Financial Statements 2009 - Manutencoop

Financial Statements 2009 - Manutencoop

Financial Statements 2009 - Manutencoop

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

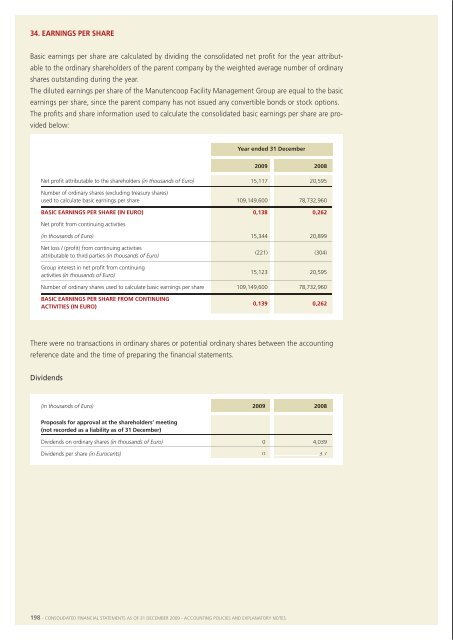

34. earnInGs per share35. commItments and contInGencIesbasic earnings per share are calculated by dividing the consolidated net profit for the year attributableto the ordinary shareholders of the parent company by the weighted average number of ordinaryshares outstanding during the year.the diluted earnings per share of the manutencoop facility management group are equal to the basicearnings per share, since the parent company has not issued any convertible bonds or stock options.the profits and share information used to calculate the consolidated basic earnings per share are providedbelow:Year ended 31 december<strong>2009</strong> 2008net profit attributable to the shareholders (in thousands of Euro) 15,117 20,595number of ordinary shares (excluding treasury shares)used to calculate basic earnings per share 109,149,600 78,732,960basIc earnInGs per share (In euro) 0,138 0,262net profit from continuing activities(in thousands of Euro) 15,344 20,899finance leasesthe group has entered into finance leases for plant and machinery used in the production processesof asa laundering/sterilisation and for motor vehicles. the finance lease commitments are detailedin the following table together with the present value of the future instalments:(in thousands of Euro) 31 december <strong>2009</strong> 31 december 2008Instalments present value Instalments present valueof instalmentsof instalmentsWithin one year 1,120 1,030 1,702 1,588beyond one year, but within five years 1,833 1,690 2,398 2,221beyond five years 133 122 232 221total lease Instalments 3,086 2,842 4,332 4,030financial charges (244) (302)present value of lease instalments 2,842 2,842 4,030 4,030net loss / (profit) from continuing activitiesattributable to third parties (in thousands of Euro)(221) (304)group interest in net profit from continuingactivities (in thousands of Euro)there were no transactions in ordinary shares or potential ordinary shares between the accountingreference date and the time of preparing the financial statements.dividends15,123 20,595number of ordinary shares used to calculate basic earnings per share 109,149,600 78,732,960basIc earnInGs per share from contInuInGactIVItIes (In euro)0,139 0,262(in thousands of Euro) <strong>2009</strong> 2008proposals for approval at the shareholders’ meeting(not recorded as a liability as of 31 december)dividends on ordinary shares (in thousands of Euro) 0 4,039dividends per share (in Eurocents) 0 3.7Guarantees givenas of 31 december <strong>2009</strong>, the group has given sureties to third parties as follows:> guarantees in favour of associates totalling euro 27,588 thousand (2008: euro 10,782 thousand);> other sureties given to third parties: i) to guarantee the proper performance of commercialcontracts with customers; ii) in lieu of deposits payable for the activation of utilities or on thesignature of rental contracts, and to obtain Vat refunds from the tax authorities, totalling euro153,527 thousand (2008: euro 100,048 thousand);> sureties in favour of Calyon s.a. Corporate & investment bank to guarantee proper performanceof the contract for the assignment of trade receivables totalling euro 14,079 thousand (2008: euro14,986 thousand).the sureties issued to Calyon cover risks of a financial nature. the fair value of this risk has thereforebeen calculated, euro 117 thousand, and recorded as a financial liability (see notes 13 and 19).the loan of euro 25,000 thousand granted to teckal by unicredit (see note 19) is guaranteed by apledge of company’s shares that does not confer voting rights.a building owned by one of the companies in the sicura group is mortgaged for euro 350 thousandto secure a loan recorded among the financial liabilities.Contingent liabilitieson 26 november <strong>2009</strong>, a group company – mCb s.p.a. (a sole shareholder company) – was notifiedof the minutes of a tax inspection. these minutes related to direct taxes for the 2007 tax year and,in particular, refer to an alleged improper tax declaration due to a deduction made in violation of art.109 of the Consolidated income tax law - tuir.the tax authorities claim that the deduction did not relate to the 2007 tax year or comply with therequirements of certainty, relevance and determinability established in art. 109 of decree 917/86.With regard to the contested violations, any penalties will be levied by the tax authorities via theissue of a dispute notice pursuant to art. 16 of decree 472/1997, or a combined dispute notice andassessment.198 - Consolidated finanCial statements as of 31 deCember <strong>2009</strong> - aCCounting poliCies and explanatory notes Consolidated finanCial statements as of 31 deCember <strong>2009</strong> - aCCounting poliCies and explanatory notes - 199