Financial Statements 2009 - Manutencoop

Financial Statements 2009 - Manutencoop

Financial Statements 2009 - Manutencoop

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

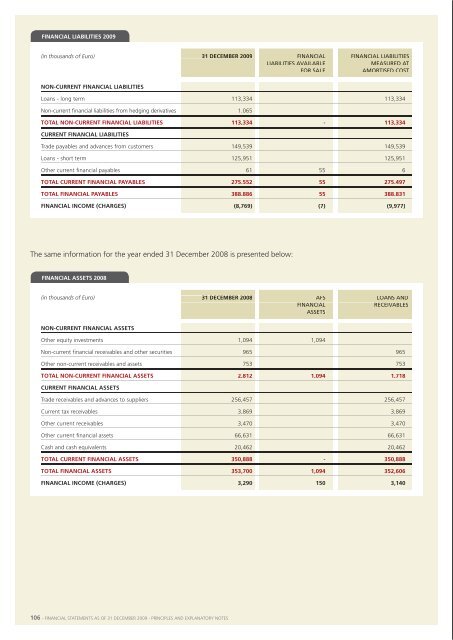

fInanCIal lIabIlItIes <strong>2009</strong>fInanCIal lIabIlItIes 2008(in thousands of Euro) 31 deCember <strong>2009</strong>FINANCIALFINANCIAL LIABILITIESLIABILITIES AVAILABLEMEASURED ATFOR SALEAMORTISED COSTnon-Current fInanCIal lIabIlItIesloans - long term 113,334 113,334non-current financial liabilities from hedging derivatives 1.065total non-Current fInanCIal lIabIlItIes 113,334 - 113,334Current fInanCIal lIabIlItIestrade payables and advances from customers 149,539 149,539loans - short term 125,951 125,951other current financial payables 61 55 6total Current fInanCIal payables 275,552 55 275,497total fInanCIal payables 388,886 55 388,831(in thousands of Euro) 31 deCember 2008FINANCIALFINANCIALLIABILITIES AT FAIRLIABILITIES ATVALUE ThROUGh P/LAMORTISED COSTnon-Current fInanCIal lIabIlItIesloans - long term 104,355 104,355total non-Current fInanCIal lIabIlItIes 104,355 - 104,355Current fInanCIal lIabIlItIestrade payables and advances from customers 159,188 159,188loans - short term 92,918 92,918other current financial payables 13,266 55 13,211total Current fInanCIal payables 265,372 55 265,317total fInanCIal payables 369,727 55 369,672fInanCIal InCome (Charges) (9,981) (4) (9,977)fInanCIal InCome (Charges) (8,769) (7) (9,977)the same information for the year ended 31 December 2008 is presented below:fInanCIal assets 2008(in thousands of Euro) 31 deCember 2008AFSLOANS ANDFINANCIALRECEIVABLESASSETSnon-Current fInanCIal assetsother equity investments 1,094 1,094non-current financial receivables and other securities 965 965other non-current receivables and assets 753 753total non-Current fInanCIal assets 2,812 1,094 1,718Current fInanCIal assetsLiquidity riskthe company's objective is to keep a balance between the maintenance of funding and theflexibility deriving from the use of overdrafts, bank loans and lease finance.Risk of changes in the prices of raw materialsthe company's exposure to price risk solely relates to the purchase cost of oil products, whichrepresent about 50% of the total purchase cost of raw materials and consumables. this commodity,which is a primary factor of production for heat management contracts, is highly susceptible toprice fluctuations due to political events and seasonal climatic variations.the following table shows the sensitivity of the cost of raw materials and consumables assumingconstant volume. these fluctuations would have largely been absorbed by the contracts in forcewith customers, because price revisions are covered both contractually and pursuant to art. 115of Decree 163 dated 12 april 2006. as such, their effect on the company's profit for the yearwould not have been significant.trade receivables and advances to suppliers 256,457 256,457current tax receivables 3,869 3,869other current receivables 3,470 3,470percentageincrease/decreaseeffect on cost of raw materialsconsumed, gross of taxation(in thousands of Euro)other current financial assets 66,631 66,631cash and cash equivalents 20,462 20,462total Current fInanCIal assets 350,888 - 350,888total fInanCIal assets 353,700 1,094 352,606fInanCIal InCome (Charges) 3,290 150 3,140<strong>2009</strong> 20% 5,655-5% (1,414)2008 20% 5,691-5% (1,423)Credit riskthe company's portfolio mainly comprises contracts with the public administration which,accordingly, are not subject to serious insolvency problems. they do however require continualcontact with the customers concerned, in order to minimise bureaucratic delays and resolve therelated financial management issues. in this area, the company deploys personnel and suitableprocedures in order to monitor the situation continually and counter the tendency for collectiontimes to extend.106 - <strong>Financial</strong> statements as oF 31 December <strong>2009</strong> - principles anD explanatory notes <strong>Financial</strong> statements as oF 31 December <strong>2009</strong> - principles anD explanatory notes - 107