Financial Statements 2009 - Manutencoop

Financial Statements 2009 - Manutencoop

Financial Statements 2009 - Manutencoop

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

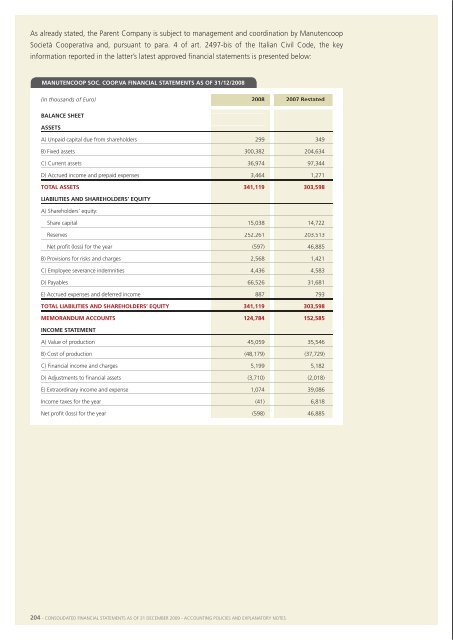

as already stated, the parent Company is subject to management and coordination by manutencoopsocietà Cooperativa and, pursuant to para. 4 of art. 2497-bis of the italian Civil Code, the keyinformation reported in the latter’s latest approved financial statements is presented below:manutencoop soc. coop.Va fInancIal statements as of 31/12/2008(in thousands of Euro) 2008 2007 restatedbalance sheetassetsa) unpaid capital due from shareholders 299 349b) fixed assets 300,382 204,634C) Current assets 36,974 97,344d) accrued income and prepaid expenses 3,464 1,271total assets 341,119 303,598lIabIlItIes and shareholders’ eQuItYa) shareholders’ equity:share capital 15,038 14,722reserves 252,261 203,513net profit (loss) for the year (597) 46,885remuneration of the board of directors, other executives with strategic responsibilities andthe board of statutory auditorsthe remuneration paid to members of the parent Company’s administrative and control bodies, andto executives with strategic responsibilities, including that for any work performed for other groupcompanies, is set out below:(in thousands of Euro) 31 december <strong>2009</strong> 31 december 2008board of directors/management boardshort-term benefits 1.148 1.052future benefits (severance indemnities) 5total boards 1.148 1.057other executives with strategic responsibilitiesshort-term benefits 733 522future benefits (severance indemnities) 49 32total other eXecutIVes 782 554board of statutory auditors / supervisory boardshort-term benefits 441 317total board of statutorY audItors / superVIsorY board 441 317b) provisions for risks and charges 2,568 1,421C) employee severance indemnities 4,436 4,583d) payables 66,526 31,681e) accrued expenses and deferred income 887 793total lIabIlItIes and shareholders’ eQuItY 341,119 303,598memorandum accounts 124,784 152,585Income statementa) Value of production 45,059 35,546b) Cost of production (48,179) (37,729)C) financial income and charges 5,199 5,182d) adjustments to financial assets (3,710) (2,018)e) extraordinary income and expense 1,074 39,086income taxes for the year (41) 6,818net profit (loss) for the year (598) 46,885during 2008, mfm s.p.a. implemented a dual-board governance system which replaced the boardof directors and the board of statutory auditors with a management board and a supervisory board.the fees of the group’s independent auditors, recorded in the consolidated income statement for<strong>2009</strong>, totalled euro 710 thousand.37. manaGement of fInancIal rIsKs: obJectIVes and crIterIafinancing requirements and the related risks (mainly interest-rate risk and liquidity risk) are managedon a centralised basis by the group treasury, following guidelines approved by the parent Company’smanagement board which are reviewed periodically. the main purpose of these guidelines is to ensurethat the structure of liabilities matches that of the assets reported in the financial statements, with aview to maintaining a high degree of financial strength.the main financial instruments used comprise:> short-term loans and a revolving factoring facility that involves the sale of receivables withoutrecourse in order to finance working capital;> medium/long-term loans repayable in instalments, to finance the investment in fixed assets and thepurchase of companies and lines of business.the group also uses the trade payables deriving from operating activities as financial instruments.it is group policy not to trade in financial instruments. this policy was followed during the year justended.204 - Consolidated finanCial statements as of 31 deCember <strong>2009</strong> - aCCounting poliCies and explanatory notes Consolidated finanCial statements as of 31 deCember <strong>2009</strong> - aCCounting poliCies and explanatory notes - 205