Financial Statements 2009 - Manutencoop

Financial Statements 2009 - Manutencoop

Financial Statements 2009 - Manutencoop

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

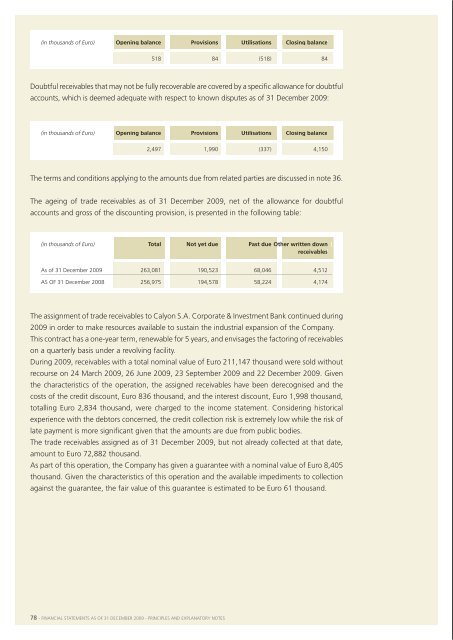

(in thousands of Euro) opening balance provisions utilisations Closing balance518 84 (518) 84Doubtful receivables that may not be fully recoverable are covered by a specific allowance for doubtfulaccounts, which is deemed adequate with respect to known disputes as of 31 December <strong>2009</strong>:13. other Current reCeIvables(in thousands of Euro) 31 december <strong>2009</strong> 31 december 2008Due from employees 118 78Due from suppliers 74 98Due from social security institutions 301 192Due from parent company 1 3(in thousands of Euro) opening balance provisions utilisations Closing balance2,497 1,990 (337) 4,150Due from subsidiaries 1 195bank accounts - inpDap 2,178 2,176Vat recoverable 185 64other 1,935 663the terms and conditions applying to the amounts due from related parties are discussed in note 36.the ageing of trade receivables as of 31 December <strong>2009</strong>, net of the allowance for doubtfulaccounts and gross of the discounting provision, is presented in the following table:(in thousands of Euro) total not yet due past due other written downreceivablesas of 31 December <strong>2009</strong> 263,081 190,523 68,046 4,512roundings 0 1total other Current reCeIvables 4,792 3,470the amount of euro 2,178 thousand relates to the current account balances held with banca diroma and managed for and in the name of inpDap, as envisaged in the property managementcontract signed with that entity by b.s.m. s.r.l., which was absorbed in 2006.other receivables include euro 1,713 thousand due in relation to temporary business associationsin which manutencoop Facility management s.p.a. is the lead company.as oF 31 December 2008 256,975 194,578 58,224 4,17414. other Current fInanCIal assetsthe assignment of trade receivables to calyon s.a. corporate & investment bank continued during<strong>2009</strong> in order to make resources available to sustain the industrial expansion of the company.this contract has a one-year term, renewable for 5 years, and envisages the factoring of receivableson a quarterly basis under a revolving facility.During <strong>2009</strong>, receivables with a total nominal value of euro 211,147 thousand were sold withoutrecourse on 24 march <strong>2009</strong>, 26 June <strong>2009</strong>, 23 september <strong>2009</strong> and 22 December <strong>2009</strong>. Giventhe characteristics of the operation, the assigned receivables have been derecognised and thecosts of the credit discount, euro 836 thousand, and the interest discount, euro 1,998 thousand,totalling euro 2,834 thousand, were charged to the income statement. considering historicalexperience with the debtors concerned, the credit collection risk is extremely low while the risk oflate payment is more significant given that the amounts are due from public bodies.the trade receivables assigned as of 31 December <strong>2009</strong>, but not already collected at that date,amount to euro 72,882 thousand.as part of this operation, the company has given a guarantee with a nominal value of euro 8,405thousand. Given the characteristics of this operation and the available impediments to collectionagainst the guarantee, the fair value of this guarantee is estimated to be euro 61 thousand.(in thousands of Euro) 31 december <strong>2009</strong> 31 december 2008servizi marche soc.cons. a r.l. 12 12consorzio imolese pulizie soc.cons. a r.l. 36 36Gymnasium soc.cons. a r.l. 7 7Gestlotto6 soc.cons. a r.l. 20 20consorzio igiene ospedaliera soc.cons. a r.l. 175 665consorzio pulizie Veneto soc.cons. a r.l. 0 40omasa s.p.a. 0 2,748m.c.b. s.p.a. 1,161 0teckal s.p.a. 2,946 0società manutenzione illuminazione s.p.a. 3,681 210integra F.m. bV 47 60,448altair s.p.a. 83,448 0Global prov. rimini soc.cons. a r.l. 170 170Due on purchase of investment 1,023 1,023manutenzione installazione ascensori s.p.a. 813 0Dividends to be collected 0 1,250Due on disposal of line of business 195 0roundings 0 2total reCeIvables and other Current fInanCIal assets 93,735 66,63178 - <strong>Financial</strong> statements as oF 31 December <strong>2009</strong> - principles anD explanatory notes <strong>Financial</strong> statements as oF 31 December <strong>2009</strong> - principles anD explanatory notes - 79