Financial Statements 2009 - Manutencoop

Financial Statements 2009 - Manutencoop

Financial Statements 2009 - Manutencoop

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

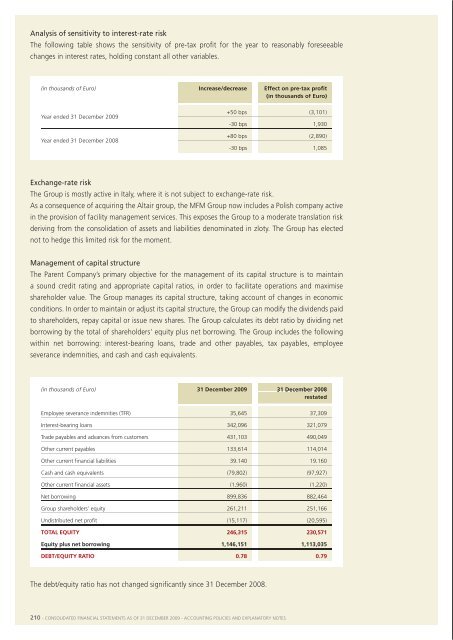

analysis of sensitivity to interest-rate riskthe following table shows the sensitivity of pre-tax profit for the year to reasonably foreseeablechanges in interest rates, holding constant all other variables.(in thousands of Euro) Increase/decreaseeffect on pre-tax profit(in thousands of euro)year ended 31 december <strong>2009</strong>+50 bps (3,101)-30 bps 1,930year ended 31 december 2008+80 bps (2,890)-30 bps 1,08538. subseQuent eVentsthe absorption of integra fm bV, altair ifm s.p.a., gestin facility s.p.a. and teckal s.p.a. by mfms.p.a. took effect on 1 January 2010.on the same date, the absorption of mCb s.p.a. by mp facility s.p.a. also took effect.the operational phase of the integration process has continued in early 2010 and should be completedlater in the year, when the new organisational structure will become fully effective.the chairman of the management boardClaudio Levoratoexchange-rate riskthe group is mostly active in italy, where it is not subject to exchange-rate risk.as a consequence of acquiring the altair group, the mfm group now includes a polish company activein the provision of facility management services. this exposes the group to a moderate translation riskderiving from the consolidation of assets and liabilities denominated in zloty. the group has electednot to hedge this limited risk for the moment.management of capital structurethe parent Company’s primary objective for the management of its capital structure is to maintaina sound credit rating and appropriate capital ratios, in order to facilitate operations and maximiseshareholder value. the group manages its capital structure, taking account of changes in economicconditions. in order to maintain or adjust its capital structure, the group can modify the dividends paidto shareholders, repay capital or issue new shares. the group calculates its debt ratio by dividing netborrowing by the total of shareholders’ equity plus net borrowing. the group includes the followingwithin net borrowing: interest-bearing loans, trade and other payables, tax payables, employeeseverance indemnities, and cash and cash equivalents.(in thousands of Euro) 31 december <strong>2009</strong> 31 december 2008restatedemployee severance indemnities (tfr) 35,645 37,309interest-bearing loans 342,096 321,079trade payables and advances from customers 431,103 490,049other current payables 133,614 114,014other current financial liabilities 39,140 19,160Cash and cash equivalents (79,802) (97,927)other current financial assets (1,960) (1,220)net borrowing 899,836 882,464group shareholders’ equity 261,211 251,166undistributed net profit (15,117) (20,595)total eQuItY 246,315 230,571equity plus net borrowing 1,146,151 1,113,035debt/eQuItY ratIo 0.78 0.79the debt/equity ratio has not changed significantly since 31 december 2008.210 - Consolidated finanCial statements as of 31 deCember <strong>2009</strong> - aCCounting poliCies and explanatory notes Consolidated finanCial statements as of 31 deCember <strong>2009</strong> - aCCounting poliCies and explanatory notes - 211