Financial Statements 2009 - Manutencoop

Financial Statements 2009 - Manutencoop

Financial Statements 2009 - Manutencoop

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

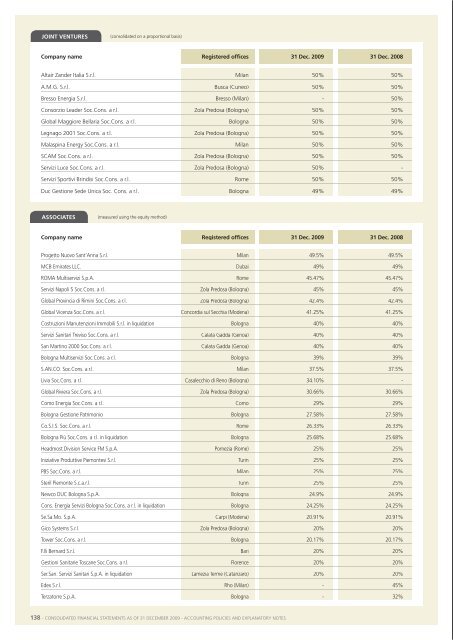

JoInt Ventures(consolidated on a proportional basis)subsIdIarIes and JoInt Ventures carrIed at eQuItY(measured using the equity method)company name registered offices 31 dec. <strong>2009</strong> 31 dec. 2008ompany name registered offices 31 dec. 2008 31 dec. 2008altair Zander italia s.r.l. milan 50% 50%a.m.g. s.r.l. busca (Cuneo) 50% 50%bresso energia s.r.l. bresso (milan) - 50%Consorzio leader soc.Cons. a r.l. Zola predosa (bologna) 50% 50%global maggiore bellaria soc.Cons. a r.l. bologna 50% 50%legnago 2001 soc.Cons. a r.l. Zola predosa (bologna) 50% 50%malaspina energy soc.Cons. a r.l. milan 50% 50%fleur bruzia s.r.l. in liquidation Cosenza 100% 100%alisei s.r.l. in liquidation Zola predosa (bologna) 100% 100%pit soc.Cons. a r.l. in liquidation pozzuoli (naples) 100% 100%gymnasium soc.Cons. a r.l. in liquidation Zola predosa (bologna) 68% 68%Cpsis Consorzio polo di sterilizzazione padua 60% 60%gestlotto 6 soc.Cons. a r.l. in liquidation Zola predosa (bologna) 55% 55%sCam soc.Cons. a r.l. Zola predosa (bologna) 50% 50%servizi luce soc.Cons. a r.l. Zola predosa (bologna) 50% -servizi sportivi brindisi soc.Cons. a r.l. rome 50% 50%duc gestione e sede unica soc. Cons. a r.l. bologna 49% 49%assocIates (measured using the equity method)company name registered offices 31 dec. <strong>2009</strong> 31 dec. 2008progetto nuovo sant’anna s.r.l. milan 49.5% 49.5%mCb emirates llC. dubai 49% 49%roma multiservizi s.p.a. rome 45.47% 45.47%servizi napoli 5 soc.Cons. a r.l. Zola predosa (bologna) 45% 45%global provincia di rimini soc.Cons. a r.l. Zola predosa (bologna) 42.4% 42.4%global Vicenza soc.Cons. a r.l. Concordia sul secchia (modena) 41.25% 41.25%Costruzioni manutenzioni immobili s.r.l. in liquidation bologna 40% 40%servizi sanitari treviso soc.Cons. a r.l. Calata gadda (genoa) 40% 40%san martino 2000 soc.Cons. a r.l. Calata gadda (genoa) 40% 40%bologna multiservizi soc.Cons. a r.l. bologna 39% 39%s.an.Co. soc.Cons. a r.l. milan 37.5% 37.5%livia soc.Cons. a r.l. Casalecchio di reno (bologna) 34.10% -global riviera soc.Cons. a r.l. Zola predosa (bologna) 30.66% 30.66%Como energia soc.Cons. a r.l. Como 29% 29%bologna gestione patrimonio bologna 27.58% 27.58%Co.s.i.s. soc.Cons. a r.l. rome 26.33% 26.33%bologna più soc.Cons. a r.l. in liquidation bologna 25.68% 25.68%Headmost division service fm s.p.a. pomezia (rome) 25% 25%iniziative produttive piemontesi s.r.l. turin 25% 25%pbs soc.Cons. a r.l. milan 25% 25%steril piemonte s.c.a.r.l. turin 25% 25%newco duC bologna s.p.a. bologna 24.9% 24.9%Cons. energia servizi bologna soc.Cons. a r.l. in liquidation bologna 24.25% 24.25%se.sa.mo. s.p.a. Carpi (modena) 20.91% 20.91%gico systems s.r.l. Zola predosa (bologna) 20% 20%tower soc.Cons. a r.l. bologna 20.17% 20.17%f.lli bernard s.r.l. bari 20% 20%gestioni sanitarie toscane soc.Cons. a r.l. florence 20% 20%ser.san. servizi sanitari s.p.a. in liquidation lamezia terme (Catanzaro) 20% 20%edex s.r.l. rho (milan) - 45%terzatorre s.p.a. bologna - 32%during <strong>2009</strong>, the group acquired 3 companies that provide specialist facility management servicesinvolving, in particular, the installation and maintenance of lifting equipment:> in January <strong>2009</strong>, mia s.p.a. (mia) acquired 60% of Cofam s.r.l., an sme (<strong>2009</strong> sales of about euro3.1 million) operating in the provinces of bologna and modena, for euro 4,146 thousand includingpurchase-related expenses; with regard to the remaining 40% of the capital, the seller granted a calloption to mia which, in turn, granted a put option to the seller;> in december <strong>2009</strong>, mia acquired 100% of both Coplift s.r.l. (for euro 542 thousand includingpurchase-related expenses) and mpe s.r.l. (for euro 1,406 thousand including purchase-related expenses),two small companies (combined <strong>2009</strong> sales of euro 1.5 million) operating in the milan area.these acquisitions are described in detail in note 4, to which reference is made.in addition, following the major acquisitions made at the end of 2008, work to reorganise the mfmgroup has commenced and will be completed during 2010. the principal non-recurring transactionsrelating to group companies during <strong>2009</strong> were:> the absorption of omasa s.p.a. by servizi ospedalieri s.p.a., both active in the laundering-sterilisationsector;> the absorption of altair ifm polska sp.zo.o. by gestin polska sp.zo.o.;> the absorption of Consorzio pulizie Veneto soc.Cons. a r.l. by mfm;> the formation in november <strong>2009</strong> of manutencoop Costruzioni s.p.a. to which mfm contributed thebuilding activities line of business.in november, smail s.p.a., active in the provision of public lighting services, formed servizi luce soc.Cons.a r.l. as a 50% joint venture to manage the contract for public lighting services in the municipalityof Quartu sant’elena, in sardinia.the investment in bresso energia s.r.l., a joint venture, has been measured as of 31 december <strong>2009</strong> inaccordance with the provisions of IFRS 5 – Non-current Assets Held for Sale and Discontinued Operations,since agreement to sell the investment for euro 99 thousand had already been reached by thatdate. the transaction was completed on 27 January 2010 (see note 15 for further information).With regard to associates, during <strong>2009</strong>:> mfm s.p.a. subscribed for 34.10% of livia soc.Cons. a r.l., a new consortium formed to formaliserelations in the context of a temporary business association established to manage a contract for thesupply of facility management services.> the parent Company decided not to participate in the capital reconstruction of edex s.r.l., followingthe cancellation of its quota capital to cover losses, and is no longer a member of that company.> the parent Company sold 23% of the shares in terzatorre s.p.a. to other shareholders for euro1,012 thousand, thus reducing its equity interest to 10%. this investment has therefore been reclassifiedamong the Other investments and will no longer be measured using the equity method.138 - Consolidated finanCial statements as of 31 deCember <strong>2009</strong> - aCCounting poliCies and explanatory notes Consolidated finanCial statements as of 31 deCember <strong>2009</strong> - aCCounting poliCies and explanatory notes - 139