FEDERAL

Sixth Semiannual Report to the Congress - Federal Housing ...

Sixth Semiannual Report to the Congress - Federal Housing ...

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

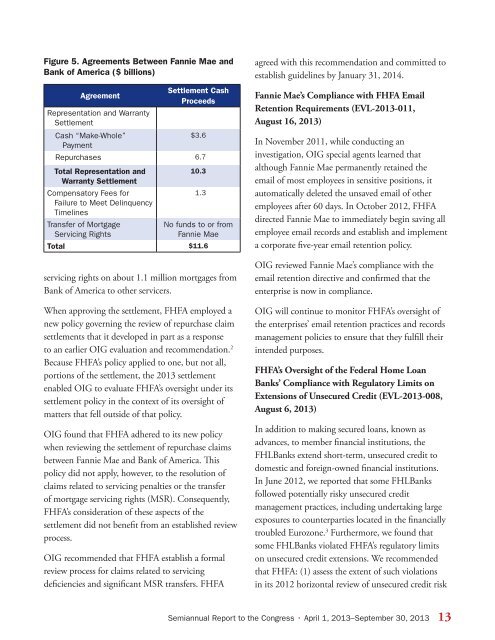

Figure 5. Agreements Between Fannie Mae and<br />

Bank of America ($ billions)<br />

Agreement<br />

Representation and Warranty<br />

Settlement<br />

Cash “Make-Whole”<br />

Payment<br />

Settlement Cash<br />

Proceeds<br />

$3.6<br />

Repurchases 6.7<br />

Total Representation and<br />

Warranty Settlement<br />

Compensatory Fees for<br />

Failure to Meet Delinquency<br />

Timelines<br />

Transfer of Mortgage<br />

Servicing Rights<br />

10.3<br />

1.3<br />

No funds to or from<br />

Fannie Mae<br />

Total $11.6<br />

servicing rights on about 1.1 million mortgages from<br />

Bank of America to other servicers.<br />

When approving the settlement, FHFA employed a<br />

new policy governing the review of repurchase claim<br />

settlements that it developed in part as a response<br />

to an earlier OIG evaluation and recommendation. 2<br />

Because FHFA’s policy applied to one, but not all,<br />

portions of the settlement, the 2013 settlement<br />

enabled OIG to evaluate FHFA’s oversight under its<br />

settlement policy in the context of its oversight of<br />

matters that fell outside of that policy.<br />

OIG found that FHFA adhered to its new policy<br />

when reviewing the settlement of repurchase claims<br />

between Fannie Mae and Bank of America. This<br />

policy did not apply, however, to the resolution of<br />

claims related to servicing penalties or the transfer<br />

of mortgage servicing rights (MSR). Consequently,<br />

FHFA’s consideration of these aspects of the<br />

settlement did not benefit from an established review<br />

process.<br />

OIG recommended that FHFA establish a formal<br />

review process for claims related to servicing<br />

deficiencies and significant MSR transfers. FHFA<br />

agreed with this recommendation and committed to<br />

establish guidelines by January 31, 2014.<br />

Fannie Mae’s Compliance with FHFA Email<br />

Retention Requirements (EVL-2013-011,<br />

August 16, 2013)<br />

In November 2011, while conducting an<br />

investigation, OIG special agents learned that<br />

although Fannie Mae permanently retained the<br />

email of most employees in sensitive positions, it<br />

automatically deleted the unsaved email of other<br />

employees after 60 days. In October 2012, FHFA<br />

directed Fannie Mae to immediately begin saving all<br />

employee email records and establish and implement<br />

a corporate five-year email retention policy.<br />

OIG reviewed Fannie Mae’s compliance with the<br />

email retention directive and confirmed that the<br />

enterprise is now in compliance.<br />

OIG will continue to monitor FHFA’s oversight of<br />

the enterprises’ email retention practices and records<br />

management policies to ensure that they fulfill their<br />

intended purposes.<br />

FHFA’s Oversight of the Federal Home Loan<br />

Banks’ Compliance with Regulatory Limits on<br />

Extensions of Unsecured Credit (EVL-2013-008,<br />

August 6, 2013)<br />

In addition to making secured loans, known as<br />

advances, to member financial institutions, the<br />

FHLBanks extend short-term, unsecured credit to<br />

domestic and foreign-owned financial institutions.<br />

In June 2012, we reported that some FHLBanks<br />

followed potentially risky unsecured credit<br />

management practices, including undertaking large<br />

exposures to counterparties located in the financially<br />

troubled Eurozone. 3 Furthermore, we found that<br />

some FHLBanks violated FHFA’s regulatory limits<br />

on unsecured credit extensions. We recommended<br />

that FHFA: (1) assess the extent of such violations<br />

in its 2012 horizontal review of unsecured credit risk<br />

Semiannual Report to the Congress • April 1, 2013–September 30, 2013 13