Financial Statements 2009 - Manutencoop

Financial Statements 2009 - Manutencoop

Financial Statements 2009 - Manutencoop

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

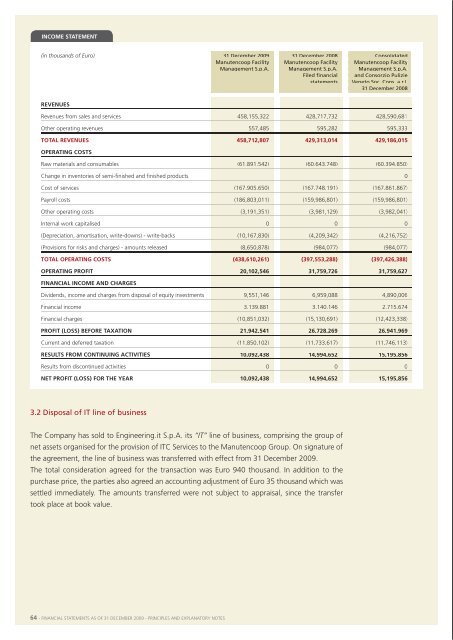

InCome statementthe following schedule summarises the balance sheet effects of this transaction:(in thousands of Euro) 31 December <strong>2009</strong> 31 December 2008 Consolidated<strong>Manutencoop</strong> Facility <strong>Manutencoop</strong> Facility <strong>Manutencoop</strong> FacilityManagement S.p.A. Management S.p.A. Management S.p.A.Filed financialand Consorzio PuliziestatementsVeneto Soc. Cons. a r.l.31 December 2008revenuesrevenues from sales and services 458,155,322 428,717,732 428,590,681other operating revenues 557,485 595,282 595,333total revenues 458,712,807 429,313,014 429,186,015operatIng Costsraw materials and consumables (61,891,542) (60,643,748) (60,394,850)change in inventories of semi-finished and finished products 0balanCe sheet effeCt: dIsposal of It lIne of busIness(in thousands of Euro) recognised valuebook valueproperty, plant and equipment 1,030 1,030assets 1,030 1,030employee severance indemnities 29 29other current payables 26 26lIabIlItIes 55 55fair value of net assets 975 975total cost of disposal 940adjustment 35cost of services (167,905,650) (167,748,191) (167,861,867)payroll costs (186,803,011) (159,986,801) (159,986,801)other operating costs (3,191,351) (3,981,129) (3,982,041)internal work capitalised 0 0 0(Depreciation, amortisation, write-downs) - write-backs (10,167,830) (4,209,342) (4,216,752)(provisions for risks and charges) - amounts released (8,650,878) (984,077) (984,077)total operatIng Costs (438,610,261) (397,553,288) (397,426,388)operatIng profIt 20,102,546 31,759,726 31,759,627fInanCIal InCome and ChargesDividends, income and charges from disposal of equity investments 9,551,146 6,959,088 4,890,006<strong>Financial</strong> income 3,139,881 3,140,146 2,715,674<strong>Financial</strong> charges (10,851,032) (15,130,691) (12,423,338)profIt (loss) before taXatIon 21,942,541 26,728,269 26,941,969current and deferred taxation (11,850,102) (11,733,617) (11,746,113)results from ContInuIng aCtIvItIes 10,092,438 14,994,652 15,195,856results from discontinued activities 0 0 0net profIt (loss) for the year 10,092,438 14,994,652 15,195,8563.2 Disposal of IT line of businessthe company has sold to engineering.it s.p.a. its “IT” line of business, comprising the group ofnet assets organised for the provision of itc services to the manutencoop Group. on signature ofthe agreement, the line of business was transferred with effect from 31 December <strong>2009</strong>.the total consideration agreed for the transaction was euro 940 thousand. in addition to thepurchase price, the parties also agreed an accounting adjustment of euro 35 thousand which wassettled immediately. the amounts transferred were not subject to appraisal, since the transfertook place at book value.3.3 Disposal of Building Division line of businesson 22 December <strong>2009</strong>, the company contributed to manutencoop costruzioni s.p.a. the line ofbusiness relating to the design, construction and maintenance of building works for public andprivate customers, in order to optimise the use of resources and contain costs by rationalising theorganisational structure.the independent expert appointed to appraise the value of the net assets contributed determinedthe value of the economic capital of the line of business of manutencoop Facility managements.p.a. known as the “Building Division”.. this expert determined the value of the businesscontributed to be euro 289 thousand which, compared with the carrying amount of the relatednet liabilities, euro 330 thousand, resulted in the recognition of a capital gain of euro 619thousand. this transaction represents a business combination between entities under commoncontrol, since manutencoop costruzioni s.p.a. is a wholly-owned subsidiary of manutencoopFacility management s.p.a.the transaction is not governed by iFrs 3 since it was carried out by parties that are undercommon control. as indicated in assirevi Document opi 1 on the “accounting treatment ofbusiness combinations of entities under common control”, economic substance consists in thegeneration of value added for all the parties concerned (in the form, for example, of higherrevenues, cost savings, release of synergies), in the form of significant changes in the cash flowsgenerated before and after the combination of activities. application of the consistency principlegives rise to the recognition in the statement of financial position of the amounts that would havebeen recorded had the combined businesses always been united. the net assets of the acquiredand acquiring entities were therefore recognised at the respective carrying amounts recordedprior to the combination.accordingly, recognition of the transaction involving the Building Division using the consistencymethod has resulted in the creation of an equity reserve of euro 611 thousand, representingthe additional appraised value of the contributed net assets and liabilities with respect to theircarrying amounts, net of the related tax effect (euro 8 thousand).64 - <strong>Financial</strong> statements as oF 31 December <strong>2009</strong> - principles anD explanatory notes <strong>Financial</strong> statements as oF 31 December <strong>2009</strong> - principles anD explanatory notes - 65