Financial Statements 2009 - Manutencoop

Financial Statements 2009 - Manutencoop

Financial Statements 2009 - Manutencoop

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

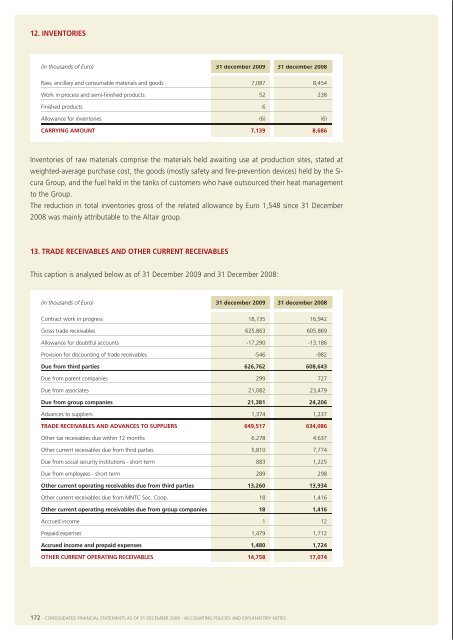

12. InVentorIesthe terms and conditions applying to the amounts due from related parties are discussed in note 36.(in thousands of Euro) 31 december <strong>2009</strong> 31 december 2008raw, ancillary and consumable materials and goods 7,087 8,454Work in process and semi-finished products 52 238finished products 6allowance for inventories (6) (6)carrYInG amount 7,139 8,686trade receivables and advances to suppliers have increased from euro 634,086 thousand to euro649,517 thousand. they comprise receivables that do not earn interest which, in general, are contractuallycollectible between 30 and 90 days.this increase (euro 15,431 thousand) reflects higher revenues deriving from growth in the volume ofbusiness.since the group’s customers include numerous public entities, which notoriously pay very late, thetrade receivables due from third parties have been discounted to their present value.the changes in the provision for discounting of trade receivables during <strong>2009</strong> are analysed below:inventories of raw materials comprise the materials held awaiting use at production sites, stated atweighted-average purchase cost, the goods (mostly safety and fire-prevention devices) held by the sicuragroup, and the fuel held in the tanks of customers who have outsourced their heat managementto the group.the reduction in total inventories gross of the related allowance by euro 1,548 since 31 december2008 was mainly attributable to the altair group.(in thousands of Euro) 31 december Increases releases other 31 december2008 <strong>2009</strong>provision for discounting of trade receivables 982 197 (520) (113) 546the overall reduction in the provision for the discounting of trade receivables was principally due tothe fall in market interest rates.13. trade receIVables and other current receIVablesthis caption is analysed below as of 31 december <strong>2009</strong> and 31 december 2008:doubtful receivables that may not be fully recoverable are covered by a specific allowance for doubtfulaccounts, euro 17,290 thousand as of 31 december <strong>2009</strong> (euro 13,186 thousand as of 31 december2008), which is deemed adequate with respect to known disputes at year end.(in thousands of Euro) 31 december <strong>2009</strong> 31 december 2008Contract work in progress 18,735 16,942the changes in the allowance for doubtful accounts during the year ended 31 december <strong>2009</strong> arereported below:gross trade receivables 625,863 605,869allowance for doubtful accounts -17,290 -13,186provision for discounting of trade receivables -546 -982due from third parties 626,762 608,643due from parent companies 299 727due from associates 21,082 23,479due from group companies 21,381 24,206advances to suppliers 1,374 1,237(in thousands of Euro) 31 december Increases utilisations releases business 31 december2008 combinations <strong>2009</strong>allowance for doubtful accounts 13,186 4,954 (772) (371) 293 17,290the trade receivables which were overdue but not written down or in dispute as of 31 december <strong>2009</strong>are analysed below on a comparative basis:trade receIVables and adVances to supplIers 649,517 634,086other tax receivables due within 12 months 6,278 4,637other current receivables due from third parties 5,810 7,774due from social security institutions - short term 883 1,225due from employees - short term 289 298in thousands of Euro)overdue but not written downtotal not overdue or < 30 days 30 - 60 days 60 - 90 days 90 - 120 days beyondor written down120 daysother current operating receivables due from third parties 13,260 13,934other current receivables due from mntC soc. Coop. 18 1,416other current operating receivables due from group companies 18 1,416accrued income 1 12prepaid expenses 1,479 1,712accrued income and prepaid expenses 1,480 1,724other current operatInG receIVables 14,758 17,07431 december <strong>2009</strong> 608,573 419,902 49,757 27,953 15,639 18,217 77,10531 december 2008 592,710 447,180 27,601 31,041 16,137 7,362 63,389the above balances are stated net of written-down receivables but gross of the discounting effectreferred to above.the assignment of trade receivables to Calyon s.a. Corporate & investment bank continued during<strong>2009</strong>, under the contract signed in 2007 which was renewed in <strong>2009</strong> (the contract is renewable for 5years). this contract envisages the factoring of receivables on a quarterly basis under a revolving facility.the receivables are sold without recourse during the last ten days of each quarter and the total nominal172 - Consolidated finanCial statements as of 31 deCember <strong>2009</strong> - aCCounting poliCies and explanatory notes Consolidated finanCial statements as of 31 deCember <strong>2009</strong> - aCCounting poliCies and explanatory notes - 173