World Investment Report 2009: Transnational Corporations - Unctad

World Investment Report 2009: Transnational Corporations - Unctad

World Investment Report 2009: Transnational Corporations - Unctad

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

CHAPTER I 21<br />

services, also began to feel the adverse effects of<br />

the crisis, though to a lesser extent. Confronted by<br />

declining profits and growing overcapacities, many<br />

TNCs announced major cost-cutting programmes,<br />

including layoffs, divestments, and a reduction<br />

of investment expenditures. In some of the most<br />

affected industries, such as automotives, the crisis<br />

also triggered a wave of major restructurings (as<br />

mentioned in section A above).<br />

Activity indicators for the top 100 TNCs<br />

show that the impact of the crisis was only marginal<br />

in 2008 as a whole (annex tables A.I.9-A.I.10).<br />

Their total sales increased from their 2007 sales<br />

figures by 12% in current dollar terms, representing<br />

additional revenue of about $901 billion, and their<br />

total employment also rose by 4%. 27 A handful of<br />

TNCs in the automotive industry (especially General<br />

Motors, Chrysler, Toyota, Nissan and Honda), which<br />

had already faced a depressed market even before the<br />

crisis began, recorded declining sales in 2008.<br />

There are three major reasons for these<br />

apparently paradoxical results. First, the financial<br />

crisis, which deepened in September 2008, started<br />

affecting the activities of the largest TNCs only from<br />

the last quarter of 2008, thus limiting the apparent<br />

impact on activity indicators for the year as a whole<br />

(figure I.15). For instance, despite a sharp fall in<br />

demand for commodities (and subsequently in prices)<br />

at the end of 2008, many oil and even some mining<br />

companies, such as Total, ExxonMobil and BHP<br />

Billiton, outperformed the previous year’s results in<br />

terms of sales and profits for the whole year because<br />

of favourable market conditions in the first three<br />

quarters of 2008.<br />

Second, in many industries such as utilities,<br />

food and beverages and business services, the market<br />

remained relatively stable until the end of the year.<br />

For instance, sales for the fourth quarter of 2008 by<br />

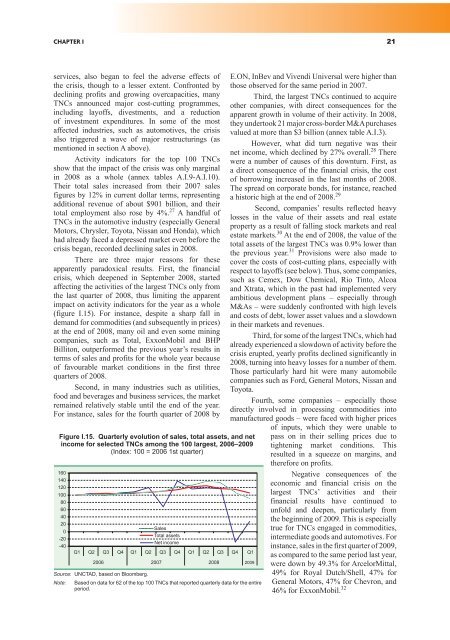

Figure I.15. Quarterly evolution of sales, total assets, and net<br />

income for selected TNCs among the 100 largest, 2006–<strong>2009</strong><br />

(Index: 100 = 2006 1st quarter)<br />

���<br />

���<br />

���<br />

���<br />

��<br />

��<br />

��<br />

��<br />

�<br />

���<br />

���<br />

�����<br />

����� ������<br />

��� ������<br />

�� �� �� �� �� �� �� �� �� �� �� �� ��<br />

���� ���� ���� ����<br />

Source: UNCTAD, based on Bloomberg.<br />

Note: Based on data for 62 of the top 100 TNCs that reported quarterly data for the entire<br />

period.<br />

E.ON, InBev and Vivendi Universal were higher than<br />

those observed for the same period in 2007.<br />

Third, the largest TNCs continued to acquire<br />

other companies, with direct consequences for the<br />

apparent growth in volume of their activity. In 2008,<br />

they undertook 21 major cross-border M&A purchases<br />

valued at more than $3 billion (annex table A.I.3).<br />

However, what did turn negative was their<br />

net income, which declined by 27% overall. 28 There<br />

were a number of causes of this downturn. First, as<br />

a direct consequence of the financial crisis, the cost<br />

of borrowing increased in the last months of 2008.<br />

The spread on corporate bonds, for instance, reached<br />

a historic high at the end of 2008. 29<br />

Second, companies’ results reflected heavy<br />

losses in the value of their assets and real estate<br />

property as a result of falling stock markets and real<br />

estate markets. 30 At the end of 2008, the value of the<br />

total assets of the largest TNCs was 0.9% lower than<br />

the previous year. 31 Provisions were also made to<br />

cover the costs of cost-cutting plans, especially with<br />

respect to layoffs (see below). Thus, some companies,<br />

such as Cemex, Dow Chemical, Rio Tinto, Alcoa<br />

and Xtrata, which in the past had implemented very<br />

ambitious development plans – especially through<br />

M&As – were suddenly confronted with high levels<br />

and costs of debt, lower asset values and a slowdown<br />

in their markets and revenues.<br />

Third, for some of the largest TNCs, which had<br />

already experienced a slowdown of activity before the<br />

crisis erupted, yearly profits declined significantly in<br />

2008, turning into heavy losses for a number of them.<br />

Those particularly hard hit were many automobile<br />

companies such as Ford, General Motors, Nissan and<br />

Toyota.<br />

Fourth, some companies – especially those<br />

directly involved in processing commodities into<br />

manufactured goods – were faced with higher prices<br />

of inputs, which they were unable to<br />

pass on in their selling prices due to<br />

tightening market conditions. This<br />

��������� ��� �� �������� ��� ��������� ����<br />

therefore on profits.<br />

Negative consequences of the<br />

economic and financial crisis on the<br />

largest TNCs’ activities and their<br />

financial results have continued to<br />

unfold and deepen, particularly from<br />

the beginning of <strong>2009</strong>. This is especially<br />

true for TNCs engaged in commodities,<br />

intermediate goods and automotives. For<br />

instance, sales in the first quarter of <strong>2009</strong>,<br />

as compared to the same period last year,<br />

were down by 49.3% for ArcelorMittal,<br />

49% for Royal Dutch/Shell, 47% for<br />

General Motors, 47% for Chevron, and<br />

46% for ExxonMobil. 32