FEDERAL

Sixth Semiannual Report to the Congress - Federal Housing ...

Sixth Semiannual Report to the Congress - Federal Housing ...

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

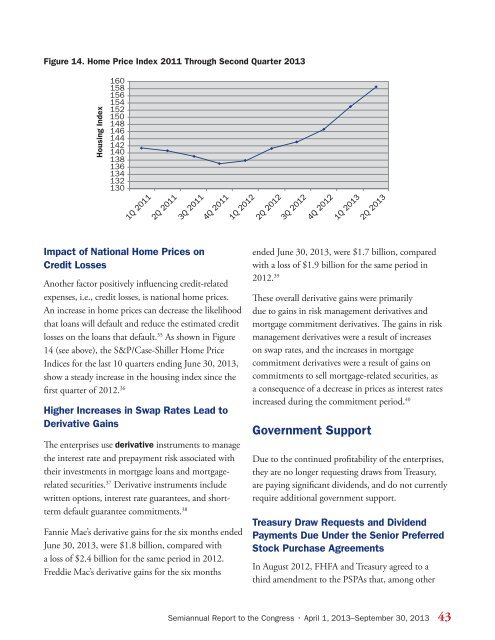

Figure 14. Home Price Index 2011 Through Second Quarter 2013<br />

Housing Index<br />

160<br />

158<br />

156<br />

154<br />

152<br />

150<br />

148<br />

146<br />

144<br />

142<br />

140<br />

138<br />

136<br />

134<br />

132<br />

130<br />

1Q 2011<br />

2Q 2011<br />

3Q 2011<br />

4Q 2011<br />

1Q 2012<br />

2Q 2012<br />

3Q 2012<br />

4Q 2012<br />

1Q 2013<br />

2Q 2013<br />

Impact of National Home Prices on<br />

Credit Losses<br />

Another factor positively influencing credit-related<br />

expenses, i.e., credit losses, is national home prices. These overall derivative gains were primarily<br />

An increase in home prices can decrease the likelihood due to gains in risk management derivatives and<br />

that loans will default and reduce the estimated credit mortgage commitment derivatives. The gains in risk<br />

losses on the loans that default. 35 As shown in Figure management derivatives were a result of increases<br />

14 (see above), the S&P/Case-Shiller Home Price on swap rates, and the increases in mortgage<br />

Indices for the last 10 quarters ending June 30, 2013, commitment derivatives were a result of gains on<br />

show a steady increase in the housing index since the commitments to sell mortgage-related securities, as<br />

first quarter of 2012. 36<br />

a consequence of a decrease in prices as interest rates<br />

increased during the commitment period. 40<br />

Higher Increases Figure in Swap 14. Home Rates Price Lead Index to 2011 Through Second Quarter 2013<br />

Derivative Gains<br />

The enterprises use derivative instruments to manage<br />

the interest rate and prepayment risk associated with<br />

their investments in mortgage loans and mortgagerelated<br />

securities. 37 Derivative instruments include<br />

written options, interest rate guarantees, and shortterm<br />

default guarantee commitments. 38<br />

Fannie Mae’s derivative gains for the six months ended<br />

June 30, 2013, were $1.8 billion, compared with<br />

a loss of $2.4 billion for the same period in 2012.<br />

Freddie Mac’s derivative gains for the six months<br />

ended June 30, 2013, were $1.7 billion, compared<br />

with a loss of $1.9 billion for the same period in<br />

2012. 39<br />

Government Support<br />

Due to the continued profitability of the enterprises,<br />

they are no longer requesting draws from Treasury,<br />

are paying significant dividends, and do not currently<br />

require additional government support.<br />

Treasury Draw Requests and Dividend<br />

Payments Due Under the Senior Preferred<br />

Stock Purchase Agreements<br />

In August 2012, FHFA and Treasury agreed to a<br />

third amendment to the PSPAs that, among other<br />

Semiannual Report to the Congress • April 1, 2013–September 30, 2013 43