Financial Statements 2009 - Manutencoop

Financial Statements 2009 - Manutencoop

Financial Statements 2009 - Manutencoop

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

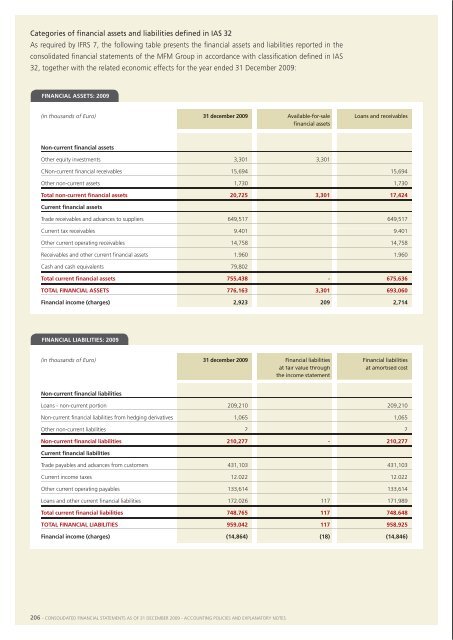

Categories of financial assets and liabilities defined in ias 32as required by ifrs 7, the following table presents the financial assets and liabilities reported in theconsolidated financial statements of the mfm group in accordance with classification defined in ias32, together with the related economic effects for the year ended 31 december <strong>2009</strong>:fInancIal assets: <strong>2009</strong>(in thousands of Euro) 31 december <strong>2009</strong>available-for-saleloans and receivablesfinancial assetsnon-current financial assetsother equity investments 3,301 3,301Cnon-current financial receivables 15,694 15,694other non-current assets 1,730 1,730total non-current financial assets 20,725 3,301 17,424current financial assetstrade receivables and advances to suppliers 649,517 649,517Current tax receivables 9,401 9,401other current operating receivables 14,758 14,758receivables and other current financial assets 1,960 1,960Cash and cash equivalents 79,802the same information for the year ended 31 december 2008 is presented below:fInancIal assets: 2008(in thousands of Euro) 31 december 2008available-for-saleloans and receivablesfinancial assetsnon-current financial assetsother equity investments 2,836 2,836non-current financial receivables 6,708 6,708other non-current assets 1,414 1,414total non-current financial assets 10,958 2,836 8,122current financial assetstrade receivables and advances to suppliers 634,777 634,777Current tax receivables 234 234other current operating receivables 17,076 17,076receivables and other current financial assets 1,220 1,220Cash and cash equivalents 97,927total current financial assets 751,234 - 653,307total fInancIal assets 762,192 2,836 661,429financial income (charges) 3,979 182 3,797total current financial assets 755,438 - 675,636total fInancIal assets 776,163 3,301 693,060financial income (charges) 2,923 209 2,714fInancIal lIabIlItIes: <strong>2009</strong>(in thousands of Euro) 31 december <strong>2009</strong>financial liabilitiesfinancial liabilitiesat fair value throughat amortised costthe income statementnon-current financial liabilitiesloans - non-current portion 209,210 209,210non-current financial liabilities from hedging derivatives 1,065 1,065other non-current liabilities 2 2non-current financial liabilities 210,277 - 210,277current financial liabilitiestrade payables and advances from customers 431,103 431,103Current income taxes 12,022 12,022other current operating payables 133,614 133,614fInancIal lIabIlItIes: 2008(in thousands of Euro) 31 december 2008financial liabilitiesfinancial liabilitiesat fair value throughat amortised costthe income statementnon-current financial liabilitiesloans - non-current portion 229,708 229,708other non-current liabilities 12 12non-current financial liabilities 229,720 - 229,720current financial liabilitiestrade payables and advances from customers 490,049 490,049other current operating payables 114,014 114,014Current loans 91,371 91,371other current financial liabilities 19,160 99 19,061total current financial liabilities 714,594 99 714,495total fInancIal lIabIlItIes 944,314 99 944,215financial income (charges) (13,147) 2 (13,149)loans and other current financial liabilities 172,026 117 171,989total current financial liabilities 748,765 117 748,648total fInancIal lIabIlItIes 959,042 117 958,925financial income (charges) (14,864) (18) (14,846)liquidity riskthe group’s objective is to keep a balance between the maintenance of funding and the flexibilityderiving from the use of current account overdrafts, short-term bank loans (hot money and advances),lease finance and medium/long-term loans.206 - Consolidated finanCial statements as of 31 deCember <strong>2009</strong> - aCCounting poliCies and explanatory notes Consolidated finanCial statements as of 31 deCember <strong>2009</strong> - aCCounting poliCies and explanatory notes - 207