World Investment Report 2009: Transnational Corporations - Unctad

World Investment Report 2009: Transnational Corporations - Unctad

World Investment Report 2009: Transnational Corporations - Unctad

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

58 <strong>World</strong> <strong>Investment</strong> <strong>Report</strong> <strong>2009</strong>: <strong>Transnational</strong> <strong>Corporations</strong>, Agricultural Production and Development<br />

� �������<br />

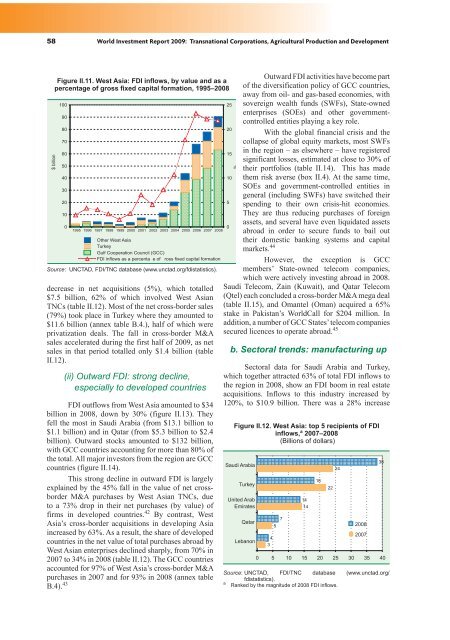

Figure II.11. West Asia: FDI inflows, by value and as a<br />

percentage of gross fixed capital formation, 1995–2008<br />

���<br />

��<br />

��<br />

��<br />

��<br />

��<br />

��<br />

��<br />

��<br />

��<br />

�<br />

���� ���� ���� ���� ���� ���� ���� ���� ���� ���� ���� ���� ���� ���� �<br />

����� ���� ����<br />

������<br />

���� ����������� ������� �����<br />

��� ������� �� � ���������� ������� ����� ������� ���������<br />

Source: UNCTAD, FDI/TNC database (www.unctad.org/fdistatistics).<br />

decrease in net acquisitions (5%), which totalled<br />

$7.5 billion, 62% of which involved West Asian<br />

TNCs (table II.12). Most of the net cross-border sales<br />

(79%) took place in Turkey where they amounted to<br />

$11.6 billion (annex table B.4.), half of which were<br />

privatization deals. The fall in cross-border M&A<br />

sales accelerated during the first half of <strong>2009</strong>, as net<br />

sales in that period totalled only $1.4 billion (table<br />

II.12).<br />

(ii) Outward FDI: strong decline,<br />

especially to developed countries<br />

FDI outflows from West Asia amounted to $34<br />

billion in 2008, down by 30% (figure II.13). They<br />

fell the most in Saudi Arabia (from $13.1 billion to<br />

$1.1 billion) and in Qatar (from $5.3 billion to $2.4<br />

billion). Outward stocks amounted to $132 billion,<br />

with GCC countries accounting for more than 80% of<br />

the total. All major investors from the region are GCC<br />

countries (figure II.14).<br />

This strong decline in outward FDI is largely<br />

explained by the 45% fall in the value of net crossborder<br />

M&A purchases by West Asian TNCs, due<br />

to a 73% drop in their net purchases (by value) of<br />

firms in developed countries. 42 By contrast, West<br />

Asia’s cross-border acquisitions in developing Asia<br />

increased by 63%. As a result, the share of developed<br />

countries in the net value of total purchases abroad by<br />

West Asian enterprises declined sharply, from 70% in<br />

2007 to 34% in 2008 (table II.12). The GCC countries<br />

accounted for 97% of West Asia’s cross-border M&A<br />

purchases in 2007 and for 93% in 2008 (annex table<br />

B.4). 43<br />

Outward FDI activities have become part<br />

of the diversification policy of GCC countries,<br />

away from oil- and gas-based economies, with<br />

sovereign wealth funds (SWFs), State-owned<br />

enterprises (SOEs) and other governmentcontrolled<br />

entities playing a key role.<br />

With the global financial crisis and the<br />

collapse of global equity markets, most SWFs<br />

in the region – as elsewhere – have registered<br />

significant losses, estimated at close to 30% of<br />

their portfolios (table II.14). This has made<br />

them risk averse (box II.4). At the same time,<br />

SOEs and government-controlled entities in<br />

general (including SWFs) have switched their<br />

spending to their own crisis-hit economies.<br />

They are thus reducing purchases of foreign<br />

assets, and several have even liquidated assets<br />

abroad in order to secure funds to bail out<br />

their domestic banking systems and capital<br />

markets. 44<br />

However, the exception is GCC<br />

members’ State-owned telecom companies,<br />

which were actively investing abroad in 2008.<br />

Saudi Telecom, Zain (Kuwait), and Qatar Telecom<br />

(Qtel) each concluded a cross-border M&A mega deal<br />

(table II.15), and Omantel (Oman) acquired a 65%<br />

stake in Pakistan’s <strong>World</strong>Call for $204 million. In<br />

addition, a number of GCC States’ telecom companies<br />

secured licences to operate abroad. 45<br />

��<br />

��<br />

��<br />

��<br />

�<br />

�<br />

b. Sectoral trends: manufacturing up<br />

Sectoral data for Saudi Arabia and Turkey,<br />

which together attracted 63% of total FDI inflows to<br />

the region in 2008, show an FDI boom in real estate<br />

acquisitions. Inflows to this industry increased by<br />

120%, to $10.9 billion. There was a 28% increase<br />

Figure II.12. West Asia: top 5 recipients of FDI<br />

inflows, a 2007–2008<br />

(Billions of dollars)<br />

����� ������<br />

������<br />

������ ����<br />

��������<br />

�����<br />

�������<br />

�<br />

�<br />

�<br />

�<br />

��<br />

��<br />

Source: UNCTAD, FDI/TNC database (www.unctad.org/<br />

fdistatistics).<br />

a Ranked by the magnitude of 2008 FDI inflows.<br />

��<br />

� � �� �� �� �� �� �� ��<br />

��<br />

��<br />

����<br />

����<br />

��