Financial Statements 2009 - Manutencoop

Financial Statements 2009 - Manutencoop

Financial Statements 2009 - Manutencoop

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

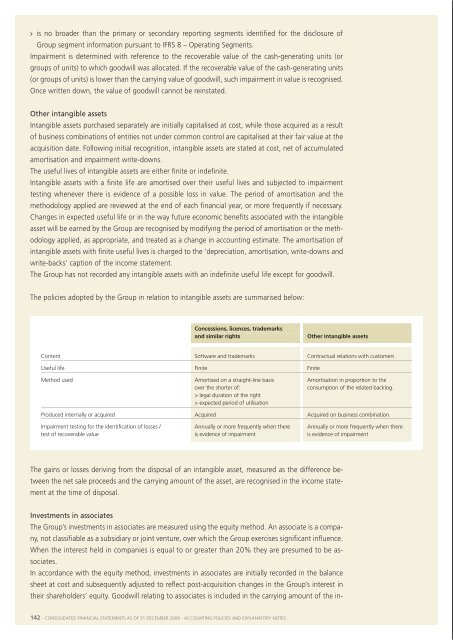

is no broader than the primary or secondary reporting segments identified for the disclosure ofgroup segment information pursuant to ifrs 8 – operating segments.impairment is determined with reference to the recoverable value of the cash-generating units (orgroups of units) to which goodwill was allocated. if the recoverable value of the cash-generating units(or groups of units) is lower than the carrying value of goodwill, such impairment in value is recognised.once written down, the value of goodwill cannot be reinstated.other intangible assetsintangible assets purchased separately are initially capitalised at cost, while those acquired as a resultof business combinations of entities not under common control are capitalised at their fair value at theacquisition date. following initial recognition, intangible assets are stated at cost, net of accumulatedamortisation and impairment write-downs.the useful lives of intangible assets are either finite or indefinite.intangible assets with a finite life are amortised over their useful lives and subjected to impairmenttesting whenever there is evidence of a possible loss in value. the period of amortisation and themethodology applied are reviewed at the end of each financial year, or more frequently if necessary.Changes in expected useful life or in the way future economic benefits associated with the intangibleasset will be earned by the group are recognised by modifying the period of amortisation or the methodologyapplied, as appropriate, and treated as a change in accounting estimate. the amortisation ofintangible assets with finite useful lives is charged to the ‘depreciation, amortisation, write-downs andwrite-backs’ caption of the income statement.the group has not recorded any intangible assets with an indefinite useful life except for goodwill.the policies adopted by the group in relation to intangible assets are summarised below:concessions, licences, trademarksand similar rightsother intangible assetsContent software and trademarks Contractual relations with customersuseful life finite finitemethod used amortised on a straight-line basis amortisation in proportion to theover the shorter of:consumption of the related backlog.> legal duration of the right> expected period of utilisationproduced internally or acquired acquired acquired on business combination.impairment testing for the identification of losses / annually or more frequently when there annually or more frequently when theretest of recoverable value is evidence of impairment is evidence of impairmentvestment and is not amortised. following application of the equity method, the group determinesif it is necessary to recognise any additional impairment losses with reference to the group’s netinterest in the associate. the group’s interest in the results for the year of the associate is reflectedin the income statement. if associates make direct adjustments to their shareholders’ equity, thegroup recognises its interest and, where applicable, reports such adjustments in the statement ofchanges in shareholders’ equity.in the majority of cases, the accounting reference date used by associates is the same as that ofthe group. Where this is not the case, the majority of the associates concerned prepare accountingstatements as of the group’s financial year end.the accounting policies adopted by associates are consistent with those applied by the group inrelation to events and transactions of the same type taking place in similar circumstances.impairment of assetsat each balance sheet date, the group determines if there is any evidence that the value of assetsmay be impaired. in this case, or whenever annual impairment testing is required, the group makesan estimate of recoverable value. recoverable value is the fair value of an asset or cash-generatingunit, net of selling costs, or, if higher, its value in use. recoverable value is determined for eachindividual asset, unless its cash flows are not broadly independent of those generated by otherassets or groups of assets. impairment is recognised if the carrying amount of an asset exceedsits recoverable value and, accordingly, such amount is written down to reflect recoverable value.When determining value in use, the group discounts estimated future cash flows to present valueusing a pre-tax discounting rate that reflects market assessments of the time value of money andthe specific risks associated with the asset. losses in value suffered by assets in use are charged tothe ‘depreciation, amortisation, write-downs and write-backs’ caption of the income statement.at each balance sheet date, the group also determines if there is any evidence that the reasonsfor previous impairment adjustments have ceased (wholly or in part) to apply and, in such cases,estimates the revised recoverable value of the assets concerned. the value of previously writtendownassets may only be reinstated if, subsequent to the most recent impairment adjustment, thereare changes in the estimates used to determine their recoverable value. in such cases, the carryingamount of the assets concerned is increased to reflect their recoverable value without, however,exceeding the carrying amount net of accumulated depreciation that would have been recordedhad impairment not been recognised in prior years. all write-backs are credited to the income statementin the caption used to report the earlier write-downs, except when the asset is recorded at arevalued amount, in which case the write-back is treated as a revaluation. following write-backs,the depreciation charge for the assets concerned is adjusted on a prospective basis in order to allocatetheir revised carrying amounts, net of any residual value, on a straight-line basis over theirresidual useful lives.the gains or losses deriving from the disposal of an intangible asset, measured as the difference betweenthe net sale proceeds and the carrying amount of the asset, are recognised in the income statementat the time of disposal.investments in associatesthe group’s investments in associates are measured using the equity method. an associate is a company,not classifiable as a subsidiary or joint venture, over which the group exercises significant influence.When the interest held in companies is equal to or greater than 20% they are presumed to be associates.in accordance with the equity method, investments in associates are initially recorded in the balancesheet at cost and subsequently adjusted to reflect post-acquisition changes in the group’s interest intheir shareholders’ equity. goodwill relating to associates is included in the carrying amount of the in-financial assetsias 39 envisages the following types of financial instruments:> financial assets at fair value through the income statement. this category comprises financial assetsthat are held for trading and any assets purchased for resale in the short term;> loans and receivables, i.e. non-derivative financial assets with fixed or determinable paymentsthat are not listed on an active market;> held-to-maturity investments, i.e. non-derivative financial assets that involve payments at fixed ordeterminable intervals which the owner intends and is able to hold to maturity.> available-for-sale financial assets, i.e. non-derivative financial assets that have been designated asavailable for sale or which are not classified in any of the three categories described above.initially, all financial assets are recognised at their fair value as uplifted, except for assets at fairvalue through the income statement, by any related charges; the group classifies its financial assets142 - Consolidated finanCial statements as of 31 deCember <strong>2009</strong> - aCCounting poliCies and explanatory notes Consolidated finanCial statements as of 31 deCember <strong>2009</strong> - aCCounting poliCies and explanatory notes - 143