Financial Statements 2009 - Manutencoop

Financial Statements 2009 - Manutencoop

Financial Statements 2009 - Manutencoop

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

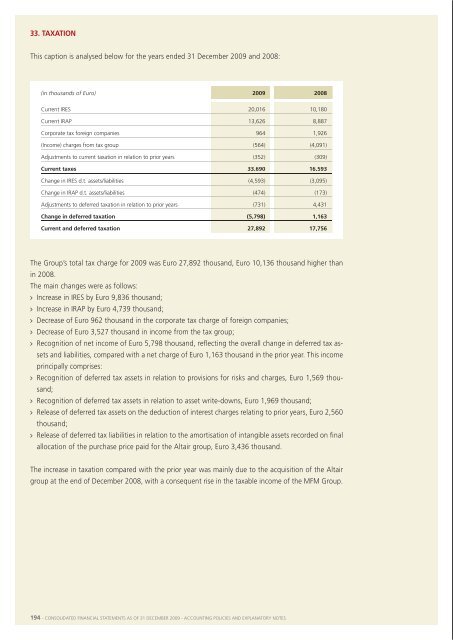

33. taXatIonthis caption is analysed below for the years ended 31 december <strong>2009</strong> and 2008:reported current income taxes are reconciled below with the theoretical taxes calculated by applyingthe ires rate in force for the years ended 31 december <strong>2009</strong> and 2008 to the related profit beforetaxation:reconcIlIatIon of theoretIcal Ires rate WIth effectIVe rate(in thousands of Euro) <strong>2009</strong> 2008Current ires 20,016 10,180Current irap 13,626 8,887Corporate tax foreign companies 964 1,926(income) charges from tax group (564) (4,091)adjustments to current taxation in relation to prior years (352) (309)current taxes 33,690 16,593Change in ires d.t. assets/liabilities (4,593) (3,095)Change in irap d.t. assets/liabilities (474) (173)adjustments to deferred taxation in relation to prior years (731) 4,431(in thousands of Euro) 31 december <strong>2009</strong> 31 december 2008(in thousands of euro) % (in thousands of euro) %profit before taxation 39,049 38,655standard tax rate 27.5% 27.5%effect of tax disallowances (allowances):> temporary differences 51,716 36.42% (4,859) (3.45%)> permanent differences (20,032) (14.11%) 3,353 2.38%Ires taxable income 70,733 37,149tax / effective tax rate 19,452 49.81% 10,216 26.43%change in deferred taxation (5,798) 1,163current and deferred taxation 27,892 17,756the group’s total tax charge for <strong>2009</strong> was euro 27,892 thousand, euro 10,136 thousand higher thanin 2008.the main changes were as follows:> increase in ires by euro 9,836 thousand;> increase in irap by euro 4,739 thousand;> decrease of euro 962 thousand in the corporate tax charge of foreign companies;> decrease of euro 3,527 thousand in income from the tax group;> recognition of net income of euro 5,798 thousand, reflecting the overall change in deferred tax assetsand liabilities, compared with a net charge of euro 1,163 thousand in the prior year. this incomeprincipally comprises:> recognition of deferred tax assets in relation to provisions for risks and charges, euro 1,569 thousand;> recognition of deferred tax assets in relation to asset write-downs, euro 1,969 thousand;> release of deferred tax assets on the deduction of interest charges relating to prior years, euro 2,560thousand;> release of deferred tax liabilities in relation to the amortisation of intangible assets recorded on finalallocation of the purchase price paid for the altair group, euro 3,436 thousand.the increase in taxation compared with the prior year was mainly due to the acquisition of the altairgroup at the end of december 2008, with a consequent rise in the taxable income of the mfm group.the actual effective ires current tax charge (euro 19,452 thousand) comprises the current ires chargeshown in the above table, euro 20,016 thousand, net of tax group income of euro 564 thousand.the effective rate of 49.81% reflects the effect on current ires/taxable income of the consolidationadjustments, the tax effect of which is recorded among the deferred tax liabilities.in particular, the increase in the effective ires rate from 26.43% in the prior year to 49.81% in <strong>2009</strong>was largely due to the amortisation recorded in the consolidated financial statements of the intangibleassets recognised as part of the ppa process. more specifically, amortisation of the ppa reduces consolidatedincome before taxation without any effect on current taxation, thereby causing the effectiverate to increase. for comparative purposes, the effective ires rate for <strong>2009</strong> would have been 38.8%without the effect of ppa amortisation.the effective and theoretical irap rates are reconciled below:reconcIlIatIon of theoretIcal Irap rate WIth effectIVe rate(in thousands of Euro) 31 december <strong>2009</strong> 31 december 2008(in thousands of euro) % (in thousands of euro) %results before taxation 39,049 38,655standard tax rate 3.90% 3.90%4.73% 4.73%4.82% 4.82%effect of tax disallowances (allowances):> payroll costs 334,900 219,493> results of financial management 14,961 14,605> other differences between taxable income and pre-tax profits (62,560) (53,615)Irap taxable income 326,350 219,138> inc. at 3.90% 228,123 182,063> inc. at 4.73% 5,329 847> inc. at 4.82% 92,898 36,228tax / effective tax rate 13,626 34.90% 8,887 22.99%194 - Consolidated finanCial statements as of 31 deCember <strong>2009</strong> - aCCounting poliCies and explanatory notes Consolidated finanCial statements as of 31 deCember <strong>2009</strong> - aCCounting poliCies and explanatory notes - 195