FEDERAL

Sixth Semiannual Report to the Congress - Federal Housing ...

Sixth Semiannual Report to the Congress - Federal Housing ...

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

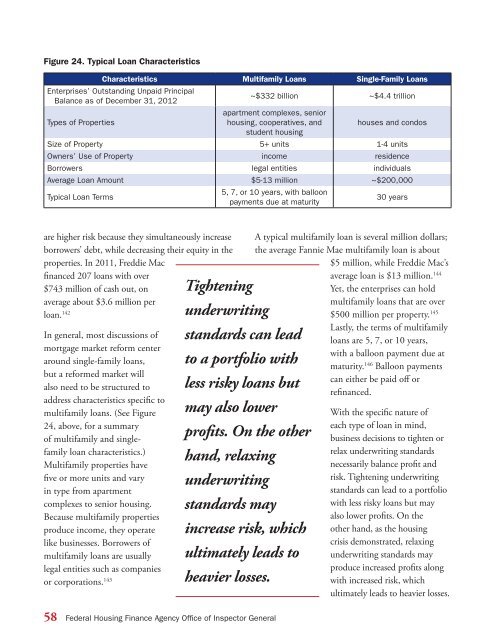

Figure 24. Typical Loan Characteristics<br />

Characteristics Multifamily Loans Single-Family Loans<br />

Enterprises’ Outstanding Unpaid Principal<br />

Balance as of December 31, 2012<br />

Types of Properties<br />

~$332 billion ~$4.4 trillion<br />

apartment complexes, senior<br />

housing, cooperatives, and<br />

student housing<br />

houses and condos<br />

Size of Property 5+ units 1-4 units<br />

Owners’ Use of Property income residence<br />

Borrowers legal entities individuals<br />

Average Loan Amount $5-13 million ~$200,000<br />

Typical Loan Terms<br />

5, 7, or 10 years, with balloon<br />

payments due at maturity<br />

30 years<br />

are higher risk because they simultaneously increase<br />

borrowers’ debt, while decreasing their equity in the<br />

properties. In 2011, Freddie Mac<br />

financed 207 loans with over<br />

$743 million of cash out, on<br />

average about $3.6 million per<br />

loan. 142<br />

In general, most discussions of<br />

mortgage market reform center<br />

around single-family loans,<br />

but a reformed market will<br />

also need to be structured to<br />

address characteristics specific to<br />

multifamily loans. (See Figure<br />

24, above, for a summary<br />

of multifamily and singlefamily<br />

loan characteristics.)<br />

Multifamily properties have<br />

five or more units and vary<br />

in type from apartment<br />

complexes to senior housing.<br />

Because multifamily properties<br />

produce income, they operate<br />

like businesses. Borrowers of<br />

multifamily loans are usually<br />

legal entities such as companies<br />

or corporations. 143<br />

Tightening<br />

underwriting<br />

standards can lead<br />

to a portfolio with<br />

less risky loans but<br />

may also lower<br />

profits. On the other<br />

hand, relaxing<br />

underwriting<br />

standards may<br />

increase risk, which<br />

ultimately leads to<br />

heavier losses.<br />

A typical multifamily loan is several million dollars;<br />

the average Fannie Mae multifamily loan is about<br />

$5 million, while Freddie Mac’s<br />

average loan is $13 million. 144<br />

Yet, the enterprises can hold<br />

multifamily loans that are over<br />

$500 million per property. 145<br />

Lastly, the terms of multifamily<br />

loans are 5, 7, or 10 years,<br />

with a balloon payment due at<br />

maturity. 146 Balloon payments<br />

can either be paid off or<br />

refinanced.<br />

With the specific nature of<br />

each type of loan in mind,<br />

business decisions to tighten or<br />

relax underwriting standards<br />

necessarily balance profit and<br />

risk. Tightening underwriting<br />

standards can lead to a portfolio<br />

with less risky loans but may<br />

also lower profits. On the<br />

other hand, as the housing<br />

crisis demonstrated, relaxing<br />

underwriting standards may<br />

produce increased profits along<br />

with increased risk, which<br />

ultimately leads to heavier losses.<br />

58 Federal Housing Finance Agency Office of Inspector General