Financial Statements 2009 - Manutencoop

Financial Statements 2009 - Manutencoop

Financial Statements 2009 - Manutencoop

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

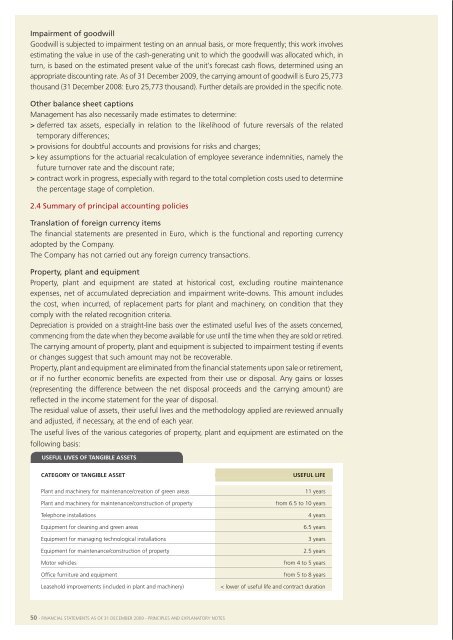

Impairment of goodwillGoodwill is subjected to impairment testing on an annual basis, or more frequently; this work involvesestimating the value in use of the cash-generating unit to which the goodwill was allocated which, inturn, is based on the estimated present value of the unit's forecast cash flows, determined using anappropriate discounting rate. as of 31 December <strong>2009</strong>, the carrying amount of goodwill is euro 25,773thousand (31 December 2008: euro 25,773 thousand). Further details are provided in the specific note.Other balance sheet captionsmanagement has also necessarily made estimates to determine:> deferred tax assets, especially in relation to the likelihood of future reversals of the relatedtemporary differences;> provisions for doubtful accounts and provisions for risks and charges;> key assumptions for the actuarial recalculation of employee severance indemnities, namely thefuture turnover rate and the discount rate;> contract work in progress, especially with regard to the total completion costs used to determinethe percentage stage of completion.2.4 Summary of principal accounting policiesTranslation of foreign currency itemsthe financial statements are presented in euro, which is the functional and reporting currencyadopted by the company.the company has not carried out any foreign currency transactions.Property, plant and equipmentproperty, plant and equipment are stated at historical cost, excluding routine maintenanceexpenses, net of accumulated depreciation and impairment write-downs. this amount includesthe cost, when incurred, of replacement parts for plant and machinery, on condition that theycomply with the related recognition criteria.Depreciation is provided on a straight-line basis over the estimated useful lives of the assets concerned,commencing from the date when they become available for use until the time when they are sold or retired.the carrying amount of property, plant and equipment is subjected to impairment testing if eventsor changes suggest that such amount may not be recoverable.property, plant and equipment are eliminated from the financial statements upon sale or retirement,or if no further economic benefits are expected from their use or disposal. any gains or losses(representing the difference between the net disposal proceeds and the carrying amount) arereflected in the income statement for the year of disposal.the residual value of assets, their useful lives and the methodology applied are reviewed annuallyand adjusted, if necessary, at the end of each year.the useful lives of the various categories of property, plant and equipment are estimated on thefollowing basis:useful lIves of tangIble assetsCategory of tangIble assetplant and machinery for maintenance/creation of green areasplant and machinery for maintenance/construction of propertytelephone installationsequipment for cleaning and green areasequipment for managing technological installationsuseful lIfe11 yearsfrom 6.5 to 10 years4 years6.5 years3 yearsin addition to plant and equipment in the strict sense, this category also includes machinery,motor vehicles, office machines and furniture.<strong>Financial</strong> chargesas in previous years, no assets were identified during the year that justified the capitalisation offinancial charges, being assets requiring a significant period before they become available for theirintended use (qualifying assets under the terms of ias 23).Goodwillthe goodwill arising from business combinations is initially measured at cost, being the differencebetween acquisition cost and the company's interest in the net fair value of the related identifiableassets, liabilities and contingent liabilities. after initial recognition, goodwill is measured at costnet of any accumulated impairment losses. Goodwill is subjected to impairment testing on anannual basis, or more frequently if events or changes suggest that it may not be fully recoverable.For impairment testing purposes, goodwill is allocated from the date of acquisition to each ofthe company's cash-generating units (or groups of units) that are expected to benefit from thesynergies released from the acquisition, regardless of the allocation of other assets or liabilities tothe same units (or groups of units). this is only done if such allocation is not arbitrary. each unitor group of units to which goodwill is allocated:> represents the lowest level, within the company, at which goodwill is monitored for internaloperational purposes;> is no broader than the primary or secondary reporting segments identified for the disclosure ofsegment information pursuant to ias 14 - segment reporting.impairment is determined with reference to the recoverable value of the cash-generating units (orgroups of units) to which goodwill was allocated. if the recoverable value of the cash-generatingunits (or groups of units) is lower than the carrying value of goodwill, such impairment in valueis recognised.once written down, the value of goodwill cannot be reinstated.Other intangible assetsintangible assets purchased separately are initially capitalised at cost, while those acquired as aresult of business combinations are capitalised at their fair value at the acquisition date. Followinginitial recognition, intangible assets are stated at cost, net of accumulated amortisation andimpairment write-downs.the useful lives of intangible assets are either finite or indefinite.intangible assets with a finite life are amortised over their useful lives and subjected to impairmenttesting whenever there is evidence of a possible loss in value. the period of amortisation andthe methodology applied are reviewed at the end of each financial year, or more frequently ifnecessary. changes in expected useful life or in the way future economic benefits associatedwith the intangible asset will be earned by the company are recognised by modifying theperiod of amortisation or the methodology applied, as appropriate, and treated as a change inaccounting estimate. the amortisation of intangible assets with finite useful lives is charged to thedepreciation, amortisation, write-downs and write-backs caption of the income statement.the company has not recognised any intangible assets with an indefinite useful life, except forgoodwill and a licence to transport goods for third parties.equipment for maintenance/construction of propertymotor vehiclesoffice furniture and equipmentleasehold improvements (included in plant and machinery)2.5 yearsfrom 4 to 5 yearsfrom 5 to 8 years< lower of useful life and contract duration50 - <strong>Financial</strong> statements as oF 31 December <strong>2009</strong> - principles anD explanatory notes <strong>Financial</strong> statements as oF 31 December <strong>2009</strong> - principles anD explanatory notes - 51