Financial Statements 2009 - Manutencoop

Financial Statements 2009 - Manutencoop

Financial Statements 2009 - Manutencoop

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

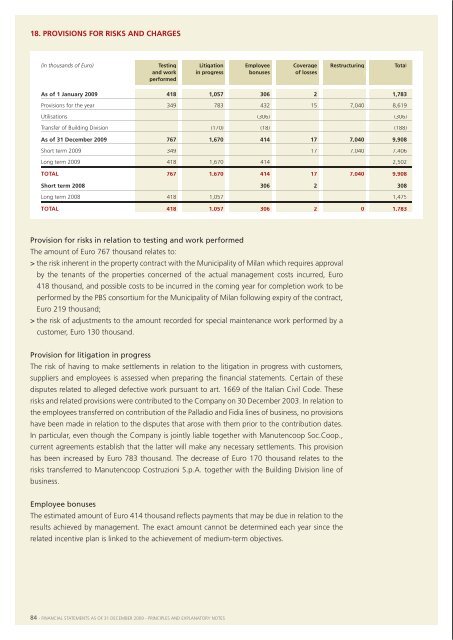

18. provIsIons for rIsKs and Charges(in thousands of Euro) testing litigation employee Coverage restructuring totaland work in progress bonuses of lossesperformedas of 1 January <strong>2009</strong> 418 1,057 306 2 1,783provisions for the year 349 783 432 15 7,040 8,619Utilisations (306) (306)transfer of building Division (170) (18) (188)as of 31 december <strong>2009</strong> 767 1,670 414 17 7,040 9,908short term <strong>2009</strong> 349 17 7,040 7,406long term <strong>2009</strong> 418 1,670 414 2,502total 767 1,670 414 17 7,040 9,908short term 2008 306 2 308long term 2008 418 1,057 1,475total 418 1,057 306 2 0 1,783Provision for risks in relation to testing and work performedthe amount of euro 767 thousand relates to:> the risk inherent in the property contract with the municipality of milan which requires approvalby the tenants of the properties concerned of the actual management costs incurred, euro418 thousand, and possible costs to be incurred in the coming year for completion work to beperformed by the pbs consortium for the municipality of milan following expiry of the contract,euro 219 thousand;> the risk of adjustments to the amount recorded for special maintenance work performed by acustomer, euro 130 thousand.Provision for litigation in progressthe risk of having to make settlements in relation to the litigation in progress with customers,suppliers and employees is assessed when preparing the financial statements. certain of thesedisputes related to alleged defective work pursuant to art. 1669 of the italian civil code. theserisks and related provisions were contributed to the company on 30 December 2003. in relation tothe employees transferred on contribution of the palladio and Fidia lines of business, no provisionshave been made in relation to the disputes that arose with them prior to the contribution dates.in particular, even though the company is jointly liable together with manutencoop soc.coop.,current agreements establish that the latter will make any necessary settlements. this provisionhas been increased by euro 783 thousand. the decrease of euro 170 thousand relates to therisks transferred to manutencoop costruzioni s.p.a. together with the building Division line ofbusiness.Provision for restructuringFollowing the company's acquisition of the altair Group (formerly pirelli & c. re iFm) on 23December 2008 and considering the significance of the transaction, management immediatelylaunched a project designed to integrate the businesses as rapidly as possible, in order to releasethe synergies deriving from the acquisition.an executive committee for the reorganisation was established in march <strong>2009</strong> and, at the sametime, a leading firm of consultants was engaged to “assist manutencoop and altair with theintegration process”. the activities initially included broad definition of the resulting organisationand, subsequently, the definition of the new organisational structure.in may <strong>2009</strong>, the executive committee approved work on the merger of the following companies:> manutencoop Facility management s.p.a.;> integra Fm bV;> altair iFm s.p.a.;> Gestin Facility s.p.a.;> teckal s.p.a.the decision to establish a single operational holding company, essentially combining within theFacility management strategic business area:> the “operations” function;> the “commercial, development and technical sales” function;> all business support functions (personnel, purchasing, security) for the entire Group;> and the management and control functions (administration and control, it, Finance andtreasury, legal and corporate affairs, strategic planning etc.), highlighted the availability ofsignificant additional synergies deriving from the elimination of duplicated functions and theoptimisation of operational management via the reduction of employment.the merger proposal was approved on 25 June <strong>2009</strong> by the management board of mFm and bythe board of Directors of the other companies involved.as of 31 December <strong>2009</strong>, the plan:> has been prepared in detail, covering the operating units and positions involved, the costs to beincurred and the estimated time required for implementation;> has justifiably caused third parties to expect that the restructuring will be completed, since it hasalready been partially implemented by the company via contacts with individuals; in addition, aformal redundancy process has commenced and the trade unions have been notified.the estimated cost of the above plan has resulted in total provisions of euro 7,040 thousand.Employee bonusesthe estimated amount of euro 414 thousand reflects payments that may be due in relation to theresults achieved by management. the exact amount cannot be determined each year since therelated incentive plan is linked to the achievement of medium-term objectives.84 - <strong>Financial</strong> statements as oF 31 December <strong>2009</strong> - principles anD explanatory notes <strong>Financial</strong> statements as oF 31 December <strong>2009</strong> - principles anD explanatory notes - 85