Financial Statements 2009 - Manutencoop

Financial Statements 2009 - Manutencoop

Financial Statements 2009 - Manutencoop

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

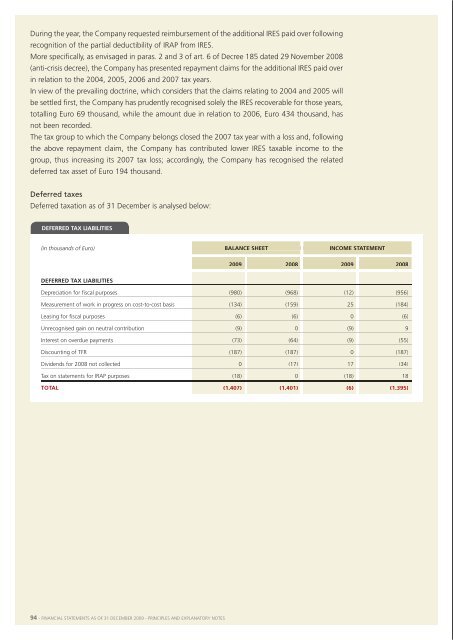

During the year, the company requested reimbursement of the additional ires paid over followingrecognition of the partial deductibility of irap from ires.more specifically, as envisaged in paras. 2 and 3 of art. 6 of Decree 185 dated 29 november 2008(anti-crisis decree), the company has presented repayment claims for the additional ires paid overin relation to the 2004, 2005, 2006 and 2007 tax years.in view of the prevailing doctrine, which considers that the claims relating to 2004 and 2005 willbe settled first, the company has prudently recognised solely the ires recoverable for those years,totalling euro 69 thousand, while the amount due in relation to 2006, euro 434 thousand, hasnot been recorded.the tax group to which the company belongs closed the 2007 tax year with a loss and, followingthe above repayment claim, the company has contributed lower ires taxable income to thegroup, thus increasing its 2007 tax loss; accordingly, the company has recognised the relateddeferred tax asset of euro 194 thousand.Deferred taxesDeferred taxation as of 31 December is analysed below:deferred taX lIabIlItIes(in thousands of Euro) balanCe sheetInCome statement<strong>2009</strong> 2008 <strong>2009</strong> 2008deferred taX lIabIlItIesDepreciation for fiscal purposes (980) (968) (12) (956)measurement of work in progress on cost-to-cost basis (134) (159) 25 (184)leasing for fiscal purposes (6) (6) 0 (6)Unrecognised gain on neutral contribution (9) 0 (9) 9deferred taX assets(in thousands of Euro) balanCe sheetInCome statement<strong>2009</strong> 2008 <strong>2009</strong> 2008deferred taX assetsmeasurement of work in progress on cost-to-cost basis 141 0 141 0tax depreciation of costs expensed 7 218 (211) (82)leasing balloon payment 11 11 0 0Discounting of financial receivables 9 101 (92) (1)Discounting of trade receivables 1 35 (34) (183)Disallowed equipment maintenance and repairs 39 77 (38) (37)allowance for inventories 26 0 26 0entertaining expenses 15 42 (27) (27)provisions for risks and charges 2,707 465 2,242 9estimated losses on default interest charged 32 21 11 (30)allowance for doubtful accounts 763 341 422 0membership fees not paid 0 7 (7) 7Write-down of investments on absorption of bsm s.r.l. 1 1 0 0professional services 45 0 45 (110)capital increase expenses recognised in equity 846 0 (282) 0irap reimbursement claim 195 0 195 0tax effect of irs derivative 293 0 0 0Goodwill on unexpired contracts - 1/18th deduction 137 0 137 0tax depreciation of costs recognised in equity 145 157 (12) (3)total 5,413 1,476 2,516 (457)interest on overdue payments (73) (64) (9) (55)Discounting of tFr (187) (187) 0 (187)Dividends for 2008 not collected 0 (17) 17 (34)tax on statements for irap purposes (18) 0 (18) 18total (1,407) (1,401) (6) (1,395)Deferred tax assets have been recognised in full since their recovery in future years is reasonablycertain. the amounts reported reflect application of the 27.5% ires rate and the 3.9% irap rate.34. earnIngs per sharethe company has decided to make the earnings per share disclosure solely in the consolidatedfinancial statements, as envisaged in ias 33.dIvIdends(in thousands of Euro) <strong>2009</strong> 2008proposals for approval at the shareholders' meetIngDividends on ordinary shares: 0 4,0392008 dividend: 0.047 euro94 - <strong>Financial</strong> statements as oF 31 December <strong>2009</strong> - principles anD explanatory notes <strong>Financial</strong> statements as oF 31 December <strong>2009</strong> - principles anD explanatory notes - 95