Financial Statements 2009 - Manutencoop

Financial Statements 2009 - Manutencoop

Financial Statements 2009 - Manutencoop

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

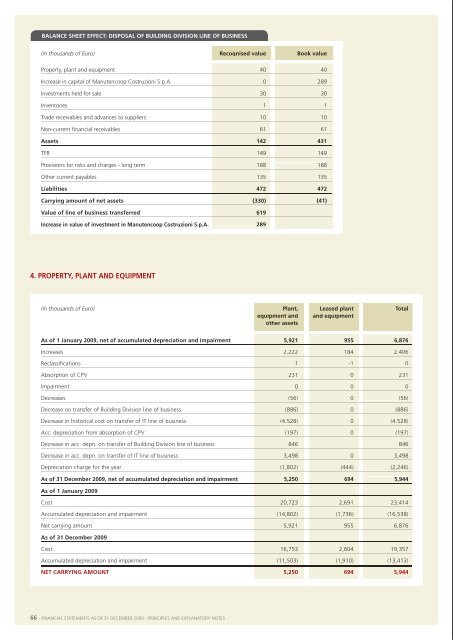

alanCe sheet effeCt: dIsposal of buIldIng dIvIsIon lIne of busIness(in thousands of Euro) recognised valuebook valueproperty, plant and equipment 40 40increase in capital of manutencoop costruzioni s.p.a. 0 289the above table highlights the historical costs and accumulated depreciation deriving from thebusiness combinations carried out during the year, as described in note 3.additions during the year related to technological and productivity improvements to industrialequipment, motor vehicles and assets for the it system, as well as furniture and furnishings.property, plant and equipment have never been revalued.investments held for sale 30 30inventories 1 1trade receivables and advances to suppliers 10 10non-current financial receivables 61 61assets 142 431tFr 149 149provisions for risks and charges - long term 188 188other current payables 135 135liabilities 472 472Carrying amount of net assets (330) (41)value of line of business transferred 619Increase in value of investment in manutencoop Costruzioni s.p.a. 289(in thousands of Euro) plant, leased plant totalequipment andand equipmentother assetsas of 1 January 2008, net of accumulated depreciation and impairment 4,658 1,299 5,957increases 2,664 146 2,810revaluations 0 0 0absorption of minati 180 0 180acquisition of astrocoop line of business 961 0 961acquisition of sec line of business 3 0 3impairment 0 0 0Decreases (46) 0 (46)acc. depreciation from absorption of minati (116) 0 (116)acc. depn. from acquisition of astrocoop line of business (728) 0 (728)4. property, plant and equIpment(in thousands of Euro) plant, leased plant totalequipment andand equipmentother assetsas of 1 January <strong>2009</strong>, net of accumulated depreciation and impairment 5,921 955 6,876increases 2,222 184 2,406reclassifications 1 -1 0absorption of cpV 231 0 231impairment 0 0 0acc. depn. from acquisition of sec line of business 0 0 0Depreciation charge for the year (1,655) (490) (2,145)as of 31 december 2008, net of accumulated depreciation and impairment 5,921 955 6,876as of 1 January 2008cost 17,501 2,737 20,238accumulated depreciation and impairment (12,843) (1,438) (14,281)net carrying amount 4,658 1,299 5,957as of 31 december 2008cost 20,723 2,691 23,414accumulated depreciation and impairment (14,802) (1,736) (16,538)net CarryIng amount 5,921 955 6,876Decreases (56) 0 (56)Decrease on transfer of building Division line of business (886) 0 (886)Decrease in historical cost on transfer of it line of business (4,528) 0 (4,528)acc. depreciation from absorption of cpV (197) 0 (197)Decrease in acc. depn. on transfer of building Division line of business 846 846Decrease in acc. depn. on transfer of it line of business 3,498 0 3,498Depreciation charge for the year (1,802) (444) (2,246)as of 31 december <strong>2009</strong>, net of accumulated depreciation and impairment 5,250 694 5,944as of 1 January <strong>2009</strong>cost 20,723 2,691 23,414accumulated depreciation and impairment (14,802) (1,736) (16,538)net carrying amount 5,921 955 6,876as of 31 december <strong>2009</strong>cost 16,753 2,604 19,357accumulated depreciation and impairment (11,503) (1,910) (13,413)net CarryIng amount 5,250 694 5,94466 - <strong>Financial</strong> statements as oF 31 December <strong>2009</strong> - principles anD explanatory notes <strong>Financial</strong> statements as oF 31 December <strong>2009</strong> - principles anD explanatory notes - 67