Financial Statements 2009 - Manutencoop

Financial Statements 2009 - Manutencoop

Financial Statements 2009 - Manutencoop

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

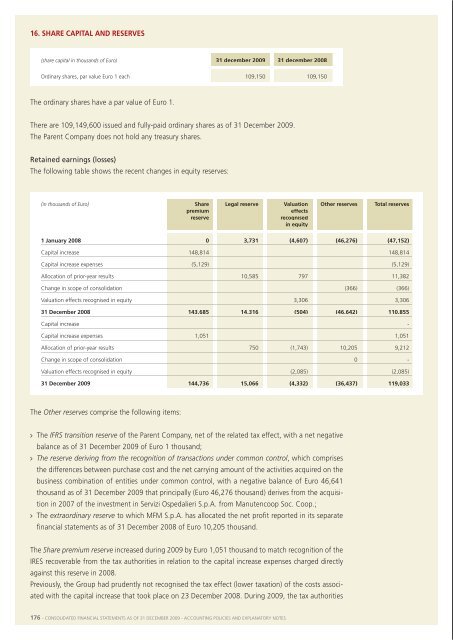

16. share capItal and reserVes(share capital in thousands of Euro) 31 december <strong>2009</strong> 31 december 2008ordinary shares, par value euro 1 each 109,150 109,150were asked to clarify the proper treatment of these costs for fiscal purposes. following approval fromthe tax authorities, the tax credit has been recognised in the reserve against which the related chargeswere deducted.the following table shows the recent changes in retained earnings (losses):the ordinary shares have a par value of euro 1.there are 109,149,600 issued and fully-paid ordinary shares as of 31 december <strong>2009</strong>.the parent Company does not hold any treasury shares.retained earnings (losses)the following table shows the recent changes in equity reserves:retained earnings (losses) consolidation total retainedof parent company reserve earnings (losses)1 January 2008 1,326 8,970 10,296allocation of prior-year results 2,483 (2,213) 27031 december 2008 3,809 6,757 10,566allocation of prior-year results 7,345 7,34531 december <strong>2009</strong> 3,809 14,102 17,911(in thousands of Euro) share legal reserve Valuation other reserves total reservespremiumeffectsreserverecognisedin equity1 January 2008 0 3,731 (4,607) (46,276) (47,152)Capital increase 148,814 148,814Capital increase expenses (5,129) (5,129)allocation of prior-year results 10,585 797 11,382Change in scope of consolidation (366) (366)Valuation effects recognised in equity 3,306 3,30631 december 2008 143,685 14,316 (504) (46,642) 110,855Capital increase -Capital increase expenses 1,051 1,05117. emploYee benefIts and pensIon fundsthe group has no defined benefit pension plans, in the strict sense.However, the employee severance indemnities (tfr) envisaged by art. 2120 of the italian Civil Codefall into this category for reporting purposes and, accordingly, have been recorded as such on the basisdescribed in the accounting policies.Commencing from 2008 the group has elected to recognise directly in equity, rather than through theincome statement, the actuarial gains and losses deriving from application of the projected unit creditmethod (puCm).the net cost of the benefits earned is analysed below.allocation of prior-year results 750 (1,743) 10,205 9,212Change in scope of consolidation 0 -Valuation effects recognised in equity (2,085) (2,085)31 december <strong>2009</strong> 144,736 15,066 (4,332) (36,437) 119,033the Other reserves comprise the following items:> the IFRS transition reserve of the parent Company, net of the related tax effect, with a net negativebalance as of 31 december <strong>2009</strong> of euro 1 thousand;> The reserve deriving from the recognition of transactions under common control, which comprisesthe differences between purchase cost and the net carrying amount of the activities acquired on thebusiness combination of entities under common control, with a negative balance of euro 46,641thousand as of 31 december <strong>2009</strong> that principally (euro 46,276 thousand) derives from the acquisitionin 2007 of the investment in servizi ospedalieri s.p.a. from manutencoop soc. Coop.;> the extraordinary reserve to which mfm s.p.a. has allocated the net profit reported in its separatefinancial statements as of 31 december 2008 of euro 10,205 thousand.the Share premium reserve increased during <strong>2009</strong> by euro 1,051 thousand to match recognition of theires recoverable from the tax authorities in relation to the capital increase expenses charged directlyagainst this reserve in 2008.previously, the group had prudently not recognised the tax effect (lower taxation) of the costs associatedwith the capital increase that took place on 23 december 2008. during <strong>2009</strong>, the tax authorities(in thousands of Euro) Year endedYear ended31 december <strong>2009</strong> 31 december 2008Curtailment (778)Cost of benefits earned (service cost) 438financial charges on obligations 2,072 727actuarial (gains)/losses (in equity) 1,444 (2,916)net cost of benefIts 3,176 (2,189)the financial charges associated with the obligation, as well as the service cost and the curtailment(where applicable), are recorded as payroll costs while, as mentioned, the actuarial gains and losses arerecognised directly in equity.the cost of curtailment is principally attributable to the effects of measuring the long-service bonusespayable to employees and the bonuses deriving from the restructuring plan implemented by thegroup, which is described in note 18.as part of the acquisition of the sicura group, the group acquired a defined benefits obligation towardscertain directors of companies in that group (end-of-mandate indemnity). in order to ensurethat this liability is fully covered on the date that settlement falls due, specific insurance policies havebeen arranged with leading institutions. this means that there is no residual liability to be borne bythe group.176 - Consolidated finanCial statements as of 31 deCember <strong>2009</strong> - aCCounting poliCies and explanatory notes Consolidated finanCial statements as of 31 deCember <strong>2009</strong> - aCCounting poliCies and explanatory notes - 177