Financial Statements 2009 - Manutencoop

Financial Statements 2009 - Manutencoop

Financial Statements 2009 - Manutencoop

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

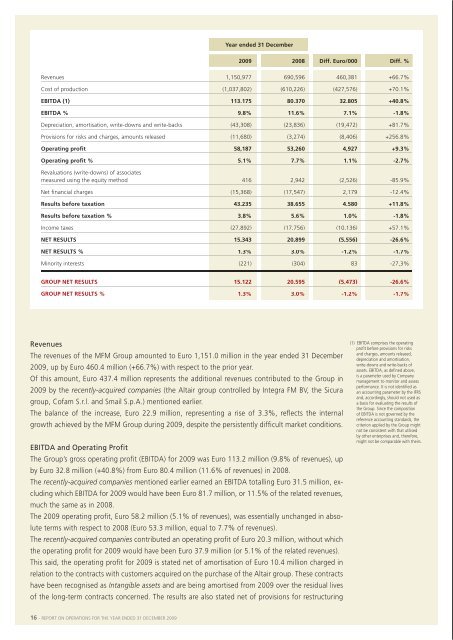

year ended 31 december<strong>2009</strong> 2008 diff. euro/000 diff. %revenues 1,150,977 690,596 460,381 +66.7%Cost of production (1,037,802) (610,226) (427,576) +70.1%ebitda (1) 113,175 80,370 32,805 +40.8%ebitda % 9.8% 11.6% 7.1% -1.8%depreciation, amortisation, write-downs and write-backs (43,308) (23,836) (19,472) +81.7%Provisions for risks and charges, amounts released (11,680) (3,274) (8,406) +256.8%operating profit 58,187 53,260 4,927 +9.3%operating profit % 5.1% 7.7% 1.1% -2.7%revaluations (write-downs) of associatesmeasured using the equity method 416 2,942 (2,526) -85.9%net financial charges (15,368) (17,547) 2,179 -12.4%results before taxation 43,235 38,655 4,580 +11.8%results before taxation % 3.8% 5.6% 1.0% -1.8%income taxes (27,892) (17,756) (10,136) +57.1%net results 15,343 20,899 (5,556) -26.6%net results % 1.3% 3.0% -1.2% -1.7%minority interests (221) (304) 83 -27,3%group net results 15,122 20,595 (5,473) -26.6%group net results % 1.3% 3.0% -1.2% -1.7%revenuesthe revenues of the mfm Group amounted to euro 1,151.0 million in the year ended 31 december<strong>2009</strong>, up by euro 460.4 million (+66.7%) with respect to the prior year.of this amount, euro 437.4 million represents the additional revenues contributed to the Group in<strong>2009</strong> by the recently-acquired companies (the altair group controlled by integra fm bV, the sicuragroup, Cofam s.r.l. and smail s.p.a.) mentioned earlier.the balance of the increase, euro 22.9 million, representing a rise of 3.3%, reflects the internalgrowth achieved by the mfm Group during <strong>2009</strong>, despite the persistently difficult market conditions.eBitda and operating profitthe Group’s gross operating profit (ebitda) for <strong>2009</strong> was euro 113.2 million (9.8% of revenues), upby euro 32.8 million (+40.8%) from euro 80.4 million (11.6% of revenues) in 2008.the recently-acquired companies mentioned earlier earned an ebitda totalling euro 31.5 million, excludingwhich ebitda for <strong>2009</strong> would have been euro 81.7 million, or 11.5% of the related revenues,much the same as in 2008.the <strong>2009</strong> operating profit, euro 58.2 million (5.1% of revenues), was essentially unchanged in absoluteterms with respect to 2008 (euro 53.3 million, equal to 7.7% of revenues).the recently-acquired companies contributed an operating profit of euro 20.3 million, without whichthe operating profit for <strong>2009</strong> would have been euro 37.9 million (or 5.1% of the related revenues).this said, the operating profit for <strong>2009</strong> is stated net of amortisation of euro 10.4 million charged inrelation to the contracts with customers acquired on the purchase of the altair group. these contractshave been recognised as Intangible assets and are being amortised from <strong>2009</strong> over the residual livesof the long-term contracts concerned. the results are also stated net of provisions for restructuring(1) ebitda comprises the operatingprofit before provisions for risksand charges, amounts released,depreciation and amortisation,write-downs and write-backs ofassets. ebitda, as defined above,is a parameter used by Companymanagement to monitor and assessperformance. it is not identified asan accounting parameter by the ifrsand, accordingly, should not used asa basis for evaluating the results ofthe Group. since the compositionof ebitda is not governed by thereference accounting standards, thecriterion applied by the Group mightnot be consistent with that utilisedby other enterprises and, therefore,might not be comparable with theirs.totalling euro 7.0 million, consequent to the reorganisation and integration project implemented bythe Group from the second quarter of <strong>2009</strong>, which will be completed during 2010. furthermore, theoperating profit also absorbs other reorganisation costs of euro 2.8 million (see the introduction tothis section 4). excluding the above effects, on a consistent basis of comparison, the Group’s operatingprofit has improved in absolute terms and remained stable as a percentage of revenues.results before taxationthe operating profit was adjusted by adding the net revaluation of companies measured using theequity method, euro 0.4 million (2008: euro 2.9 million), and deducting euro 15.4 million of net financialcharges (2008: euro 17.5 million). as a consequence, the <strong>2009</strong> results before taxation totalledeuro 43.2 million, up by euro 4.6 million (+11.8%) with respect to the prior year.analysing in detail the results of companies measured using the equity method and the net financialcharges, the former have fallen significantly (down euro 2.5 million) due, in the main, to the lowerprofitability of roma multiservizi s.p.a., a 45.47%-held associate, while the latter reflect net savingsof euro 2.2 million with respect to the prior year. Considering that euro 5.3 million of the net financialcharges totalling euro 15.4 million relate to the recently-acquired companies, it is clear that comparisonwith 2008 on a consistent basis would show an overall saving of euro 7.5 million due, almostentirely, to the fall in financial market interest rates.net profit for the yearthe <strong>2009</strong> profit before taxation was adjusted by deducting taxation of euro 27.9 million, reflecting aconsolidated effective tax rate of 64.5%, leaving consolidated net profit for the year of euro 15.3 million.this was euro 5.6 million lower than in 2008, when the income tax charge of euro 17.8 millionrepresented an effective tax rate of 45.9%.the increase in taxation was partly due to the contribution made by the recently-acquired companieswhich reported current and deferred tax charges for <strong>2009</strong> totalling euro 10.5 million, excluding whichthe tax charge would have been euro 17.4 million with an effective tax rate with respect to profitbefore taxation of 60.7%.the remaining significant difference between the tax rates for <strong>2009</strong> an 2008 was due to a numberof “non-recurring” items that benefited the Income taxes caption in 2008 including, in particular:> the use by servizi ospedalieri in 2008 of a tax loss brought forward from prior years amounting toeuro 2.4 million, that had not been recognised previously since the necessary conditions for suchrecognition were not met;> the franking of the difference between the values for tangible and intangible fixed assets recognisedfor statutory and fiscal purposes pursuant to the 2008 finance law. these differences arosedue to the off-book adjustments made in the years up to 31 december 2007, giving rise to a nettax saving of euro 0.6 million in 2008.16 - rePort on oPerations for the year ended 31 deCember <strong>2009</strong> rePort on oPerations for the year ended 31 deCember <strong>2009</strong> - 17