Financial Statements 2009 - Manutencoop

Financial Statements 2009 - Manutencoop

Financial Statements 2009 - Manutencoop

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

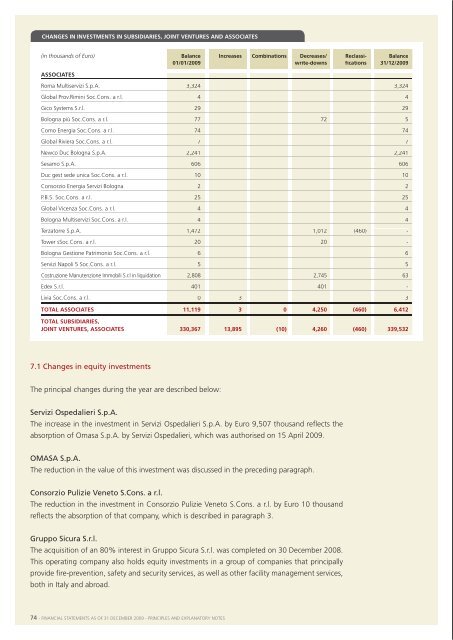

Changes In Investments In subsIdIarIes, JoInt ventures and assoCIates(in thousands of Euro) balance Increases Combinations decreases/ reclassi- balance01/01/<strong>2009</strong> write-downs fications 31/12/<strong>2009</strong>assoCIatesroma multiservizi s.p.a. 3,324 3,324Global prov.rimini soc.cons. a r.l. 4 4Gico systems s.r.l. 29 29bologna più soc.cons. a r.l. 77 72 5como energia soc.cons. a r.l. 74 74Global riviera soc.cons. a r.l. 7 7newco Duc bologna s.p.a. 2,241 2,241sesamo s.p.a. 606 606Duc gest sede unica soc.cons. a r.l. 10 10consorzio energia servizi bologna 2 2p.b.s. soc.cons. a r.l. 25 25Global Vicenza soc.cons. a r.l. 4 4bologna multiservizi soc.cons. a r.l. 4 4terzatorre s.p.a. 1,472 1,012 (460) -tower ssoc.cons. a r.l. 20 20 -bologna Gestione patrimonio soc.cons. a r.l. 6 6servizi napoli 5 soc.cons. a r.l. 5 5costruzione manutenzione immobili s.r.l in liquidation 2,808 2,745 63edex s.r.l. 401 401 -livia soc.cons. a r.l. 0 3 3total assoCIates 11,119 3 0 4,250 (460) 6,412total subsIdIarIes,JoInt ventures, assoCIates 330,367 13,895 (10) 4,260 (460) 339,532the total cost of the acquisition was euro 15,329 thousand, including euro 184 thousand inpurchase-related costs (legal expenses, financial consultancy and antitrust procedures).the purchase consideration was paid to the seller on completion of the transaction.the contract also envisaged:> payment to the sellers of an additional price (earn-out) for the 80% interest acquired. thisamount is payable, upon request from the sellers between 1 July 2014 and 30 June 2015,on condition that the normalised consolidated ebitDa of Gruppo sicura for 2013 exceeds itsnormalised ebitDa for 2007;> grant of a put option (by the buyer to the sellers, exercisable between 30 June 2014 and 30June 2015) and a call option (by the sellers to the buyer, exercisable between 1 July 2015 and 1July 2017) for the transfer of the remaining 20% of the quota capital.the additional price for the 80% interest acquired and the exercise price of the options over theresidual 20% will be determined with reference to updated valuations for the investment at thetime the sellers request payment and at the option exercise date.the updated valuation of the investment will be determined by multiplying the normalisedconsolidated ebitDa for 2013 by a coefficient (defined by contract or, if mFm s.p.a. is listed at thetime, representing the average market price over the preceding 3 months), less the consolidatednet financial position of Gruppo sicura s.r.l. as of 31 December 2013.pursuant to current standards, the present value of the additional price payable (earn-out) inrelation to the sicura group has been determined to be euro 13,483 thousand. this amount hasbeen recognised as a financial liability in these financial statements since management believesit likely that the earn-out condition will be met (ebitDa 2013 greater than ebitDa 2007). thefinancial charges contributing to the determination of this present value, euro 653 thousand,have also been recognised.7.1 Changes in equity investmentsthe principal changes during the year are described below:Servizi Ospedalieri S.p.A.the increase in the investment in servizi ospedalieri s.p.a. by euro 9,507 thousand reflects theabsorption of omasa s.p.a. by servizi ospedalieri, which was authorised on 15 april <strong>2009</strong>.OMASA S.p.A.the reduction in the value of this investment was discussed in the preceding paragraph.Consorzio Pulizie Veneto S.Cons. a r.l.the reduction in the investment in consorzio pulizie Veneto s.cons. a r.l. by euro 10 thousandreflects the absorption of that company, which is described in paragraph 3.Gruppo Sicura S.r.l.the acquisition of an 80% interest in Gruppo sicura s.r.l. was completed on 30 December 2008.this operating company also holds equity investments in a group of companies that principallyprovide fire-prevention, safety and security services, as well as other facility management services,both in italy and abroad.<strong>Manutencoop</strong> Costruzioni S.p.A.manutencoop costruzioni s.p.a. was formed on 12 november <strong>2009</strong>. its objects are to perform,in any configuration, contracts or concessions for the design and construction of works. thecapital subscribed and paid in by manutencoop Facility management s.p.a., euro 120 thousand,represents 100% of the company's share capital. the residual amount of the company's capital,euro 289 thousand, was contributed in kind, in the form of the building Division line of businessdiscussed further in point 3.Bologna Più S.Cons. a.r.l.on 12 may <strong>2009</strong>, the extraordinary meeting of bologna più cons. a r.l. resolved to liquidate thecompany and reduced its quota capital from euro 300 thousand to euro 20 thousand, with theconsequent proportional return to quotaholders of part of their paid-in capital.Scam S.Cons. a r.l. and Tower S.Cons. a r.l.the reduction in the investments in scam s.cons. a r.l. and tower s.cons. a r.l. derives from thecontribution of the “Building Division” line of business to manutencoop costruzioni s.p.a.Terzatorre S.p.A.the reduction in the investment in terzatorre s.p.a. by euro 1,012 thousand derives from the saleof 1,012,000 shares, par value euro 1 each, representing 22% of the company. this investment,originally 33% held, is now 10% owned and has therefore become a minor investment as of 31December <strong>2009</strong>. the disposal did not give rise to any capital gains.74 - <strong>Financial</strong> statements as oF 31 December <strong>2009</strong> - principles anD explanatory notes <strong>Financial</strong> statements as oF 31 December <strong>2009</strong> - principles anD explanatory notes - 75