Financial Statements 2009 - Manutencoop

Financial Statements 2009 - Manutencoop

Financial Statements 2009 - Manutencoop

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

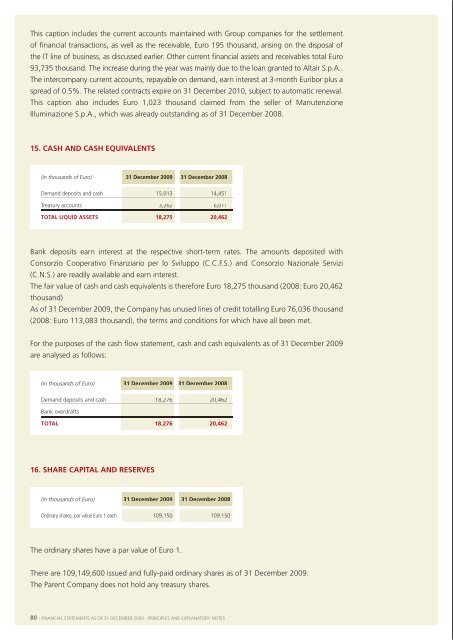

this caption includes the current accounts maintained with Group companies for the settlementof financial transactions, as well as the receivable, euro 195 thousand, arising on the disposal ofthe it line of business, as discussed earlier. other current financial assets and receivables total euro93,735 thousand. the increase during the year was mainly due to the loan granted to altair s.p.a..the intercompany current accounts, repayable on demand, earn interest at 3-month euribor plus aspread of 0.5%. the related contracts expire on 31 December 2010, subject to automatic renewal.this caption also includes euro 1,023 thousand claimed from the seller of manutenzioneilluminazione s.p.a., which was already outstanding as of 31 December 2008.retaIned earnIngs (losses)(in thousands of Euro) legal share other total retainedreserve premium reserves reserves earningsreserve(losses)as of 31 december 2006 4,940 0 (49,537) (44,597) 2,502allocation of 2006 results 6,394 6,394 432Utilisation on 5/12/2007 (7,603) 49,535 41,932 (2,934)as of 31 december 2007 3,731 0 2 3,733 0effects of change in accounting policy (tFr) (3,809) (3,809) 1,32615. Cash and Cash equIvalents(in thousands of Euro) 31 december <strong>2009</strong> 31 december 2008Demand deposits and cash 15,013 14,451treasury accounts 3,262 6,011total lIquId assets 18,275 20,462bank deposits earn interest at the respective short-term rates. the amounts deposited withconsorzio cooperativo Finanziario per lo sviluppo (c.c.F.s.) and consorzio nazionale servizi(c.n.s.) are readily available and earn interest.the fair value of cash and cash equivalents is therefore euro 18,275 thousand (2008: euro 20,462thousand)as of 31 December <strong>2009</strong>, the company has unused lines of credit totalling euro 76,036 thousand(2008: euro 113,083 thousand), the terms and conditions for which have all been met.For the purposes of the cash flow statement, cash and cash equivalents as of 31 December <strong>2009</strong>are analysed as follows:(in thousands of Euro) 31 december <strong>2009</strong> 31 december 2008Demand deposits and cash 18,276 20,462bank overdraftstotal 18,276 20,46216. share CapItal and reserves(in thousands of Euro) 31 december <strong>2009</strong> 31 december 2008as of 31 december 2007 restated 3,731 0 (3,807) (76) 1,326allocation of 2007 results 10,585 10,585capital increase 143,685 143,685effect of sorie method 1,563 1,563combination of entities under common control (366) (366) 2,483roundings 2as of 31 december 2008 14,316 143,685 (2,610) 155,393 3,809allocation of 2008 results 750 10,206 10,956capital increase 1,052 1,052combination of entities under common control 611 611total comprehensive profit/(loss) (1,062) (1,062)roundings (1) (2) (3)as of 31 december <strong>2009</strong> 15,066 144,736 7,143 166,947 3,809note that:> the share premium reserve increased during <strong>2009</strong> by euro 1,051 thousand to match recognitionof the ires recoverable from the tax authorities in relation to the capital increase expenses chargeddirectly against this reserve in 2008. previously, the company had prudently not recognised thetax effect (lower taxation) of the costs associated with the capital increase that took place on23 December 2008. During <strong>2009</strong>, the tax authorities were asked to clarify the proper treatmentof these costs for fiscal purposes. Following approval from the tax authorities, the tax credit hasbeen recognised in the reserve against which the related charges were deducted.> the combination of entities under common control caption includes the capital gain, euro 611thousand, generated on the disposal of the building Division line of business, net of the relatedtax effect as discussed earlier.> the total comprehensive profit/(loss) caption includes actuarial profits and losses recognised inequity of euro 291 thousand, net of the related tax effect, as well as the fair value adjustmentrecognised in equity of the irs derivative hedging the loan from bnp paribas of euro 773thousand, net of the related tax effect, and the tax effect of expenses incurred in the prior yearand recognised in equity in relation to the share capital increase.ordinary shares, par value euro 1 each 109,150 109,150the ordinary shares have a par value of euro 1.there are 109,149,600 issued and fully-paid ordinary shares as of 31 December <strong>2009</strong>.the parent company does not hold any treasury shares.80 - <strong>Financial</strong> statements as oF 31 December <strong>2009</strong> - principles anD explanatory notes <strong>Financial</strong> statements as oF 31 December <strong>2009</strong> - principles anD explanatory notes - 81