FEDERAL

Sixth Semiannual Report to the Congress - Federal Housing ...

Sixth Semiannual Report to the Congress - Federal Housing ...

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

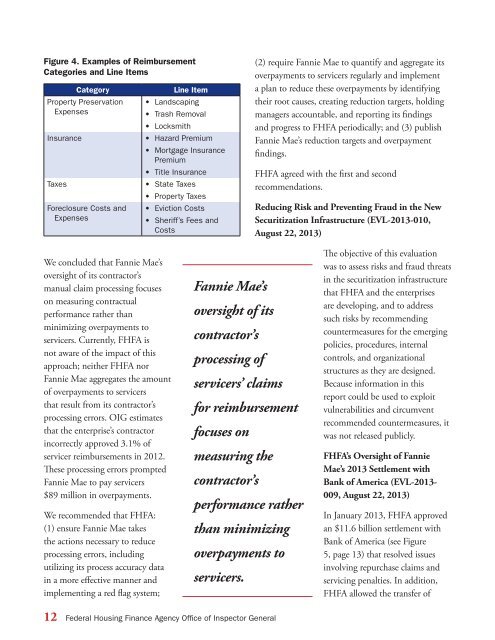

Figure 4. Examples of Reimbursement<br />

Categories and Line Items<br />

Category<br />

Property Preservation<br />

Expenses<br />

Insurance<br />

Taxes<br />

Foreclosure Costs and<br />

Expenses<br />

Line Item<br />

• Landscaping<br />

• Trash Removal<br />

• Locksmith<br />

• Hazard Premium<br />

• Mortgage Insurance<br />

Premium<br />

• Title Insurance<br />

• State Taxes<br />

• Property Taxes<br />

• Eviction Costs<br />

• Sheriff’s Fees and<br />

Costs<br />

(2) require Fannie Mae to quantify and aggregate its<br />

overpayments to servicers regularly and implement<br />

a plan to reduce these overpayments by identifying<br />

their root causes, creating reduction targets, holding<br />

managers accountable, and reporting its findings<br />

and progress to FHFA periodically; and (3) publish<br />

Fannie Mae’s reduction targets and overpayment<br />

findings.<br />

FHFA agreed with the first and second<br />

recommendations.<br />

Reducing Risk and Preventing Fraud in the New<br />

Securitization Infrastructure (EVL-2013-010,<br />

August 22, 2013)<br />

We concluded that Fannie Mae’s<br />

oversight of its contractor’s<br />

manual claim processing focuses<br />

on measuring contractual<br />

performance rather than<br />

minimizing overpayments to<br />

servicers. Currently, FHFA is<br />

not aware of the impact of this<br />

approach; neither FHFA nor<br />

Fannie Mae aggregates the amount<br />

of overpayments to servicers<br />

that result from its contractor’s<br />

processing errors. OIG estimates<br />

that the enterprise’s contractor<br />

incorrectly approved 3.1% of<br />

servicer reimbursements in 2012.<br />

These processing errors prompted<br />

Fannie Mae to pay servicers<br />

$89 million in overpayments.<br />

We recommended that FHFA:<br />

(1) ensure Fannie Mae takes<br />

the actions necessary to reduce<br />

processing errors, including<br />

utilizing its process accuracy data<br />

in a more effective manner and<br />

implementing a red flag system;<br />

Fannie Mae’s<br />

oversight of its<br />

contractor’s<br />

processing of<br />

servicers’ claims<br />

for reimbursement<br />

focuses on<br />

measuring the<br />

contractor’s<br />

performance rather<br />

than minimizing<br />

overpayments to<br />

servicers.<br />

The objective of this evaluation<br />

was to assess risks and fraud threats<br />

in the securitization infrastructure<br />

that FHFA and the enterprises<br />

are developing, and to address<br />

such risks by recommending<br />

countermeasures for the emerging<br />

policies, procedures, internal<br />

controls, and organizational<br />

structures as they are designed.<br />

Because information in this<br />

report could be used to exploit<br />

vulnerabilities and circumvent<br />

recommended countermeasures, it<br />

was not released publicly.<br />

FHFA’s Oversight of Fannie<br />

Mae’s 2013 Settlement with<br />

Bank of America (EVL-2013-<br />

009, August 22, 2013)<br />

In January 2013, FHFA approved<br />

an $11.6 billion settlement with<br />

Bank of America (see Figure<br />

5, page 13) that resolved issues<br />

involving repurchase claims and<br />

servicing penalties. In addition,<br />

FHFA allowed the transfer of<br />

12 Federal Housing Finance Agency Office of Inspector General