />

decline by 3% in <strong>2009</strong>, with the real GDP of the<br />

United States forecast to decline by 2.5%, of the<br />

EU by 3% and of Japan by 2% (IMF, <strong>2009</strong>a). In<br />

addition, access to bank financing of cross-border<br />

M&As remains difficult. Several bank lending<br />

surveys point in this direction (ECB, <strong>2009</strong>).<br />

Banks have tightened credit standards, and risk<br />

premiums have risen considerably. Private equity<br />

funds and other collective investment funds that<br />

were important drivers of the previous M&A boom<br />

have been seriously hurt by the crisis. Financing<br />

for large leveraged buyouts is hard to find. As a<br />

result, TNCs are cutting back their investment<br />

plans. For example, while in 2008 Japanese TNCs<br />

were very active abroad, as noted, their FDI is<br />

expected to fall by as much as 33% in fiscal year<br />

<strong>2009</strong> (ending March 2010), and this fall will be<br />

mostly in developed countries, ranging between<br />

40% for EU countries and 44% for the United<br />

States; China, on the other hand, is expected to see<br />

only a small decline in Japanese FDI, of 3%. 121<br />

FDI flows, both outward and inward, could fall by<br />

30–50% in <strong>2009</strong>.<br />

In UNCTAD’s <strong>World</strong> <strong>Investment</strong> Prospects<br />

Survey <strong>2009</strong>-2011, respondent firms indicated a<br />

decline in planned investments in the medium term,<br />

in all sub-groups of developed countries except “other<br />

Europe” and “other developed countries” (figure<br />

II.29). Almost 42% of European investors indicated<br />

they would reconsider the way they propose to expand<br />

their international operations and FDI activity in <strong>2009</strong>.<br />

Non-cash mergers and consolidation are likely to be<br />

the preferred modes, as companies seek to survive the<br />

financial turmoil by optimizing assets and combining<br />

with competitors to cut costs (Ernst & Young, <strong>2009</strong>).<br />

In the ����� ������� ������� ���� ������� (<strong>2009</strong>) by<br />

PricewaterhouseCoopers, pessimism prevails across<br />

all geographic regions, business sectors and levels of<br />

economic development: nearly 70 per cent of CEOs<br />

mentioned that they would delay planned investments<br />

due to higher financing costs.