FEDERAL

Sixth Semiannual Report to the Congress - Federal Housing ...

Sixth Semiannual Report to the Congress - Federal Housing ...

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

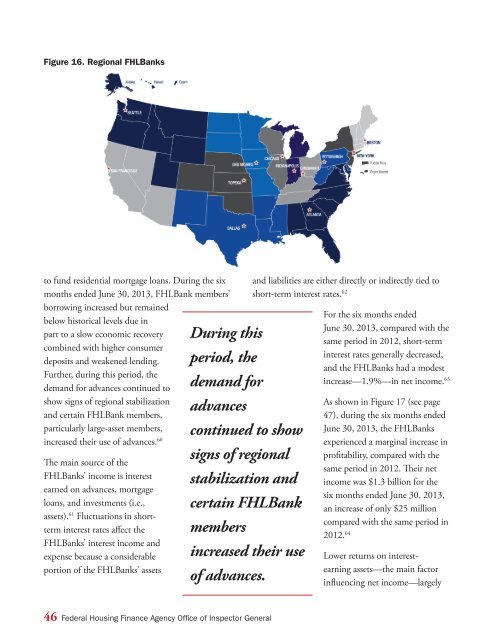

Figure 16. Regional FHLBanks<br />

to fund residential mortgage loans. During the six<br />

months ended June 30, 2013, FHLBank members’<br />

borrowing increased but remained<br />

below historical levels due in<br />

part to a slow economic recovery<br />

combined with higher consumer<br />

deposits and weakened lending.<br />

Further, during this period, the<br />

demand for advances continued to<br />

show signs of regional stabilization<br />

and certain FHLBank members,<br />

particularly large-asset members,<br />

increased their use of advances. 60<br />

The main source of the<br />

FHLBanks’ income is interest<br />

earned on advances, mortgage<br />

loans, and investments (i.e.,<br />

assets). 61 Fluctuations in shortterm<br />

interest rates affect the<br />

FHLBanks’ interest income and<br />

expense because a considerable<br />

portion of the FHLBanks’ assets<br />

During this<br />

period, the<br />

demand for<br />

advances<br />

continued to show<br />

signs of regional<br />

Figure 16. Regional FHLBanks<br />

stabilization and<br />

certain FHLBank<br />

members<br />

increased their use<br />

of advances.<br />

and liabilities are either directly or indirectly tied to<br />

short-term interest rates. 62<br />

For the six months ended<br />

June 30, 2013, compared with the<br />

same period in 2012, short-term<br />

interest rates generally decreased,<br />

and the FHLBanks had a modest<br />

increase—1.9%—in net income. 63<br />

As shown in Figure 17 (see page<br />

47), during the six months ended<br />

June 30, 2013, the FHLBanks<br />

experienced a marginal increase in<br />

profitability, compared with the<br />

same period in 2012. Their net<br />

income was $1.3 billion for the<br />

six months ended June 30, 2013,<br />

an increase of only $25 million<br />

compared with the same period in<br />

2012. 64<br />

Lower returns on interestearning<br />

assets—the main factor<br />

influencing net income—largely<br />

46 Federal Housing Finance Agency Office of Inspector General