Financial Statements 2009 - Manutencoop

Financial Statements 2009 - Manutencoop

Financial Statements 2009 - Manutencoop

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

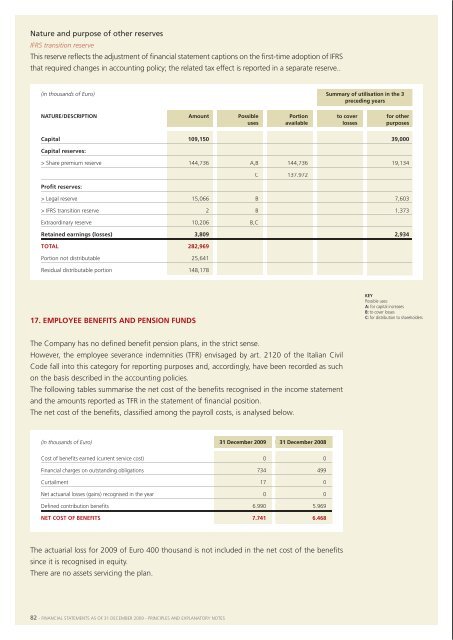

Nature and purpose of other reservesIFRS transition reservethis reserve reflects the adjustment of financial statement captions on the first-time adoption of iFrsthat required changes in accounting policy; the related tax effect is reported in a separate reserve..(in thousands of Euro) summary of utilisation in the 3preceding yearsnature/desCrIptIon amount possible portion to cover for otheruses available losses purposesCapital 109,150 39,000Capital reserves:> share premium reserve 144,736 a,b 144,736 19,134c 137,972profit reserves:> legal reserve 15,066 b 7,603> iFrs transition reserve 2 b 1,373extraordinary reserve 10,206 b,cretained earnings (losses) 3,809 2,934the changes in the present value of the defined benefit obligation (employee severance indemnities- tFr) are analysed below:(in thousands of Euro) <strong>2009</strong> 2008opening present value of the defined benefit obligation 13,455 16,454increase/(decrease) due to business combinations (135) 1,146benefits paid (1,433) (2,486)cost of benefits earned 0 0<strong>Financial</strong> charges on outstanding obligations 734 499actuarial (gains)/losses on obligation 400 (2,156)roundings 0 (2)ClosIng present value of the defIned benefIt oblIgatIon13,021 13,455the principal assumptions used to measure the obligation for employee severance indemnities aredescribed below:total 282,969portion not distributable 25,641residual distributable portion 148,17817. employee benefIts and pensIon fundsthe company has no defined benefit pension plans, in the strict sense.However, the employee severance indemnities (tFr) envisaged by art. 2120 of the italian civilcode fall into this category for reporting purposes and, accordingly, have been recorded as suchon the basis described in the accounting policies.the following tables summarise the net cost of the benefits recognised in the income statementand the amounts reported as tFr in the statement of financial position.the net cost of the benefits, classified among the payroll costs, is analysed below.(in thousands of Euro) 31 december <strong>2009</strong> 31 december 2008cost of benefits earned (current service cost) 0 0<strong>Financial</strong> charges on outstanding obligations 734 499curtailment 17 0net actuarial losses (gains) recognised in the year 0 0Defined contribution benefits 6,990 5,969net Cost of benefIts 7,741 6,468Keypossible uses:a: for capital increasesb: to cover lossesC: for distribution to shareholders% <strong>2009</strong> % 2008Discount rate 5.70% 5.70%inflation rate 2.00% 2.00%turnover 10.00% 10.00%the average number of employees is analysed below, together with those on secondment to thecompany from manutencoop società cooperativa:<strong>2009</strong> 2008executives 9 7clerical staff 251 261manual workers 8,096 7,063employees 8,356 7,331executives 16 17clerical staff 242 240manual workers 351 349seConded 609 606the actuarial loss for <strong>2009</strong> of euro 400 thousand is not included in the net cost of the benefitssince it is recognised in equity.there are no assets servicing the plan.82 - <strong>Financial</strong> statements as oF 31 December <strong>2009</strong> - principles anD explanatory notes <strong>Financial</strong> statements as oF 31 December <strong>2009</strong> - principles anD explanatory notes - 83