World Investment Report 2009: Transnational Corporations - Unctad

World Investment Report 2009: Transnational Corporations - Unctad

World Investment Report 2009: Transnational Corporations - Unctad

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

42 <strong>World</strong> <strong>Investment</strong> <strong>Report</strong> <strong>2009</strong>: <strong>Transnational</strong> <strong>Corporations</strong>, Agricultural Production and Development<br />

Group of economies<br />

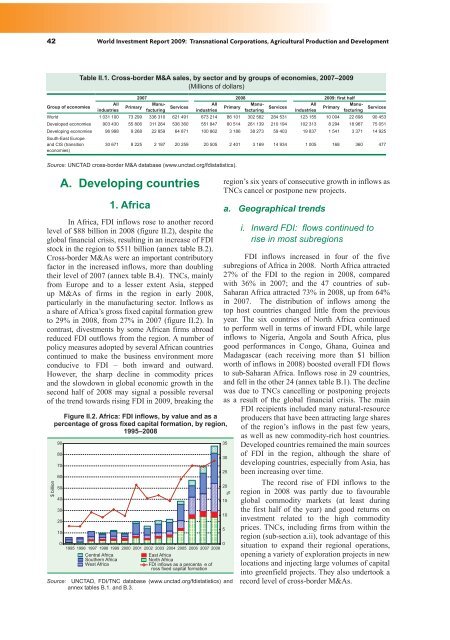

Table II.1. Cross-border M&A sales, by sector and by groups of economies, 2007–<strong>2009</strong><br />

(Millions of dollars)<br />

All<br />

industries<br />

Primary<br />

2007 2008 <strong>2009</strong>: first half<br />

Manufacturing<br />

Services<br />

All<br />

industries<br />

Primary<br />

Manufacturing<br />

Services<br />

All<br />

industries<br />

Primary<br />

Manufacturing<br />

Services<br />

<strong>World</strong> 1 031 100 73 299 336 310 621 491 673 214 86 101 302 582 284 531 123 155 10 004 22 698 90 453<br />

Developed economies 903 430 55 806 311 264 536 360 551 847 80 514 261 139 210 194 102 313 8 294 18 967 75 051<br />

Developing economies 96 998 9 268 22 859 64 871 100 862 3 186 38 273 59 403 19 837 1 541 3 371 14 925<br />

South-East Europe<br />

and CIS (transition<br />

economies)<br />

30 671 8 225 2 187 20 259 20 505 2 401 3 169 14 934 1 005 168 360 477<br />

Source: UNCTAD cross-border M&A database (www.unctad.org/fdistatistics).<br />

A. Developing countries<br />

1. Africa<br />

In Africa, FDI inflows rose to another record<br />

level of $88 billion in 2008 (figure II.2), despite the<br />

global financial crisis, resulting in an increase of FDI<br />

stock in the region to $511 billion (annex table B.2).<br />

Cross-border M&As were an important contributory<br />

factor in the increased inflows, more than doubling<br />

their level of 2007 (annex table B.4). TNCs, mainly<br />

from Europe and to a lesser extent Asia, stepped<br />

up M&As of firms in the region in early 2008,<br />

particularly in the manufacturing sector. Inflows as<br />

a share of Africa’s gross fixed capital formation grew<br />

to 29% in 2008, from 27% in 2007 (figure II.2). In<br />

contrast, divestments by some African firms abroad<br />

reduced FDI outflows from the region. A number of<br />

policy measures adopted by several African countries<br />

continued to make the business environment more<br />

conducive to FDI – both inward and outward.<br />

However, the sharp decline in commodity prices<br />

and the slowdown in global economic growth in the<br />

second half of 2008 may signal a possible reversal<br />

of the trend towards rising FDI in <strong>2009</strong>, breaking the<br />

� �������<br />

Figure II.2. Africa: FDI inflows, by value and as a<br />

percentage of gross fixed capital formation, by region,<br />

1995–2008<br />

��<br />

��<br />

��<br />

��<br />

��<br />

��<br />

��<br />

��<br />

��<br />

�<br />

�<br />

���� ���� ���� ���� ���� ���� ���� ���� ���� ���� ���� ���� ���� ����<br />

������� ������<br />

�������� ������<br />

���� ������<br />

���� ������<br />

����� ������<br />

��� ������� �� � ���������� ��<br />

����� ����� ������� ���������<br />

Source: UNCTAD, FDI/TNC database (www.unctad.org/fdistatistics) and<br />

annex tables B.1. and B.3.<br />

region’s six years of consecutive growth in inflows as<br />

TNCs cancel or postpone new projects.<br />

a. Geographical trends<br />

i. Inward FDI: flows continued to<br />

rise in most subregions<br />

FDI inflows increased in four of the five<br />

subregions of Africa in 2008. North Africa attracted<br />

27% of the FDI to the region in 2008, compared<br />

with 36% in 2007; and the 47 countries of sub-<br />

Saharan Africa attracted 73% in 2008, up from 64%<br />

in 2007. The distribution of inflows among the<br />

top host countries changed little from the previous<br />

year. The six countries of North Africa continued<br />

to perform well in terms of inward FDI, while large<br />

inflows to Nigeria, Angola and South Africa, plus<br />

good performances in Congo, Ghana, Guinea and<br />

Madagascar (each receiving more than $1 billion<br />

worth of inflows in 2008) boosted overall FDI flows<br />

to sub-Saharan Africa. Inflows rose in 29 countries,<br />

and fell in the other 24 (annex table B.1). The decline<br />

was due to TNCs cancelling or postponing projects<br />

as a result of the global financial crisis. The main<br />

FDI recipients included many natural-resource<br />

��<br />

��<br />

��<br />

��<br />

��<br />

��<br />

�<br />

�<br />

producers that have been attracting large shares<br />

of the region’s inflows in the past few years,<br />

as well as new commodity-rich host countries.<br />

Developed countries remained the main sources<br />

of FDI in the region, although the share of<br />

developing countries, especially from Asia, has<br />

been increasing over time.<br />

The record rise of FDI inflows to the<br />

region in 2008 was partly due to favourable<br />

global commodity markets (at least during<br />

the first half of the year) and good returns on<br />

investment related to the high commodity<br />

prices. TNCs, including firms from within the<br />

region (sub-section a.ii), took advantage of this<br />

situation to expand their regional operations,<br />

opening a variety of exploration projects in new<br />

locations and injecting large volumes of capital<br />

into greenfield projects. They also undertook a<br />

record level of cross-border M&As.