FEDERAL

Sixth Semiannual Report to the Congress - Federal Housing ...

Sixth Semiannual Report to the Congress - Federal Housing ...

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

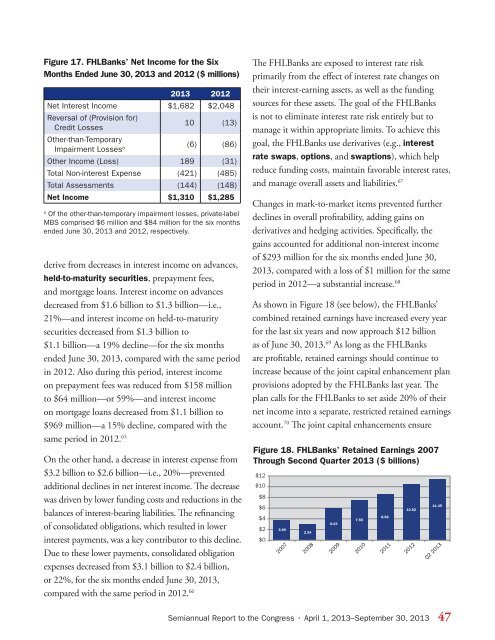

Figure 17. FHLBanks’ Net Income for the Six<br />

Months Ended June 30, 2013 and 2012 ($ millions)<br />

2013 2012<br />

Net Interest Income $1,682 $2,048<br />

Reversal of (Provision for)<br />

Credit Losses<br />

10 (13)<br />

Other-than-Temporary<br />

Impairment Losses a (6) (86)<br />

Other Income (Loss) 189 (31)<br />

Total Non-interest Expense (421) (485)<br />

Total Assessments (144) (148)<br />

Net Income $1,310 $1,285<br />

a<br />

Of the other-than-temporary impairment losses, private-label<br />

MBS comprised $6 million and $84 million for the six months<br />

ended June 30, 2013 and 2012, respectively.<br />

derive from decreases in interest income on advances,<br />

held-to-maturity securities, prepayment fees,<br />

and mortgage loans. Interest income on advances<br />

decreased from $1.6 billion to $1.3 billion—i.e.,<br />

21%—and interest income on held-to-maturity<br />

securities decreased from $1.3 billion to<br />

$1.1 billion—a 19% decline—for the six months<br />

ended June 30, 2013, compared with the same period<br />

in 2012. Also during this period, interest income<br />

on prepayment fees was reduced from $158 million<br />

to $64 million—or 59%—and interest income<br />

on mortgage loans decreased from $1.1 billion to<br />

$969 million—a 15% decline, compared with the<br />

same period in 2012. 65<br />

On the other hand, a decrease in interest expense from<br />

$3.2 billion to $2.6 billion—i.e., 20%—prevented<br />

additional declines in net interest income. The decrease<br />

was driven by lower funding costs and reductions in the<br />

balances of interest-bearing liabilities. The refinancing<br />

of consolidated obligations, which resulted in lower<br />

interest payments, was a key contributor to this decline.<br />

Due to these lower payments, consolidated obligation<br />

expenses decreased from $3.1 billion to $2.4 billion,<br />

or 22%, for the six months ended June 30, 2013,<br />

compared with the same period in 2012. 66<br />

The FHLBanks are exposed to interest rate risk<br />

primarily from the effect of interest rate changes on<br />

their interest-earning assets, as well as the funding<br />

sources for these assets. The goal of the FHLBanks<br />

is not to eliminate interest rate risk entirely but to<br />

manage it within appropriate limits. To achieve this<br />

goal, the FHLBanks use derivatives (e.g., interest<br />

rate swaps, options, and swaptions), which help<br />

reduce funding costs, maintain favorable interest rates,<br />

and manage overall assets and liabilities. 67<br />

Changes in mark-to-market items prevented further<br />

declines in overall profitability, adding gains on<br />

derivatives and hedging activities. Specifically, the<br />

gains accounted for additional non-interest income<br />

of $293 million for the six months ended June 30,<br />

2013, compared with a loss of $1 million for the same<br />

period in 2012—a substantial increase. 68<br />

As shown in Figure 18 (see below), the FHLBanks’<br />

combined retained earnings have increased every year<br />

for the last six years and now approach $12 billion<br />

as of June 30, 2013. 69 As long as the FHLBanks<br />

are profitable, retained earnings should continue to<br />

increase because of the joint capital enhancement plan<br />

provisions adopted by the FHLBanks last year. The<br />

plan calls for the FHLBanks to set aside 20% of their<br />

net income into a separate, restricted retained earnings<br />

account. 70 The joint capital enhancements ensure<br />

Figure 18. FHLBanks’ Retained Earnings 2007<br />

Through Second Quarter 2013 ($ billions)<br />

$12<br />

$10<br />

$8<br />

$6<br />

$4<br />

$2<br />

$0<br />

3.69<br />

2007<br />

2.94<br />

2008<br />

6.03<br />

2009<br />

7.55<br />

2010<br />

8.58<br />

2011<br />

10.52<br />

2012<br />

11.45<br />

Q2 2013<br />

Semiannual Report to the Congress • April 1, 2013–September 30, 2013 47