World Investment Report 2009: Transnational Corporations - Unctad

World Investment Report 2009: Transnational Corporations - Unctad

World Investment Report 2009: Transnational Corporations - Unctad

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

34 <strong>World</strong> <strong>Investment</strong> <strong>Report</strong> <strong>2009</strong>: <strong>Transnational</strong> <strong>Corporations</strong>, Agricultural Production and Development<br />

countries. The parties agreed that investment issues<br />

will be dealt with through BITs between Singapore<br />

and individual GCC member countries.<br />

In Africa, countries relied on regional<br />

������������ �������������� ��� ���������� ����� ����<br />

framework agreements. The United States concluded<br />

a Trade and <strong>Investment</strong> Framework Agreement<br />

(TIFA) with the East African Community (EAC) and<br />

a Trade and <strong>Investment</strong> Cooperative Agreement with<br />

the Southern African Customs Union (SACU). These<br />

agreements establish an institutional framework to<br />

monitor trade and investment relations between the<br />

parties and to consider ways to promote investment<br />

(see annex table A.I.13).<br />

d. Investor-State dispute settlement<br />

In parallel with the expanding IIA regime,<br />

the number of investor-State disputes has remained<br />

relatively high. The cumulative number of known<br />

treaty-based cases had reached 317 by end 2008<br />

(figure I.25). 56 In 2008, at least 30 new treaty-based<br />

investor-State dispute cases were filed, 21 of them with<br />

the International Centre for Settlement of <strong>Investment</strong><br />

Disputes (ICSID). While this was lower than in<br />

2007, when 35 new cases were filed, it is nonetheless<br />

considerably higher than those filed before 2002.<br />

Since ICSID is the only arbitration facility to maintain<br />

a public registry, the actual number of treaty-based<br />

cases is likely to be higher.<br />

The rise in disputes continues to affect many<br />

countries. In fact, at least 77 governments – 47 in<br />

developing countries, 17 in developed countries and 13<br />

in transition economies – were involved in investment<br />

treaty arbitration by the end of 2008. Argentina still<br />

tops the list with 48 claims lodged against it, two of<br />

which were brought in 2008. Mexico is second, with<br />

��� ������ �������� ��������� ��� ���� ������ ���������<br />

(15) and Ecuador (14). Countries with a relatively<br />

large number of new known cases in<br />

2008 included: Ecuador (4), Ukraine<br />

(4) and Georgia (3). Three countries<br />

faced arbitration for the first time in<br />

�������������������������������������<br />

As many as 92% of known claims<br />

(317) were initiated by investors from<br />

developed countries, whereas by the<br />

end of 2008, there were 20 cases filed<br />

by investors from developing countries<br />

and 9 from transition economies. Of<br />

the 96 cases concluded by end 2008, 51<br />

were decided in favour of the State, and<br />

45 in favour of the investor, although<br />

four of these cases are still pending<br />

before an ICSID annulment committee.<br />

At the same time, 48 cases were<br />

discontinued following settlement, 142<br />

Number of IIAs (other than BITs and DTTs)<br />

300<br />

250<br />

200<br />

150<br />

100<br />

50<br />

0<br />

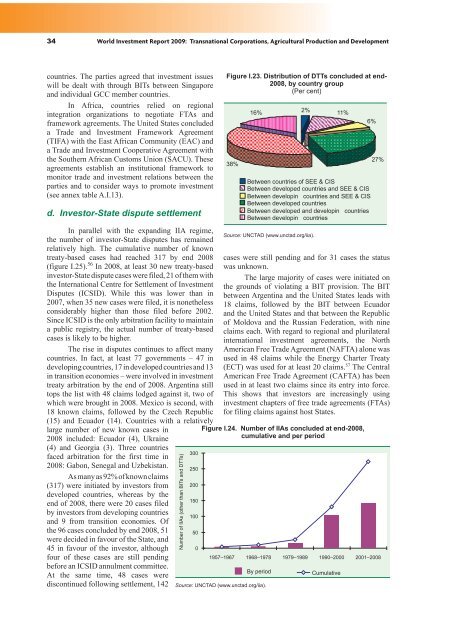

Figure I.23. Distribution of DTTs concluded at end-<br />

2008, by country group<br />

(Per cent)<br />

���<br />

���<br />

��<br />

Source: UNCTAD (www.unctad.org/iia).<br />

���<br />

������� ��������� ���������<br />

������� ��������� ��������� ��� ��� � ���<br />

������� ���������� ��������� ��� ��� � ���<br />

������� ��������� ���������<br />

������� ��������� ��� ���������� ���������<br />

������� ���������� ���������<br />

��<br />

���<br />

cases were still pending and for 31 cases the status<br />

was unknown.<br />

The large majority of cases were initiated on<br />

the grounds of violating a BIT provision. The BIT<br />

between Argentina and the United States leads with<br />

18 claims, followed by the BIT between Ecuador<br />

and the United States and that between the Republic<br />

of Moldova and the Russian Federation, with nine<br />

claims each. With regard to regional and plurilateral<br />

international investment agreements, the North<br />

American Free Trade Agreement (NAFTA) alone was<br />

used in 48 claims while the Energy Charter Treaty<br />

(ECT) was used for at least 20 claims. 57 The Central<br />

American Free Trade Agreement (CAFTA) has been<br />

used in at least two claims since its entry into force.<br />

This shows that investors are increasingly using<br />

investment chapters of free trade agreements (FTAs)<br />

for filing claims against host States.<br />

Figure I.24. Number of IIAs concluded at end-2008,<br />

cumulative and per period<br />

1957–1967 1968–1978 1979–1989 1990–2000 2001–2008<br />

Source: UNCTAD (www.unctad.org/iia).<br />

By period Cumulative