Financial Statements 2009 - Manutencoop

Financial Statements 2009 - Manutencoop

Financial Statements 2009 - Manutencoop

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

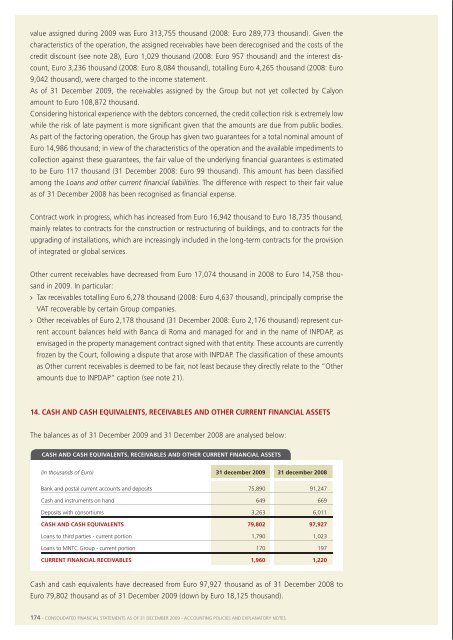

value assigned during <strong>2009</strong> was euro 313,755 thousand (2008: euro 289,773 thousand). given thecharacteristics of the operation, the assigned receivables have been derecognised and the costs of thecredit discount (see note 28), euro 1,029 thousand (2008: euro 957 thousand) and the interest discount,euro 3,236 thousand (2008: euro 8,084 thousand), totalling euro 4,265 thousand (2008: euro9,042 thousand), were charged to the income statement.as of 31 december <strong>2009</strong>, the receivables assigned by the group but not yet collected by Calyonamount to euro 108,872 thousand.Considering historical experience with the debtors concerned, the credit collection risk is extremely lowwhile the risk of late payment is more significant given that the amounts are due from public bodies.as part of the factoring operation, the group has given two guarantees for a total nominal amount ofeuro 14,986 thousand; in view of the characteristics of the operation and the available impediments tocollection against these guarantees, the fair value of the underlying financial guarantees is estimatedto be euro 117 thousand (31 december 2008: euro 99 thousand). this amount has been classifiedamong the Loans and other current financial liabilities. the difference with respect to their fair valueas of 31 december 2008 has been recognised as financial expense.Contract work in progress, which has increased from euro 16,942 thousand to euro 18,735 thousand,mainly relates to contracts for the construction or restructuring of buildings, and to contracts for theupgrading of installations, which are increasingly included in the long-term contracts for the provisionof integrated or global services.other current receivables have decreased from euro 17,074 thousand in 2008 to euro 14,758 thousandin <strong>2009</strong>. in particular:> tax receivables totalling euro 6,278 thousand (2008: euro 4,637 thousand), principally comprise theVat recoverable by certain group companies.> other receivables of euro 2,178 thousand (31 december 2008: euro 2,176 thousand) represent currentaccount balances held with banca di roma and managed for and in the name of inpdap, asenvisaged in the property management contract signed with that entity. these accounts are currentlyfrozen by the Court, following a dispute that arose with inpdap. the classification of these amountsas other current receivables is deemed to be fair, not least because they directly relate to the “otheramounts due to inpdap” caption (see note 21).bank deposits earn interest at the respective short-term rates.the amounts deposited with Consorzio Cooperativo finanziario per lo sviluppo (C.C.f.s.) and ConsorzioCooperative Costruzioni (C.C.C.), comprising the deposits with consortiums, are readily availableand earn interest. these amounts have decreased by euro 2,748 thousand since 31 december 2008.the parent Company has unused lines of credit totalling euro 76,036 thousand as of 31 december<strong>2009</strong> (2008: euro 121,676 thousand).Current financial receivables amount to euro 1,960 thousand as of 31 december <strong>2009</strong>, including euro1,790 thousand due from third parties, while euro 170 thousand relates to short-term loans to associates.Current financial receivables due from third parties as of 31 december <strong>2009</strong> include euro 1,023 thousandclaimed from the seller of smail. this balance was already outstanding as of 31 december 2008.15. non-current assets held for sale and assocIated lIabIlItIesas of 31 december 2008, Non-current assets held for sale and Liabilities associated with assets heldfor sale related to owned and leased property obtained on the acquisition of the sicura group on 30december 2008. the disposal of this property at predetermined prices in early <strong>2009</strong> had already beencontractually agreed prior to that date.the non-current assets held for sale, recognised at their agreed disposal value at the time of the acquisition,amounted to euro 6,959 thousand, while the associated liabilities totalled euro 5,345 thousand.in early <strong>2009</strong>, these assets were sold at the previously agreed prices without generating any gains orlosses.as of 31 december <strong>2009</strong>, Non-current assets held for sale and the associated liabilities relate to bressoenergia s.r.l., 50% held by the altair group, which was sold in January 2010 on the basis of an agreementsigned on 22 december <strong>2009</strong>.non-current assets held for sale amount to euro 98 thousand, while the associated liabilities total euro3 thousand. the assets and liabilities of the company held for sale are analysed below:14. cash and cash eQuIValents, receIVables and other current fInancIal assetsthe balances as of 31 december <strong>2009</strong> and 31 december 2008 are analysed below:bresso enerGIa (50% basIs)assets31 december <strong>2009</strong>cash and cash eQuIValents, receIVables and other current fInancIal assets(in thousands of Euro) 31 december <strong>2009</strong> 31 december 2008bank and postal current accounts and deposits 75,890 91,247Cash and instruments on hand 649 669Cash and cash equivalents 98total assets 98lIabIlItIestrade payables and advances from customers 3total lIabIlItIes 3deposits with consortiums 3,263 6,011cash and cash eQuIValents 79,802 97,927loans to third parties - current portion 1,790 1,023loans to mntC group - current portion 170 197the loss generated by this company during <strong>2009</strong>, euro 6 thousand, is classified in the results fromdiscontinued activities caption.current fInancIal receIVables 1,960 1,220Cash and cash equivalents have decreased from euro 97,927 thousand as of 31 december 2008 toeuro 79,802 thousand as of 31 december <strong>2009</strong> (down by euro 18,125 thousand).174 - Consolidated finanCial statements as of 31 deCember <strong>2009</strong> - aCCounting poliCies and explanatory notes Consolidated finanCial statements as of 31 deCember <strong>2009</strong> - aCCounting poliCies and explanatory notes - 175