World Investment Report 2009: Transnational Corporations - Unctad

World Investment Report 2009: Transnational Corporations - Unctad

World Investment Report 2009: Transnational Corporations - Unctad

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

22 <strong>World</strong> <strong>Investment</strong> <strong>Report</strong> <strong>2009</strong>: <strong>Transnational</strong> <strong>Corporations</strong>, Agricultural Production and Development<br />

In order to improve their balance sheets and<br />

arrest their deteriorating profits, TNCs have been<br />

extensively curtailing expenditures and taking steps<br />

to reduce their debt.<br />

This is being done through three major<br />

channels:<br />

�� ������ ����� ��� ���������� �������������� �����������<br />

through layoffs. Plans for large job cuts have been<br />

announced by many of the top 100 TNCs since<br />

September 2008. 33<br />

�� �������� ����� ����������� ������������ �����<br />

planned acquisitions or greenfield projects of<br />

the top TNCs have been cancelled, reduced or<br />

postponed due to the combined impact of a setback<br />

in market expectations and reduced internal and<br />

external financial resources. 34<br />

�� ������������ ��� ����� ���������� ������ ���� ��������<br />

These operations are meant not only to curtail<br />

operating costs, but also to generate cash in<br />

order to reduce debt ratios, and/or simply beef up<br />

available cash that had diminished due to faltering<br />

sales. This has led, in particular, to a rising number<br />

of sales of non-strategic affiliates. 35<br />

Another consequence of the crisis is an<br />

acceleration of industry restructurings due to two<br />

main factors. First, some companies suffering from<br />

an already fragile financial situation before the crisis<br />

might be affected by the current turmoil to the point<br />

that they go bankrupt or have no other choice than<br />

to be acquired to survive. Others might become<br />

vulnerable to such hostile bids due to the presently<br />

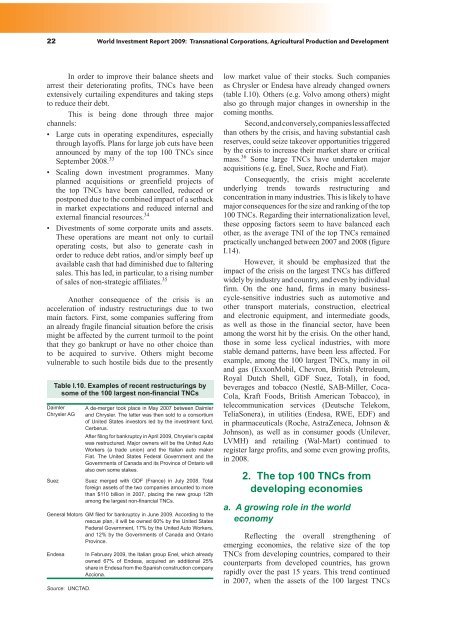

Table I.10. Examples of recent restructurings by<br />

some of the 100 largest non-financial TNCs<br />

Daimler<br />

Chrysler AG<br />

A de-merger took place in May 2007 between Daimler<br />

and Chrysler. The latter was then sold to a consortium<br />

of United States investors led by the investment fund,<br />

Cerberus.<br />

After filing for bankruptcy in April <strong>2009</strong>, Chrysler’s capital<br />

was restructured. Major owners will be the United Auto<br />

Workers (a trade union) and the Italian auto maker<br />

Fiat. The United States Federal Government and the<br />

Governments of Canada and its Province of Ontario will<br />

also own some stakes.<br />

Suez Suez merged with GDF (France) in July 2008. Total<br />

foreign assets of the two companies amounted to more<br />

than $110 billion in 2007, placing the new group 12th<br />

among the largest non-financial TNCs.<br />

General Motors GM filed for bankruptcy in June <strong>2009</strong>. According to the<br />

rescue plan, it will be owned 60% by the United States<br />

Federal Government, 17% by the United Auto Workers,<br />

and 12% by the Governments of Canada and Ontario<br />

Province.<br />

Endesa In February <strong>2009</strong>, the Italian group Enel, which already<br />

owned 67% of Endesa, acquired an additional 25%<br />

share in Endesa from the Spanish construction company<br />

Acciona.<br />

Source: UNCTAD.<br />

low market value of their stocks. Such companies<br />

as Chrysler or Endesa have already changed owners<br />

(table I.10). Others (e.g. Volvo among others) might<br />

also go through major changes in ownership in the<br />

coming months.<br />

Second, and conversely, companies less affected<br />

than others by the crisis, and having substantial cash<br />

�������������������������������������������������������<br />

by the crisis to increase their market share or critical<br />

mass. 36 Some large TNCs have undertaken major<br />

������������������������������������������������<br />

Consequently, the crisis might accelerate<br />

underlying trends towards restructuring and<br />

concentration in many industries. This is likely to have<br />

�������������������������������������������������������<br />

������������������������������������������������������<br />

these opposing factors seem to have balanced each<br />

other, as the average TNI of the top TNCs remained<br />

practically unchanged between 2007 and 2008 (figure<br />

I.14).<br />

��������� ��� ������� ��� ����������� ����� ����<br />

impact of the crisis on the largest TNCs has differed<br />

widely by industry and country, and even by individual<br />

firm. On the one hand, firms in many businesscycle-sensitive<br />

industries such as automotive and<br />

other transport materials, construction, electrical<br />

and electronic equipment, and intermediate goods,<br />

as well as those in the financial sector, have been<br />

among the worst hit by the crisis. On the other hand,<br />

those in some less cyclical industries, with more<br />

stable demand patterns, have been less affected. For<br />

example, among the 100 largest TNCs, many in oil<br />

and gas (ExxonMobil, Chevron, British Petroleum,<br />

������ ������ ������� ���� ������ �������� ��� ������<br />

beverages and tobacco (Nestlé, SAB-Miller, Coca-<br />

Cola, Kraft Foods, British American Tobacco), in<br />

telecommunication services (Deutsche Telekom,<br />

TeliaSonera), in utilities (Endesa, RWE, EDF) and<br />

in pharmaceuticals (Roche, AstraZeneca, Johnson &<br />

Johnson), as well as in consumer goods (Unilever,<br />

LVMH) and retailing (Wal-Mart) continued to<br />

register large profits, and some even growing profits,<br />

in 2008.<br />

2. The top 100 TNCs from<br />

developing economies<br />

a. A growing role in the world<br />

economy<br />

Reflecting the overall strengthening of<br />

��������� ����������� ���� ��������� ����� ��� ���� ����<br />

TNCs from developing countries, compared to their<br />

counterparts from developed countries, has grown<br />

rapidly over the past 15 years. This trend continued<br />

in 2007, when the assets of the 100 largest TNCs