World Investment Report 2009: Transnational Corporations - Unctad

World Investment Report 2009: Transnational Corporations - Unctad

World Investment Report 2009: Transnational Corporations - Unctad

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

12 <strong>World</strong> <strong>Investment</strong> <strong>Report</strong> <strong>2009</strong>: <strong>Transnational</strong> <strong>Corporations</strong>, Agricultural Production and Development<br />

Table I.4. Selected cross-border M&As and privatization programmes cancelled or postponed due to the<br />

global financial crisis<br />

Acquiring company (country)/privatization Target company (country) Value Industry<br />

Samsung Electronics (Rep. of Korea) SanDisk (United States) $5.9 billion Electronics<br />

Xstrata (United Kingdom and Switzerland) Lonmin (United States) $10 billion Mining<br />

AT&T, Vodafone, Blackstone Huawei (only mobile handset business operations) (China) $2 billion Electronics<br />

Ping An Insurance (China) Fortis (Belgium) € 2.2 billion Finance<br />

Cancelled or postponed privatization Punta Colonet (Mexico) $6 billion Ports<br />

Cancelled or postponed privatization Kuwait Airways (Kuwait) - Airlines<br />

Cancelled or postponed privatization La Poste (France) - Postal services<br />

Cancelled or postponed privatization TeliaSonera (Sweden) - Telecoms<br />

Cancelled or postponed privatization Nordea (Sweden) - Finance<br />

Cancelled or postponed privatization Oman Telecommunication Company (25%) - Telecoms<br />

Cancelled or postponed privatization SBAB (Sweden) - Finance<br />

Source: UNCTAD, <strong>2009</strong>a.<br />

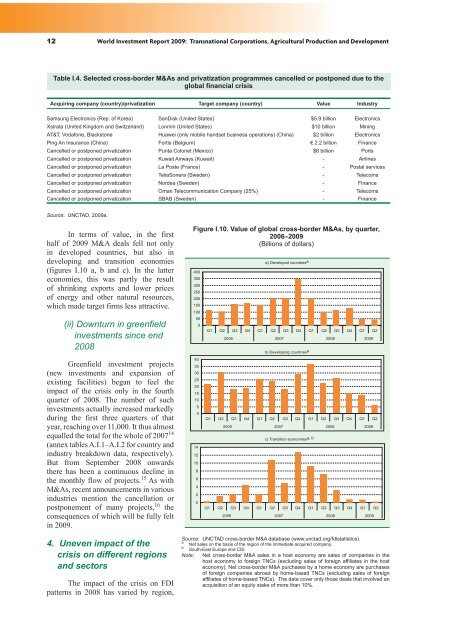

In terms of value, in the first<br />

half of <strong>2009</strong> M&A deals fell not only<br />

in developed countries, but also in<br />

developing and transition economies<br />

(figures I.10 a, b and c). In the latter<br />

economies, this was partly the result<br />

of shrinking exports and lower prices<br />

of energy and other natural resources,<br />

which made target firms less attractive.<br />

(ii) Downturn in greenfield<br />

investments since end<br />

2008<br />

Greenfield investment projects<br />

(new investments and expansion of<br />

existing facilities) began to feel the<br />

impact of the crisis only in the fourth<br />

quarter of 2008. The number of such<br />

investments actually increased markedly<br />

during the first three quarters of that<br />

year, reaching over 11,000. It thus almost<br />

equalled the total for the whole of 2007 14<br />

(annex tables A.I.1–A.I.2 for country and<br />

industry breakdown data, respectively).<br />

But from September 2008 onwards<br />

there has been a continuous decline in<br />

the monthly flow of projects. 15 As with<br />

M&As, recent announcements in various<br />

industries mention the cancellation or<br />

postponement of many projects, 16 the<br />

consequences of which will be fully felt<br />

in <strong>2009</strong>.<br />

4. Uneven impact of the<br />

crisis on different regions<br />

and sectors<br />

The impact of the crisis on FDI<br />

patterns in 2008 has varied by region,<br />

Figure I.10. Value of global cross-border M&As, by quarter,<br />

2006–<strong>2009</strong><br />

(Billions of dollars)<br />

���<br />

���<br />

���<br />

���<br />

���<br />

���<br />

���<br />

��<br />

�<br />

��<br />

��<br />

��<br />

��<br />

��<br />

��<br />

��<br />

�<br />

�<br />

��<br />

��<br />

��<br />

�<br />

�<br />

�<br />

�<br />

�<br />

�� ��������� ��������� �<br />

�� �� �� �� �� �� �� �� �� �� �� �� �� ��<br />

���� ���� ���� ����<br />

�� ���������� ��������� �<br />

�� �� �� �� �� �� �� �� �� �� �� �� �� ��<br />

���� ���� ���� ����<br />

�� ���������� ����������� �<br />

�� �� �� �� �� �� �� �� �� �� �� �� �� ��<br />

���� ���� ���� ����<br />

Source: UNCTAD cross-border M&A database (www.unctad.org/fdistatistics).<br />

a Net sales on the basis of the region of the immediate acquired company.<br />

b South-East Europe and CIS.<br />

Note: Net cross-border M&A sales in a host economy are sales of companies in the<br />

host economy to foreign TNCs (excluding sales of foreign affiliates in the host<br />

economy). Net cross-border M&A purchases by a home economy are purchases<br />

of foreign companies abroad by home-based TNCs (excluding sales of foreign<br />

affiliates of home-based TNCs). The data cover only those deals that involved an<br />

acquisition of an equity stake of more than 10%.